Economic and Monetary Union

Emmanuel Sales

-

Available versions :

EN

Emmanuel Sales

Chairman of Financière de la Cité.

1. The creation of savings products oriented towards growth companies is a necessity.

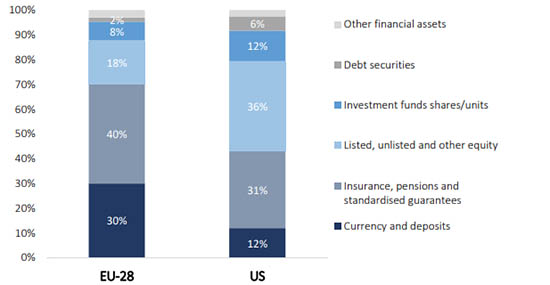

Europeans' overabundant financial savings are mainly invested in bonds or liquid investments. On average, European households hold fewer shares than their US counterparts (graph 1). In continental European countries this is particularly the case for historical and cultural reasons, Household investments are thus mainly allocated to the purchase of government bonds directly (Italy) or through life insurance schemes (France, Germany).

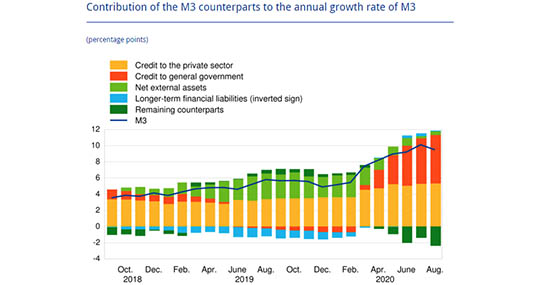

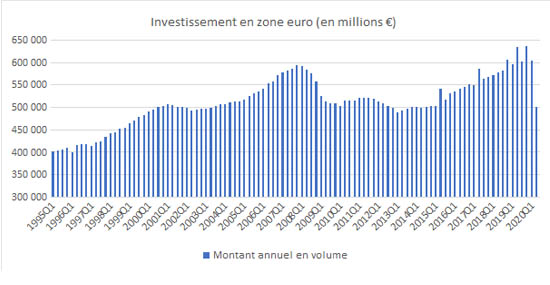

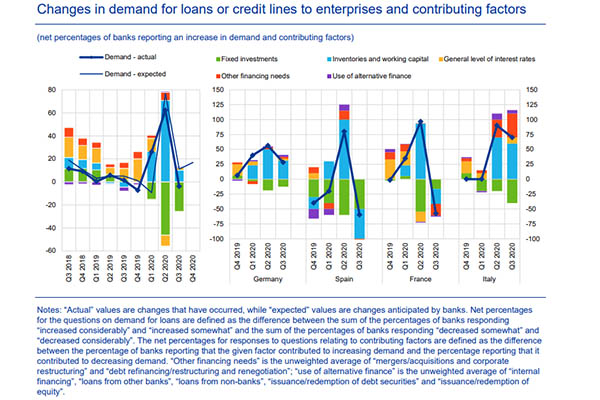

The shocks experienced by the Union over the last ten years have accentuated this tropism (graph 2). The internal demand contraction policies implemented in the wake of the financial crisis have created a chronic situation of under-investment which has been aggravated by the Covid-19 pandemic (graphs 3 and 4). However, as Christine Lagarde recently pointed out, "to grow, innovative firms need a macroeconomic environment that supports demand."

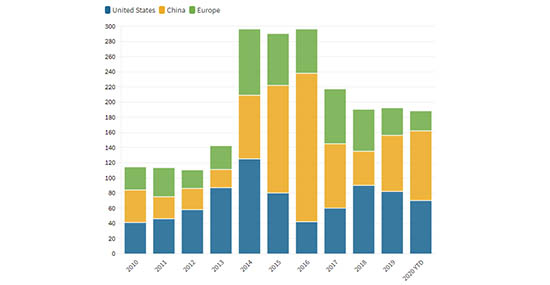

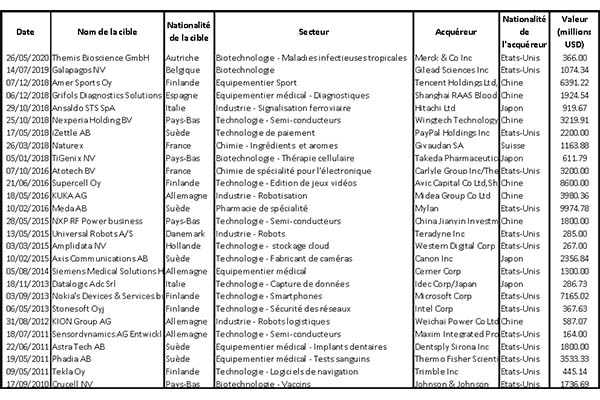

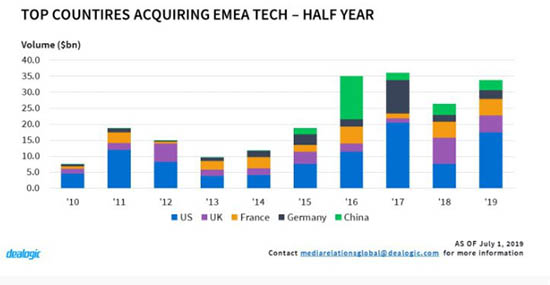

In this context, European growth companies are struggling to find resources on the financial market and rely mainly on bank financing. Initial public offerings (IPOs) have fallen steadily over the last ten years compared to the United States or China (graph 5). To ensure a new phase in their development, entrepreneurs often seek financing from non-European investors. After a first life cycle, companies quickly fall prey to large international companies (table 1) that benefit from a deep and liquid stock market (graph 6). Thus, despite the existing mechanisms, Europe is unable to impose global champions that would allow it to build its sovereignty against the United States and China.

While Europe does not have the rich financial ecosystem of the Anglo-Saxon countries (brokers, advisors, banks, analysts, lawyers, funds, etc.), it does have a considerable pool of savings and a first-rate asset management industry. The creation of mechanisms enabling Europeans to contribute directly to the financing and development of medium-sized businesses with direct spin-offs in terms of employment and growth therefore appears to be a necessity.

2. There is no suitable savings product to support investment by growth companies.

Despite the efforts made in recent years, Europe does not have a suitable savings formula that allows Europeans to support their growth companies.

Individual shareholding programmes specialising in IPOs for medium-sized companies are not widely available. The development of Fintechs should in the medium term facilitate the development of this market by making operations more fluid and providing better information to savers. However, these mechanisms are still designed for a limited public with a good economic culture and a certain familiarity with the workings of the stock market.

Venture capital funds (private equity), which specialise in unlisted companies, do not meet this objective. Institutional investors use the major benchmark funds and a very large part of the capital raised by these funds, if not the majority, is of non-European origin, coming from the United States or China. Moreover, these funds often play a role in the early stages of a company's life cycle and contribute only marginally to the formation of a deep and liquid securities market. As for retail products that allow individual savings to finance SMEs through tax incentives, they are undersized.

The adjustment of national retirement savings schemes in favour of equity investment through the relaxation of regulations only partially addresses the problem. Individual savings schemes specialising in SME financing are little used and are hampered by the lack of financial literacy of their members; the measures taken to ease the prudential constraints on equity investment in life insurance mainly benefit large, listed companies. The development of standardised pan-European individual retirement savings products (IRSPs) recently created by the European Parliament would provide a new framework for channelling Europeans' savings to growth companies. However, the diversity of national tax systems seems to limit the prospects of such a product, which does not offer savers an investment formula specifically designed for the intended purpose.

The European Long-Term Investment Funds (ELTIFs) created in 2016 to provide long-term financing for infrastructure projects, unlisted companies or listed SMEs issuing equity or debt instruments, have not been as successful as expected. With complex investment rules mixing unlisted securities, loans and physical assets, reserved in practice for professional investors with little liquidity, these products are not specifically geared towards the financing of European companies.

There is therefore a need to create a simple financial product that can be easily used by all and that can channel private savings in an efficient and transparent way towards European growth companies.

3. The creation of a new category of UCITS funds, the European Sovereign Wealth Funds, responds to this objective.

To meet the growth challenges of medium-sized European companies, a new investment vehicle, European Sovereign Funds, could be created. These funds are collective investment undertakings meeting European standards (UCITS) investing in growth companies in strategic sectors whose activity directly benefits the Union in terms of jobs, location of skills and production.

The European Sovereign Funds intend to help medium-sized European companies to access the capital market by providing them with long-term resources in the form of equity or bond finance. To be eligible for European Sovereign Funds assets, issuing companies must:

(i) have their effective decision-making centre in one of the Member States of the Union;

(ii) belong to one of the key investment sectors defined by the European Commission: defence; energy; health protection; electronic and computer systems; transport networks and services; aeronautics, etc.;

(iii) have a wage bill and workforce located mainly in the Member States of the Union;

(iv) locate more than 50% of their research and development capacities in one of the Member States of the Union;

(v) have, at the time when they are admitted to a regulated market, a market capitalisation of less than €500 million, this threshold to be adjusted according to the potential of the market.

At least 75% of the European Sovereign Funds must consist of securities (shares or bonds) of companies meeting the above criteria, subscribed at the time of issue or acquired on the secondary market. The balance (25%) may be invested in bonds of EU Member States or in securities of other European companies. Their subscription is open to all investors, individuals or legal entities, resident for tax purposes in a Member State of the European Union, with no payment ceiling.

The European Sovereign Funds provide growth companies with assistance to enable them, after an initial start-up phase, to continue their development and ensure their independence. Taking over from private equity funds, their role is to support companies in their growth phase by giving them access to the financial market. The European Sovereign Funds are also active on the secondary market, ensuring liquidity for all stakeholders.

Set up in the form of UCITS funds, European Sovereign Funds are easily integrated into the market infrastructures and practices of financial players. Savers can subscribe them to individually, either directly or through life insurance in the form of units of account. They can also be used by institutional investors to represent their retirement savings contracts. They are promoted amongst investors through the usual channels and in accordance with the marketing and governance rules in force.

Appropriate incentives should be introduced to promote European Sovereign Funds among investors. In return for the risk incurred, European Sovereign Funds might benefit from certain tax advantages according to national legislation. In particular, the holding of units or shares of European Sovereign Funds could be exempted from capital gains tax subject to a holding period of 8 years. Institutional investors may find their prudential constraints lightened in the light of their investments in European Sovereign Funds.

The creation of European Sovereign Funds could be done easily by inserting a sub-category of UCITS funds in the regulatory corpus. It does not require any substantial changes to existing regulations. European Sovereign Funds could thus spread rapidly in the different Member States according to national particularities.

***

The creation of the European Sovereign Funds would help medium-sized European companies to benefit from the long-term resources they lack, while making the European economy less dependent on bank financing and hence on monetary policy guidelines. The European Sovereign Funds would thus promote the development of a "bottom-up" ecosystem favourable to growth companies in Europe. These funds would also contribute to a strengthening of European cohesion: companies backed by their home market are better able to cope with economic shocks, are more likely to create long-term jobs and are better integrated into society. Finally, by ensuring the mastery of key skills and know-how by the residents of the Union themselves, they constitute a decisive link in the construction of European sovereignty.

Annexes

Graph 1 : Europeans' savings are mainly invested in bonds and liquid products

Source: ECMI, data from the third quarter of 2019 (EU) and in the fourth quarter of 2019 (USA)

Graph 2 : EQ operations resulted in additional precautionary savings

Source : ECB

Graph 3 : European investment is at a standstill

Source : ECB

Graph 4 : The demand for investment credit is in contraction

Source : ECB

Graph 5 : IPOs of European companies are in constant decline compared to the United States and China

Source : CNBC, 19 October 2020

Table 1 : Over the last 10 years, the takeover of European growth companies

by non-European players has intensified

Source : Bloomberg

Graph 6 :American and Chinese companies buy out the vast majority of European technology companies.

Source : Dealogic

Publishing Director : Pascale Joannin

On the same theme

To go further

Freedom, security and justice

Jean Mafart

—

15 April 2025

Asia and the Indo-Pacific

Pierrick Bouffaron

—

8 April 2025

Democracy and citizenship

Radovan Gura

—

25 March 2025

Strategy, Security and Defence

Stéphane Beemelmans

—

18 March 2025

The Letter

Schuman

European news of the week

Unique in its genre, with its 200,000 subscribers and its editions in 6 languages (French, English, German, Spanish, Polish and Ukrainian), it has brought to you, for 15 years, a summary of European news, more needed now than ever

Versions :