Multilateralism

Karine Lisbonne-de Vergeron

-

Available versions :

EN

Karine Lisbonne-de Vergeron

Introduction

China's emergence is, in many respects, an unprecedented, historical phenomenon. With its rapid economic development and a growth rate of 11.4% in 2007, it has now overtaken Germany as the world's third largest economy, although it is not yet quite the world's largest exporter. Some experts anticipate that its gross domestic product (GDP) will have tripled by 2025 to become the second largest after the United States [1], although the European Union as a whole is likely to remain in first place.

In 2006, China overtook Japan as the world's leading holder of currency reserves, with an estimated stock of nearly 2 000 billion $, including 1530 billion in official foreign exchange reserves at the end of December 2007 [2]. This potential for financial investment is even more significant for the international community as it consolidates in the midst of a financial crisis. Such a development also means that no single European country, when taken on its own, can now carry the same weight in bilateral economic relations with China on global macroeconomic and trade issues.

Given the growing and uneven intensification of trade relations between China and the EU and the rise of the euro against the dollar with its knock-on effects on the exchange rate between the euro and the renminbi, the management of this problem has become a major issue. The EU should, therefore, for the first time, at the end of next April, introduce a mechanism for high-level macro-economic dialogue with the Chinese government. The Sino-European economic relationship has indeed become highly strategic in both scope and intensity, as well as in the challenges it raises for the European Union.

1. EU-China trade relations

1.1. The European Union, China's biggest trading partner

Although the EU is becoming increasingly important for China in economic and trading terms, bilateral relations with the individual Member States remain its primary focus. But it is through the European Union as a whole, which is both the largest trading power in the world and has now, beyond doubt, the world's second currency with a population of nearly 500 million persons, that the peoples of Europe will increasingly find the resources to exert long-term influence over economic exchanges with China.

Since 2004, the EU has become China's largest trading partner, accounting for 15% of total Chinese foreign trade in 2006, with a trade growth of 25% over 2005. Overall, since 1978, bilateral trade has increased more than sixty fold to reach almost 255 billion € in 2006 [3].

In return, China is now the second largest trading partner of the European Union, after the United States, and in 2006 became the largest source of EU imports (representing nearly 192 billion € or 14.4% of total imports [4]). In the same year, EU exports to China rose by 23% to 63 billion €. Exports were 40% higher than those of the United States and were accompanied by aggregate direct investments of comparable scale. The EU is also, according to Chinese sources, the leading partner of China in terms of transfer of technology and capital goods, representing nearly 40% of total Chinese imports in this sector in 2006, as against 23 % to Japan and 19% from the United States.

1.2. China is the country with which the EU has its largest bilateral deficit

The future of China-EU trade and monetary relations has already become a key component of the global economy. But one of the main challenges for the European Union remains the growing scale of the trade deficit. Many experts have pointed out in recent months, the need for a balanced relationship with China, as China's overall trade surplus reached a record growth rate of 85% with the rest of the world for the first half of 2007. The EU currently sells more to Switzerland, a country of 7.5 million inhabitants, than to the Middle Kingdom, whilst the EU-China trade deficit is widening by almost 17 million € an hour [5]. The intensification of this trend is a matter of strategic urgency for Europe: in 2006, the trade deficit of the EU had risen to over 128 billion €, an increase of 57% compared to 2003. In the period from January to May 2007 alone, the deficit further increased by nearly 53% (a deterioration mostly attributed to a rise of 138% in exports of Chinese steel products to the European Union). Moreover, according to the latest estimates from Eurostat, the deficit is expected to approach the 160 billion € threshold for the whole of 2007, i.e. a level now comparable to the US deficit of around 176 billion €.

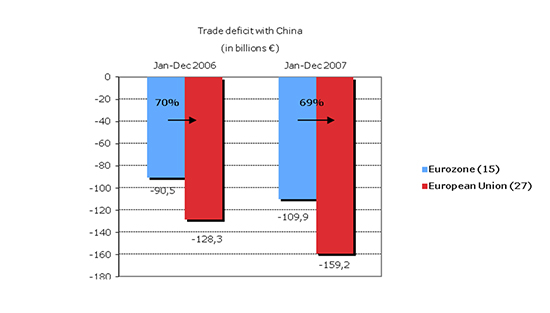

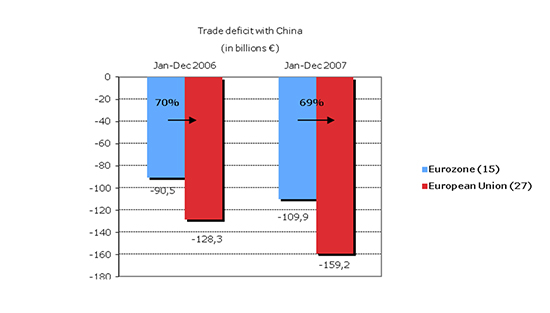

It should also be noted that in 2007, Chinese exports to the EU increased by 29% against a 14% growth of Chinese exports to the US [6]. Moreover, the member states of the Eurozone are the ones who are most impacted by the growing trade imbalance, accounting for nearly 70% of the EU-China trade deficit.

Source : Eurostat and European Commission. Data formatted by the author

Source : Eurostat and European Commission. Data formatted by the author

Another factor, which explains the strategic significance of this trend is the fact that, at the same time, the share of Asia, including China, in the total of EU imports only grew by 10% over the last ten years, as the Asian economies have increasingly centralised their production within China. This is the result of Japanese and other Asian companies setting up there. The integration of trade in East Asia has thus intensified, with China now considered to be playing the role of final assembler [7] for the region's industrial production, thereby taking over the other Asian suppliers of developed industrial economies. Whilst the Chinese share of total Asian exports has almost tripled in ten years (from 12% to 32%), that of the ASEAN-5 [8] (from 17% to 16%) and that of Japan (34% to 22%) have declined over the same period. Together, the United States and Europe are in fact China's main commercial export markets. It is indeed telling that the US Treasury Secretary Henry Paulson describes the Sino-US relationship as the most important one for the United States. However, in volume terms, the China-EU relationship is one of the largest of the world economy: in 2007, bilateral trade should have exceeded the level of 300 billion € (against some 280 billion € for Sino-US exchanges [9]).

2. The management of Sino-European trade

The EU-China relationship is markedly different from the intensity of the China-US relationship. Many experts believe that Europe ranks lower in Chinese priorities. This is partly explained by the absence of a genuine common EU foreign policy towards China. However, beyond this political dimension, recent advances in the Sino-European macroeconomic partnership should be highlighted [10].

2.1. A new framework for strategic dialogue

The establishment in June 2007 of a high-level discussion group between the European Union and China had opened the way for new proposals to address the growing bilateral trade deficit. Its conclusions were presented in Beijing on 28 November 2007 during the last EU-China summit. They came as a complement to the annual economic and financial EU-China Dialogue, set up in 2004, to promote better mutual understanding. Its third meeting on 5 July 2007 focused on exchanges of views over China's interaction with the monetary and fiscal policies of the European Union, as well over reforms in China's financial sector.

Moreover, at the last EU-China Summit, the President of the Eurogroup, the President of the European Central Bank, the Commissioner for Economic and Monetary Affairs and the Commissioner for Trade all negotiated for the first time together with one voice, and on behalf of the European Union on trade and monetary issues.

At the end of this 10th bilateral summit, both parties reached an agreement to create a mechanism for high-level dialogue, similar to those that China had established with the United States in December 2006 and with Japan in April 2007. The progress of the current negotiations, following the last visit by the European Trade Commissioner to Beijing at the end of February 2008, should result in the launch of this new mechanism during the next visit of the President of the European Commission to China, scheduled for 25 April 2008. This framework should allow the European Union and China to improve the management of their relationship on the strategic dimension of trade, investment and economic cooperation as well as on the coordination of bilateral projects.

2.2. What concrete results can be expected?

Several key issues for Sino-European trade can be identified:

- The access to Chinese markets: the findings of a recent study [11] have stressed that market access barriers represent a cost of 20 billion € per year in lost business opportunities for European companies, which is to say almost 30% of total exports in 2006. Despite successive interventions by European politicians, and although China has accumulated more than 750 billion $ of foreign direct investment, access to certain key areas remains restricted because of limits on investments in specific sectors, such as the automotive industry, telecommunications, petrochemicals and energy, or the financial services. For the latter, foreign companies are limited to a 20% stake, and up to 25% for an international consortium. Moreover, the Chamber of Commerce of the European Union in China is reporting remaining technical barriers for foreign companies and a growing trend to unequal treatment by some Chinese regulatory agencies [12]. While European investment in China declined in 2006 and 2007, due in particular to the lack of regulatory transparency, complaints against China at the World Trade Organisation by the EU and the United States further illustrate the challenge posed by the elimination of barriers to foreign investment [13].

- The defence of European norms and standards and respect for the protection of intellectual property rights: it is crucial for the European Union that compliance with European standards and the protection of these rights are upheld in the context of the new macroeconomic negotiations. According to estimates by the European Commission, China accounted for nearly 83% of counterfeits intercepted at EU borders in 2006 whilst violations of intellectual property would have led to a revenue loss of around 20% for European manufacturers based in China. While the Chinese authorities have devoted much effort to strengthening intellectual property protection, more progress should be sought to improve conditions for European companies' commercial activities. Moreover, this question could eventually extend to broader considerations of environmental standards or human rights, which are certainly not yet part of current trade discussions but could be increasingly voiced within public opinion in Europe if the improvement in the trade imbalance was not effective.

- Lastly, one of the decisive factors for a better trade balance is the future of China's consumer society. The rise in domestic demand and further related economic reforms in the country will be crucial to promote a more competitive and balanced market environment and to reduce the bilateral deficit. This includes in particular the necessary reform in banking services and the development of a real market for consumer credit.

The high-level strategic dialogue could, therefore, thus far formally cover the issue of the trade deficit, and notably that of intellectual property, the environment, high technology, energy and the improvement of investment conditions in the Chinese market. On this latter point, however, the mechanism may only be able to achieve a limited short-term impact. Since January 2007, the European Union and China have launched another negotiation round to upgrade the Trade and Economic Cooperation Agreement agreed upon in 1985 (so far, the main legal framework for bilateral relations) in the form of a new Framework Agreement on Partnership and Cooperation (PCA). These negotiations should, no doubt, further continue under the forthcoming French presidency of the European Union in the second half of 2008, during which the 11th EU-China summit will be held. After all, improved access to the Chinese market is, a priori, one of the key issues to resolving the deficit in the balance of Sino-European trade.

3. The monetary issue

3.1. The euro, the renminbi and the dollar: the necessary revaluation of the Chinese currency

In addition, this new forum for dialogue could play an even more strategic role for the EU on the specific question of the euro/renminbi exchange rate. It is clearly surprising that the exchange rate of the renminbi mostly remained a Sino-American bilateral issue up until the last EU-China summit in November 2007, since its evolution is just as significant for the euro area [14], and therefore for trade relations between the EU and China, as it is for the dollar. Indeed, the weight of China in the effective exchange rate of the dollar and the euro - a rate which benchmarks the competitiveness of one economy and currency relative to other currencies, by including in particular the balance of trade - is comparably high at 13.7% for the United States and 10.4% for the euro area . However, in the real exchange rate, the longstanding trend vis-à-vis the euro has been that of a depreciation of around 25% since 2002, whereas the renminbi has steadily appreciated against the dollar since July 2005, with an increase of approximately 15%. In 2007, it again appreciated by 6.6% vis-à-vis the dollar and weakened by 3% vis-à-vis the euro. This is can be explained by the control of the Chinese currency, which has been closely and critically linked to the US dollar since 2005, and not to the single European currency.

Source : Eurostat and European Commission. Data formatted by the author

Source : Eurostat and European Commission. Data formatted by the author

In the context of the on-going financial crisis, the Chinese currency is currently continuing its appreciation: it has risen by 2.5% since 1st January 2008 vis-à-vis the dollar and has even appreciated by about 4.5% vis-à-vis the euro since November 2007. Although this trend indicates that the real exchange rate is evolving, the need for a faster revaluation of the renminbi, recently reaffirmed by the French President, the G7 Finance Ministers and the President of the Eurogroup, still applies.

Yet many observers believe that the Chinese would now be more inclined to deal with the European Union on the same basis as their relationship with the United States, particularly on monetary matters. The high-level EU-China mechanism will specifically address the issue of the exchange rate, which should be one of the three components of the proposed dialogue. This would be a specific innovation of the Sino-European mechanism, since the strategic macro-economic dialogue between China and the US only covers the monetary dimension in the context of broader negotiations on the rebalancing of the Chinese economy. Moreover, following the last EU-China Summit, the Chinese authorities have announced their objective to allow greater flexibility in the exchange rate over time. They believe that a gradual revaluation of their currency can only occur with a concomitant reform of their banking system.

Nevertheless, the evolution of China's domestic economy could favour a relaxation and a better readjustment of the exchange rate regime notably because of rising inflationary pressures. An appreciation of the Chinese currency would be an effective response to this for at least two reasons. It would make it possible to reduce not only the impact of higher import prices for energy and raw materials but also that of excess liquidity emanating from China's increased investment in currency purchases, given its foreign exchange reserves, as well as its double current and financial external surpluses. It would indeed seem more difficult for China, in the present international conditions, to raise its interest rates, with the knock-on effects of such measures on the domestic economy, to counter inflation. Growing domestic inflationary pressures could therefore encourage arbitrage between external and internal objectives; inflation reached over one year its highest rate in a decade to nearly 4.8% and the consumer price index a record level in January 2008, above 7.1%, boosted by food prices. Moreover, given the strengthening of speculative flows in the Chinese markets in recent weeks in anticipation of further appreciation of the renminbi, many economists have concluded that an acceleration of the revaluation of the Chinese currency, not gradually but in a single major leap of around 20%, could be in fact the best possible solution.

3.2. The external dimension of the euro and its status as an international reserve currency

The management of monetary relations between China and the Eurozone could also result in greater diversification of China's reserves in favour of the single European currency given the weakness of the dollar with, already, the first contracts being signed in euros between European and Chinese companies. As nearly 70% of China's reserves are denominated in dollars, mainly in US Treasury bonds [15], only the euro would have the potential to constitute, in the medium term, a genuine alternative to the dollar to ensure greater international stability. The credibility of the euro is growing. If China's reserves continue to increase at a rate of over 5% for the last quarter of 2007, some experts anticipate a possible change towards a greater share of this to be taken by the single European currency, significantly beyond its current 20% level.

There are, however, certain complexities inherent in the management of Sino-European monetary relations. This possible development - e.g. the euro taking a greater share in China's foreign exchange reserves and, in the long term, more broadly at the international level - cannot be compared as such to the phenomenon that led to the establishment of the dollar as reserve currency indexed on gold in the 1920s and 30s. Some anticipate that the forthcoming monetary order could rather take the form of a pluralistic, or at least tripartite, system, which would be accompanied by the rising power of the renminbi as a reserve currency [16]. Other experts believe that diversification could instead occur through Chinese investments in emerging equity markets rather than just in currencies, including through its new sovereign fund [17], the China Investment Corporation.

In any event, the euro is becoming increasingly important globally. In less than ten years of existence, it has become the world's second currency [18]. A quarter of the world's foreign exchange reserves, a third of the debt market and a sixth of deposits and international lending markets are already denominated in euros. Nearly half of the exports from the Eurozone and a third of its imports are invoiced in the single European currency [19]. This external recognition also gives the euro responsibilities at the regional and international levels that cannot be neglected. Yet, on the issue of exchange rates, the ECB cannot be the only representative of the Eurozone. The Eurogroup President is indeed the only person, at the level of the European Union, who is able to deal directly with the Chinese government, and not just with the Chinese Central Bank on this issue following his participation in the negotiations held in Beijing in November 2007. The president of the Eurogroup could, therefore, be given a mandate to represent the Eurozone [20] externally on matters relating solely to exchange rate policies vis-a-vis its main partners. Such a mandate could in fact provide an increased margin of negotiation to the President of the Eurogroup under provisions set out by the Member States. This would, however, require that the Eurozone first acquire the necessary means to develop a political dimension as a complement to the ECB, with the proviso that this proposal be accompanied by close cooperation and coordination between the President of the Eurogroup and that of the European Central Bank. Such a move would give the euro a more political voice in economic matters and help the single currency achieve its full international potential.

Conclusion

The monetary aspect of the China-EU relationship highlights even more the crucial importance of the Eurozone's economic governance and that of its internal institutional strengthening. On trade matters, the ever-growing scale of Sino-European exchanges confirms the need for a more consistently balanced policy with China. As such, it represents a measure of the EU's ability to act as a regional economic bloc and manage a bilateral relationship of great strategic significance globally. While the GDP of the Eurozone, and not only of the EU as a whole, now exceeds that of the United States, the EU will also be able to realise its full economic potential by strengthening its identity and interests externally and, by fostering the conditions for a political relaunch internally.

[1] : Reference may be made to Le monde en 2025, edited by Nicole Gnesotto and Giovanni Grevi, Robert Laffont, October 2007.

[2] : There are a further 205 billion $ transferred to the sovereign fund China Investment Corporation, 160 billion $ of foreign currency bank deposits and the successive profits of bank recapitalisations or funds raised in the financial markets of Hong Kong and New York. Cf. Beijing Economic Mission, in "Greater China Financial Review", No. 331, February 15, 2008.

[3] : Estimates from Eurostat and the European Commission's Delegation in China. It should be noted, however, that Chinese statistics are lower than those from European, or US, sources, mainly due to the exclusion of goods re-exports through Hong Kong.

[4] : Eurostat, "External and intra-European Union trade", September 2007.

[5] : See Peter Mandelson, European Commissioner for Trade, Economic Summit EU-China, Beijing, 27 November 2007.

[6] : This growth partly reflects the rise of the euro in recent months against the Chinese currency, as a direct result of the weakness of the dollar, since the value of the renminbi has been effectively linked to that of the US currency since 2005.

[7] : See "Regional Review, Asia" Network of French economic missions in Asia, No. 152, January 2008.

[8] : ASEAN-5 includes Thailand, Malaysia, Indonesia, the Philippines and Vietnam.

[9] : Research Centre of the US Congress, "US-China trade issues", March 2008. Bilateral trade totalled 387 billion $ or 280 billion € (exchange rate € 1 = $ 1.38, annual average 2007)

[10] : For a more detailed analysis of the geopolitical relations between China and Europe, see "Contemporary Chinese views of Europe," Karine Lisbonne-de Vergeron, Robert Schuman Foundation and Chatham House, November 2007.

[11] : "Study on the Future Opportunities and Challenges in EU-China Trade and Investment Relations 2006-2010", published by the European Commission, February 2007.

[12] : European Chamber of Commerce in China, "China's Position Paper 2007-2008", October 2007.

[13] : See, for example, the complaint dated 3rd March 2008 filed by the EU against measures imposed by Beijing on foreign agencies for financial reporting.

[14] : Estimates of the Bank for International Settlements (BIS).

[15] : Note that the US current account deficits are of around 6.6% of GDP, which partly reflects the accumulation of China's reserves. See Jacques de Larosière, "Monetary policy in a globalized world, what new challenges?", in The State of the Union 2008. Schuman Report on Europe (edited by Thierry Chopin and Michel Foucher), Éditions Lignes de Repères, February 2008.

[16] : Such an assumption is often considered in the light of proposals concerning the potential creation of an Asian currency unit, which would lead, according to some experts, to a convergence of the yen and the renminbi. Other analysts envisage the possibility of a transatlantic monetary agreement between the euro and the dollar. Moreover, despite the recent rise in market speculation about gold prices, the return of this precious metal as a monetary indexation base remains highly unlikely.

[17] : Stephen Jen, "Petrodollar tsunami to hit euro and dollar", Financial Times, 3 March 2008.

[18] : See also Franck Lirzin "What diplomacy for the euro?", European Issue, Robert Schuman Foundation, 10th March 2008.

[19] : "The Coming of age, report on the euro", Bruegel, January 2008.

[20] : See for a detailed report on the Eurozone "The Coming of age, report on the euro", op.cit. or "Exploiting Europe's strong potential", Chatham House, January 2008.

Publishing Director : Pascale Joannin

On the same theme

To go further

Businesses in Europe

Olivier Perquel

—

16 December 2025

Digital and technologies

Josef Aschbacher

—

9 December 2025

Democracy and citizenship

Florent Menegaux

—

2 December 2025

Democracy and citizenship

Jean-Dominique Giuliani

—

25 November 2025

The Letter

Schuman

European news of the week

Unique in its genre, with its 200,000 subscribers and its editions in 6 languages (French, English, German, Spanish, Polish and Ukrainian), it has brought to you, for 15 years, a summary of European news, more needed now than ever

Versions :