supplement

-

Available versions :

EN

The energy shift towards shale gas started in the 1970's in Texas and Louisiana. The States of the American South were the first theatres for a new technique of gas extraction: horizontal drilling. When the latter was coupled with hydraulic fracturing in the 1990s - a method applied since 1947 on conventional hydrocarbon reserves - the extraction of unconventional gas became possible. The initiative did not originate, however, with the oil majors; it was developed rather by small producers, the historical actors of the North American hydrocarbon business, who were prone to take a commercial risk. As gas prices rose to record levels in North America, the large firms became aware of the profitability of extracting unconventional gas. This is how it became a common practice.

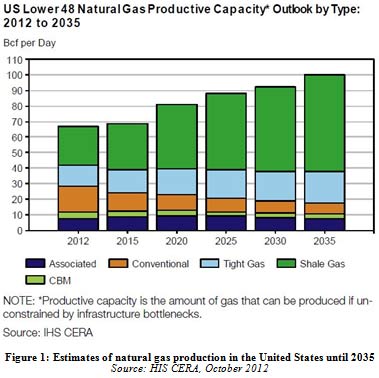

From 2007 and 2012 the US daily gas production increased by 25%[1]. Amongst the various types of unconventional gas[2], shale gas is the most common. Whilst in 2000 it represented only 2% of the US total gas production, today it represents 35%.[3] Production increased to the point of creating a supply surplus of natural gas on the American market. In 2007, the Americans were still planning to import liquefied natural gas (LNG) via coastal terminals[4]. Now domestic production is rising faster than demand and the terminals are being transformed to allow for the liquefaction and export of gas. The consulting firm IHS CERA estimates that production will rise from 1.8 BCM/day in 2012 to 2.8 BCM/day by 2035, shale gas and tight gas accounting for 80% of this increase[5]. Demand will rise from 1.96 BCM to 2.69 BCM/day by 2035.[6]

Other experts are, however, more pessimistic about the future of unconventional gas in the US. A Post Carbon Institute report 'Drill Baby, Drill' from March 2013 claims that American gas production peaked in December 2011; 80% of the USA's production come from five plays, some of which are now in decline. Indeed shale gas wells typically decline fast, hence the need for a permanent flow of investments to maintain overall production levels. When the "sweet spots" run dry, the number of wells and the need for investments rise. It is not certain that these geological and economic obstacles can be overcome in an environment of falling prices[7]. On the contrary, the report takes a sceptical view and forecasts that the "gas bubble" will burst within the next 20 years[8].

Examining the environmental impact

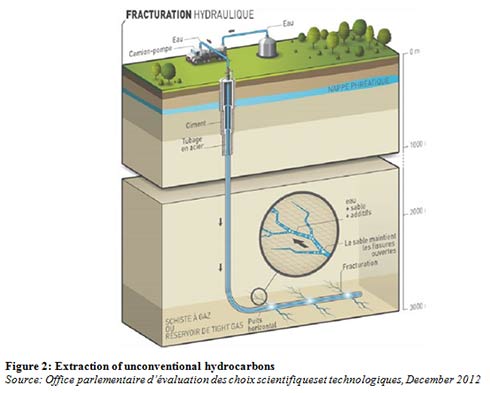

Nevertheless, a different aspect of unconventional gas operations disturbs a major part of the Western public opinion: their environmental impact. Hydraulic fracturing or "fracking" is undertaken by way of horizontal drilling, using high pressure fluids to create fissures which are kept open. The fluid is essentially water mixed with chemical additives and sand to keep the fissures open. The composition of the fluid used in the Marcellus formation in the US is a telling example: water (94.62%), chemical additives (0.14%) and sand (5.24%)[9].

The impact of fracking led to local protests, which in turn resulted in a moratorium on the use of hydraulic fracturing for extracting shale gas and tight gas in the States of North Carolina, New York, New Jersey, and in Vermont, as well as in over 100 communities[10]. Although a certain number of incidents have been linked to operations, it is still difficult to assess their precise causes. In order to identify the environmental issues the word "risk" seems more appropriate. The American experience has brought to light risks in the following domains[11] :

- Water: the risk is as much qualitative as quantitative. Drilling is suspected of polluting drinking water due to both the fluid used and the gas recovered. The risk is lower when it comes to fracking than in case of a problem with the integrity of the well or with the surface retention. The quantitative threat is linked to the large volumes of water needed. This can be a problem in areas where drinking water resources are rare. It has to be noted, however, that the quantities of water required are much lower than those required in the residential, agriculture, and the power sectors.

- Ground: fracking can activate radioactive elements contained in the rock. Hydraulic fracturing does not cause significant seismic events on the surface, the 2011 earthquake in UK's Blackpool being a potential exception. Stronger earthquakes witnessed in Texas and Arkansas were not attributed to hydraulic fracturing, but to the reinjection of the used water to the underground. Local disturbance still occurs due to exploration and production: land take, impact on landscape, and heavy truck traffic.

- Air: Although burning natural gas releases less CO2 than burning coal, the methane leaks during gas production, transport and consumption could have detrimental impact on the climate, the effects of methane on climate change over one century being 25 times stronger than that of CO2. Moreover, hydraulic fracturing requires the use of compressors generally fuelled by diesel and emitting CO2 and other greenhouse gases into the atmosphere.

While assessed, each environmental risk should be put into perspective of the extraction of other fossil fuels such as conventional gas, oil and coal. As far as the specific technique of hydraulic fracturing is concerned, no major ecological disaster directly linked to it has been observed in the US[12].

If environmental risks are present in the US, it is because of the light regulation. Indeed, it is not the state but rather its retreat which has favored the rise of unconventional gas. The regulatory framework for the development of unconventional gas comprises national, regional and local legislation and is implemented at all stages in the development. Yet, the majority of this legislation was created before the rise of shale gas in order to regulate the production of conventional hydrocarbons. The US Environmental Protection Agency introduced measures to reduce greenhouse gases during the extraction of unconventional hydrocarbons. Some states, which are responsible for water and ground protection, voted legislation that makes the composition of the fracking fluid public, and imposes greater safety on the integrity of the wells and the storage of used water. The debate on a better regulation continues on both local and national levels[13]. Although the American debate may resemble the one taking place in Europe, there is a European specificity. Natural resources in Europe belong to the state; in the US they belong to the landowner, which allows him to profit directly from the use of the subsoil.

Towards energy independence

The long-term profitability is still to be proved, the environmental impact precised, and the regulation developed, but it is now clear that the use of unconventional gas has had positive effect on the climate, the economy, and energy security in the US.

Thanks to the increased share of gas in the energy mix in 2012, the US has achieved its lowest level of CO2 emissions over the past 20 years[14]. The gas, whose prices are low, has partly replaced oil and coal in the main consuming sectors: power, transport, housing[15]. As a result, the American coal has been exported to Europe, which has, in turn, reduced its price and increased its consumption in Europe - together with Europe's greenhouse gas emissions.

Low prices have reduced the US industrial production costs, both in absolute and relative terms in comparison with Europe. The improved competitiveness has been most significant in the chemical industry and in energy-intensive industries producing electricity and aluminium[16]. According to IHS CERA, the extraction of unconventional hydrocarbons led to the creation of 1.7 million jobs until 2012 and this figure is due to double by 2035. Its contribution to public revenues, on local, state, and federal levels totalled $62 billion in 2012 and is due to reach $2,500 billion in 2035[17].

According to the International Energy Agency, thanks to its vast unconventional hydrocarbon resources, the US might replace Russia as the world's biggest gas producer by 2015 and oil producer by 2017. Given the supply surplus, the US would become a net exporter of gas by 2020 and of oil by 2030[18]. Indeed if the shale gas revolution continues, it might turn into a geopolitical revolution. The dependence of the US on supplies from the Middle East suppliers has been declining; a shift that can change the American policy in the Gulf[19].

The European underground

The time for shale gas has not yet come to Europe. But saying that the American revolution has not affected Europe would be a mistake. Gas prices on the European spot markets have declined over the past few years, because the LNG destined for the American market has been redirected to Europe. Once American exports begin, the Europe's harbours will be able to receive LNG "Made in America". American coal production has been steered to Europe because in the US it faces competition from cheap gas. As a result, the US is burning less coal, whilst Europe is burning more. Consequently, there has been a reversal in the climate balance on the two continents. From an economic point of view, the difference in energy prices increases the competitiveness gap - which is a thorn in Brussels' side at the time when Europe is negotiating a free-trade agreement with Washington. Thus, in the present energy, climate, and economic context it is be legitimate to look into the extraction of shale gas in Europe.

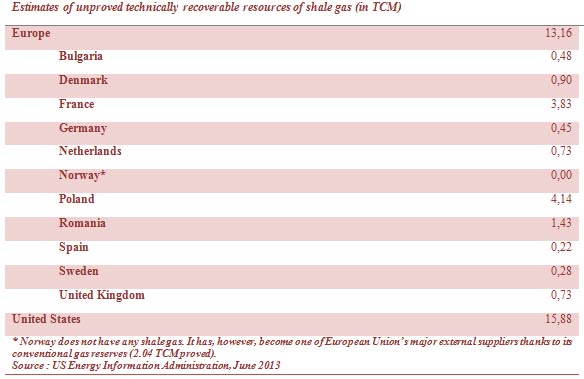

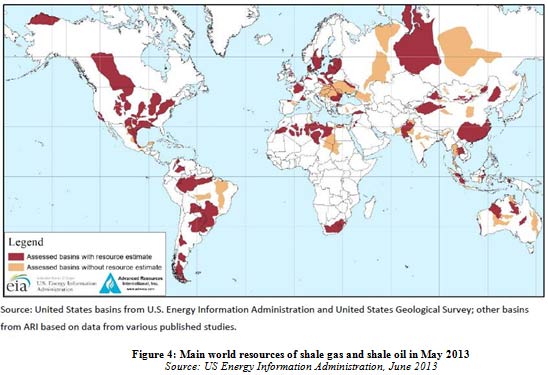

Shale gas resources in Europe are comparable to those in the US. According to the June 2013 report by the U.S. Energy Information Administration, Europe has 13.16 TCM of unproven technically recoverable resources against 15.88 TCM in the US[20]. To put the numbers in perspective, Europe has 4.06 TCM of proven conventional gas reserves, located mainly in Norway (2.04 TCM) and the Netherlands (1.2 TCM), whilst the US has twice that amount (8.9 TCM). Since Europe has not yet touched its unconventional resources, gas production totalled only 0.28 TCM in 2011 and remained well below that of the US (0.67 TCM) and that of its major supplier, Russia (0.67)[21]. As for the shale gas, 60% of the technically recoverable resources (TRR) lie in Poland and France, the remaining 40% being located in Romania, Denmark, UK, Netherlands, Bulgaria, Germany, Sweden, and Spain. Given that Europe consumed 0.44 TCM of gas in 2012, its resources represent theoretically 30 years of consumption.

Economic "recoverability"

Technical recoverability does not equal economic recoverability[22]. The volumes which are technically recoverable are defined by the present extraction technology, whilst economically recoverable volumes depend on drilling costs, the productivity of the wells, and on gas prices. European and American resources are comparable in terms of technically recoverable volumes, but not from an economic point of view.

Drilling costs depend on geological and economic factors. The estimate quoted by the French government agency "IFP Énergies nouvelles" mentions a cost three times higher in Europe than in the US[23]. Forecasts for Poland, based on initial data recovered during exploration, confirm this difference[24]. The Polish cost gap can be firstly attributed to geological factors - depth, temperature, and higher pressure. Secondly, economic factors, too, weigh heavy in Poland - difficulty in access to land (held by private parties with no direct interest in the extraction of a resource belonging to the state), population density, and lack of road, transport and gas distribution infrastructures[25]. Explorations costs vary from one basin to another and, due to the limited exploration progress in Europe, any general estimate can only be very approximate. However, except for infrastructures all of the geological and economic factors mentioned in Poland can apply across Europe as a whole. The transposition of the American case is complicated also because of the nature of the European energy landscape, lacking small oil companies ready to take a commercial risk and without the experience in the extraction of unconventional hydrocarbons.[26]

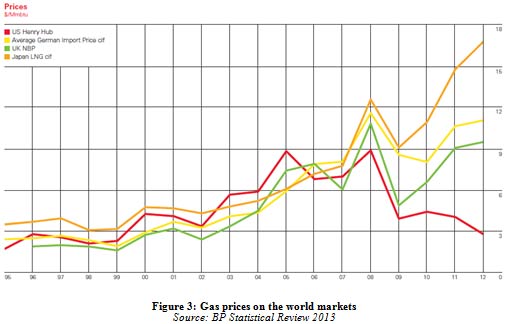

Unlike exploration costs, the prices - another economic recoverability factor - are rather favourable in Europe. They are high, which benefits the producers. Indeed, gas prices on the spot market are three times those in the US. In America they have dropped to as low as $3/MMBTU under the pressure of a gas supply surplus. The European market experienced a price collapse at the end of the last decade because of the economic crisis and the rise of shale gas in the US. Since then, prices have started to rise again, which can be explained by long-term contracts. In spite of the emergence of spot markets, the long-term contracts with prices indexed to oil continue to dominate gas supplies in Europe. Given that oil prices remain high, Europe pays $9-12/MMBTU of gas[27].

Two opposed trends will determine the future gas prices in Europe. On one hand, spot markets with lower prices will grow to the detriment of the long-term contracts with higher prices indexed to oil. Europe's most important gas suppliers, Gazprom (Russia), Statoil (Norway) and Sonatrach (Algeria) have increasingly integrated spot prices in the long-term contracts under pressure from their European clients. On the other hand, the growing European demand (at average an annual pace of 0.6% until 2035)[28] will lead to a price increase. Even though the projected Eastern European demand growth is above the European average due to higher economic growth, it will remain moderate, too[29].

The last factor of economic recoverability of unconventional gas - well productivity - is yet to be analyzed in depth. European countries still do not know exactly what they have underground, as pointed out by the report of the French Office parlementaire d'évaluation des choix scientifiques et technologiques [30].

The French non

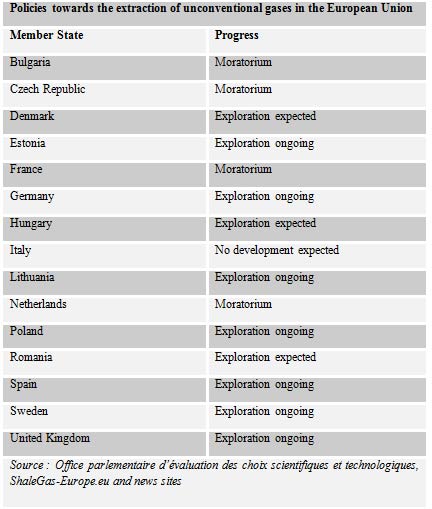

In order to establish economic recoverability, exploration has to continue. But public opinion in Europe is not unanimous, the two extremes being represented by France and Poland. Worried about the social acceptability of hydraulic fracturing and satisfied with its low carbon emissions and cheap electricity thanks to the nuclear energy, Paris banned all exploration for shale gas. Warsaw, on the contrary, continues to explore vigorously in order to strengthen its energy security and to reduce its dependency on coal. Both countries, which hold together the most important resources in Europe, represent two major trends related to the shale gas. More importantly, they show that the economic aspect is not the only one to take into account[31]. Indeed, beyond economic recoverability, social acceptability and energy security dominate in European considerations about transposing the American experience.

France banned hydraulic fracturing, the main method for the prospection of unconventional gases, by a bill on July 13, 2011. Although the bill was passed under the presidency of Nicolas Sarkozy, it has been maintained under François Hollande. "As long as I am president, there will be no shale gas exploration," reiterated Hollande in a TV interview on 14 July 2013. The ban is the result of a strong local opposition against exploration for unconventional gas. Prior to the ban, France had been considered one of the most promising countries for extraction (3,830 BCM of TRR according to the US Energy Information Administration), in particular thanks to the Parisian Basin and in the South-East. Three exploration licenses had already been granted by the government. Nevertheless, a vast movement rose against the prospection activities. Inspired by the American film Gasland (2010) accusing shale gas of a detrimental impact on the environment and public health in the US, the French opposition movement highlighted the risks for regions dependent on tourism. The conflict between the exploration companies and the public was further exacerbated by the absence of public consultation, de iure not required at the exploration stage. The bill, which currently makes it obligatory only for the production phase, should be amended soon[32].

In spite of the unlikely prospect for a lift of the ban, the French debate on shale gas continues. The French political landscape remains divided, as shown by the 2011 parliamentary report ending with two conclusions: one advocates the assessment of resources and reliable techniques to allow for a decision on the unconventional gas; the other calls for the abandon of hydrocarbon development in view of a carbon-free climate policy[33]. The debate continued in the framework of the "national debate on energy transition" from October 2012 to July 2013. The final summary of the debate maintains that "most actors (...) agreed on the need to undertake a study of the impact of the shale gas extraction on the society and economy (tourism, jobs, energy prices) and on the environment and climate, including a complete life-cycle analysis"[34]. Apart from this study, which should be launched soon, other studies by the French authorities are pursued both on the impact of extraction and on alternatives to hydraulic fracturing[35]. Industrial companies and green activists continue to battle for their respective causes with mixed results: whilst on the political level Ecology Minister Delphine Batho resigned in July 2013 under the pressure - according to her own words - of the shale gas lobby, on the legal level the Constitutional Court confirmed in October 2013 the constitutionality of the ban of hydraulic fracturing.

The Polish tak

Poland is the most advanced European country in terms of the exploration of unconventional gas. According to the US Energy Information Administration, it holds 4,140 BCM of TRR. Reserves have been reviewed downwards over the last few years both by the American agency and the Geological Institute of Poland, which now estimates them - according to a different methodology and in terms of economic recoverability - at 346–768 BCM.[36]

Yet, a more pessimistic outlook has not discouraged the government from developing shale gas. It is seen as a chance to reduce Poland's dependency on Russian gas (90% of imports) and dependency on coal (90% of electricity production). Support for unconventional gas is part of a national strategy, which is also planning for the construction of an LNG import terminal on the Baltic Sea coast in 2014 and a gas network in the north of the country[37]. Poland has also been part of the Unconventional Gas Technical Engagement Program since its launch by the US in 2010 (originally called the Global Shale Gas Initiative), which promotes cooperation with the American government. The first exploration license was granted in 2007 and 112 prospection licenses, essentially for a five-year period, were underway in November 2012[38]. Most belong to the gas company PGNiG, some are held by multinational companies like Chevron, Total and ENI[39]. The government is planning for commercial extraction by 2014-2015 and is drafting a new bill on hydrocarbons which will influence the economic profitability of extraction. The present draft modifies notably taxation of mining and the attribution of licenses, and creates a "generational hydrocarbon fund"[40].

Although Poland has been gathering experience in the extraction of hydrocarbons for a long time, the extraction of unconventional gases faces a number of risks some of which were foreseeable, while others have come to light only during the exploration phase. The problems mentioned from the start have been the lack of capital, difficult geological conditions, the lack of water resources, and the under-development of transport, distribution and gas export infrastructures[41]. The risks identified during drilling, focused in the North-East of the country, concern mainly the environment. The inhabitants of the Pomeranian Voivodeship, for example, are disturbed by the noise and traffic related to the extraction and worried about water pollution and its impact on the coastal region's real estate prices, agriculture and tourism. Opposition groups request greater protection and financial compensations[42]. However, a study undertaken by the public authorities claims that extraction activities have not polluted the air, water, or soil, and that the noise level has remained within the legal limits[43].

In spite of the local opposition, most of the Polish population, notably the inhabitants if the South-West polluted by coal-fired power plants, are supportive of the development of unconventional gas. The government is still motivated in spite of the multinationals Exxon Mobile and Marathon giving up their licenses. Their departure from Poland might be blamed not only on doubts over the economic recoverability of extraction and on local acceptance, but also on their activities in other countries which might be more profitable than in Poland.

The Europe of Shale Gas?

In France, as in Poland, the future of unconventional gas will be decided by the policy towards natural gas and by market demand. The summary of the French debate over energy transition does not openly highlight gas as a fuel of the future. But François Hollande's commitment to reduce the share of nuclear power (calling for a higher gas supply) and to increase the share of intermittent renewable energies (calling for a higher gas demand) in the electricity mix allows for some optimism regarding the gas consumption. The Polish government is clearly more favourable of an increase in gas consumption, in parallel to a nuclear power plant project. Although the difference between the French and the Polish cases shows the extent, to which the energy mix is still a national competence in the Union, it symbolizes the dilemmas at stake across Europe, on an increasingly interconnected gas market. It is therefore natural that the debate - with a strong presence of France and Poland - is pursued in Brussels. The fate of shale gas in Europe is being determined not only on the national, but also on the European level.

The debate is taking place at the very time when Europe is seeking a new energy policy. In March 2013, the European Commission published a Green Paper on the EU's climate and energy goals until 2030. Discussions should lead to a new European strategy in 2015-2016, a successor of the current so-called 20-20-20 strategy[44]. The latter, which aims to increase the share of renewable energies to 20% in the energy mix by 2020 in order to reduce greenhouse gas emissions by 20% in comparison with 1990, has not been a definite success. The economic crisis and cheap coal have paralyzed the carbon credit markets, which should have ensured a reduction of the greenhouse gases. The construction of new renewable energy capacities has proven too costly, the European consumers not being able to benefit from low wholesale prices due to overcapacities. The Fukushima accident contributed to Germany's nuclear phase-out and to scepticism regarding the nuclear energy in other countries now preferring fossil fuels. In addition, there is the problem of energy security, since Europe is still extremely dependent on external suppliers, a weakness in the increasingly competitive world race for energy[45].

At present Europe is before a puzzle: how to find clean and cheap energy source and yet to increase energy security at the same time?

One possible response is the development of the European unconventional gas resources. The success of this enterprise will be determined - as shown above - by the economic profitability of the resources available, by the social acceptability of the extraction, and by the desired level of energy security.

Since 2011, the European institutions have been trying to grasp the issue of unconventional gas and the associated constraints. The European Council of February 2011 called for the assessment of Europe's potential to extract and use conventional or unconventional fossil resources on the long term. Since then, the debate in Brussels has been dominated by the consideration of environmental risks, which does reflect the Union's strong competence in the environmental domain, but which does not take into account all the opportunities of extraction.

A report commissioned by the European Parliament in 2011 analyzed mainly the potential environmental issues linked to extraction. It pinpointed gaps in the European legislation regarding extraction. The report's conclusions are reflected in the European Parliament's resolution of November 21, 2012, on the environmental effects of shale gas and oil extraction.

The European Commission is looking into the issue. The report on the European regulatory framework regarding the extraction of unconventional gases commissioned in 2011 observed that the framework was adequate for the present phase (exploration), but proposed amendments in the perspective of a commercial phase. In 2012, the Commission published several studies, which maintain that the impact of any potential extraction of unconventional hydrocarbons on the climate, on the environment and on public health would be more damaging than the extraction of conventional gas. Finally, from December 2012 to March 2013, the Commission undertook a public consultation on shale gas in Europe. Whilst the results published in July 2013 did not show a consensus on shale gas extraction, most persons and institutions interviewed asked for an improved legislative framework across Europe.

In view of implementing the recommendations of both experts and the public, the Commission is now preparing new measures to improve the guarantee of environmental integrity of the extraction of unconventional hydrocarbons. Environment Commissioner Janez Potocnik said that the measures would aim to cover the existing gaps in the European legislation without specifying the character of these measures (law, recommendations). In any case, the Commission is due to present them by the end of the year.

What options does the Union have?

An American-style shale gas revolution will not take place in Europe on the short term as things stand at the moment. Several obstacles prevent European unconventional gas resources from being extracted like in the US. First, it is not as profitable from an economic point of view, notably due to high drilling costs and uncertain gas prices. Second, social acceptability is not guaranteed in Europe, with France being a typical example. Finally, energy security only seems to concern the political elites of the countries extremely dependent on Russian imports like Poland. Unconventional gas will therefore be extracted only in some Member States or only in certain regions to fuel specific industries, but it will not be produced on a Europe-wide scale on the short term.

However, the debate over the advantages and disadvantages continues across Europe. The success in America has not been ignored by Europe's institutions which have been trying to appreciate this experience since 2011. The Member States are defending their respective positions in Brussels in order to spread them across the board. The debate over shale gas in Europe is part of a wider discussion that should lead to a new energy and climate strategy for the Union as of 2030. As a result, the European Commission might become a decisive player in terms of shale gas in Europe.

The Commission is preparing new measures to improve the management of the environmental effects of potential extraction. The Union should not stop here: positive effects on the economy and energy security in the US, and the difficulties associated with its own climate and energy policies should make the Union think beyond environmental constraints.

The European Union should consider the following measures:

· On the short term, it should complete the analysis of gaps in the European environmental legislation and put forward new measures that will be beneficial to the environment and to potential investors through the harmonization of environmental rules.

· On the short term, it should seize the opportunity offered by the May 2014 European elections and organize a Europe-wide public debate which would take into account environmental, economic and geopolitical aspects of shale gas extraction in order to define its place in the European energy policy beyond 2030.

· On the medium term, it should provide resources allowing for the collection of data on shale gas resources in Europe and the assessment of the profitability of its extraction in the respect of European conditions (with the participation of producers and funding from the European Bank for Reconstruction and Development, EBRD).

· On the long term, it should observe the best practices in the US, facilitate the exchange of information between the extracting Member States, and improve extraction techniques towards higher environmental standards and better economic conditions (with the participation of European institutions, European energy firms and the EBRD).

[1] IHS CERA : America's New Energy Future, October 2012.

[2] A feasibility study by the Office parlementaire d'évaluation des choix scientifiques et technologiques (quoted below) recognizes three types of unconventional gas : shale gas, tight gas and coaled methane.

[3] IHS CERA : America's New Energy Future, October 2012 ; Natixis : Gaz de schiste aux États-Unis: les Européens doivent prendre au sérieux la menace sur leur industrie, September 26, 2012.

[4] Liquefied natural gas is natural gas cooled down to -162 °C, which makes it liquid and allows for transport on the sea.

[5] BCM = billion cubic meters. Although the sources used in this paper employ the cubic feet unit, the data has been converted - in this paragraph as well as in the following ones - to cubic meters, according to the following equation: 1 billion cubic feet of natural gas = 0,028 billion cubic meters of natural gas.

[6] IHS CERA : America's New Energy Future, October 2012.

[7] J. David Hughes : Drill, Baby, Drill, Post Carbon Institute, March 2013.

[8] EurActiv.fr : La bulle du gaz de schiste bon marché " explosera d'ici 2 à 4 ans ", selon un expert, May 23, 2013.

[9] Office parlementaire d'évaluation des choix scientifiques et technologiques: Etude de faisabilité d'un rapport relatif aux "Techniques alternatives à la fracturation hydraulique pour l'exploration et l'exploitation des gaz de schiste", December 2012.

[10] La Résolution du Parlement européen du 21 novembre 2012 sur les aspects environnementaux des activités d'exploitation du gaz et du pétrole de schiste (2011/2308(INI)).

[11] Office parlementaire d'évaluation des choix scientifiques et technologiques: Etude de faisabilité d'un rapport relatif aux "Techniques alternatives à la fracturation hydraulique pour l'exploration et l'exploitation des gaz de schiste", December 2012; IFPEN : Hydrocarbures de roche-mère : État des lieux, January 22, 2013.

[12] Paris Tech Review : Gaz et pétrole de schiste : leçons américaines et australiennes, January 27, 2012.

[13] AIE : Golden Rules for a Golden Age of Gas, 2012.

[14] EUISS : The shale gas 'revolution' : Challenges and implications for the EU, February 2013.

[15] Natixis : Gaz de schiste aux États-Unis: les Européens doivent prendre au sérieux la menace sur leur industrie, September 26, 2012.

[16] Ibid.

[17] IHS CERA : America's New Energy Future, October 2012.

[18] AIE : World Energy Outlook 2012.

[19] EUISS : The shale gas 'revolution' : Challenges and implications for the EU, February 2013.

[20] US EIA : Technically Recoverable Shale Oil and Shale Gas Reserves Resources: An Assessment of 137 Shale Formations in 41 Countries Outside the United States, June 2013.

[21] Production in Europe as surveyed by the US EIA also includes production in Norway (0.11 TCM in 2011) which is not an EU Member State. As for production within the EU, it totaled 0.16 TCM in 2011 against 0.65 TCM in the US and 0.61 in Russia, according to BP's Statistical Review 2013.

[22] US EIA defines technical and economic recoverability as follows: " Technically recoverable resources represent the volumes of oil and natural gas that could be produced with current technology, regardless of oil and natural gas prices and production costs. Economically recoverable resources are resources that can be profitably produced under current market conditions." (US EIA : Technically Recoverable Shale Oil and Shale Gas Reserves Resources: An Assessment of 137 Shale Formations in 41 Countries Outside the United States, June 2013).

[23] IFPEN (Hydrocarbures de roche-mère: État des lieux, January 22, 2013) estimates drilling costs at 3 USD/MBTU in the USA against 8 - 11 USD/MBTU in Europe.

[24] KPMG : Central and Eastern European Shale Gas Outlook, 2012.

[25] International Institute of Political Science of Masaryk University : Unconventional Sources of Natural Gas: Development and Possible Consequences for the Central and Eastern European Region, 2012.

[26] Joint Research Centre: Shale Gas for Europe - Main Environmental and Social Considerations (A Literature Review), 2012.

[27] BP : Statistical Review 201 3 ; Reuters : East Med gas would help European supply but not prices, July 9. 2013.

[28] AIE : World Energy Outlook 2012.

[29] KPMG : Central and Eastern European Shale Gas Outlook, 2012.

[30] Office parlementaire d'évaluation des choix scientifiques et technologiques: Etude de faisabilité d'un rapport relatif aux "Techniques alternatives à la fracturation hydraulique pour l'exploration et l'exploitation des gaz de schiste" December 2012.

[31] IFPEN gives a list of factors that will determine the transposition of the American case abroad in the report Hydrocarbures de roche-mère: État des lieux , January 22, 2013.

[32] AIE : Golden Rules for a Golden Age of Gas, 2012.

[33] Ibid.

[34] Le Monde : Gaz de schiste : une nouvelle étude d'impact demandée, July 19, 2013.

[35] Alternative methods mentioned by the Office parlementaire d'évaluation des choix scientifiques et technologiques ( Etude de faisabilité d'un rapport relatif aux "Techniques alternatives à la fracturation hydraulique pour l'exploration et l'exploitation des gaz de schiste", December 2012) and in the press by ParisTech Review (Gaz de schiste : quelles pistes alternatives à la fracturation hydraulique ?, January 14, 2013).

[36] PAP Biznes : Polish Geological Institute Director on shale gas resources, regulation et al., July 12, 2013.

[37] KPMG : Central and Eastern European Shale Gas Outlook, 2012.

[38] Maciej Wozniak (advisor to the Polish Environment Minister and head geologist): Shale Gas in Poland, presentation on December 6, 2012.

[39] AIE : Golden Rules for a Golden Age of Gas, 2012.

[40] Maciej Wozniak (advisor to the Polish environment minister and chief geologist): Shale Gas in Poland, presentation on December 6, 2012.

[41] KPMG : Central and Eastern European Shale Gas Outlook, 2012.

[42] Natural Gas Europe: Pomorze: Seeds of Polish Shale Gas Counter Revolution, November 26, 2012.

[43] Maciej Wozniak (advisor to the Polish environment minister and chief geologist): Shale Gas in Poland, presentation on December 6, 2012.

[44] Le Monde : Climat : l'Europe se projette en 2030, March 29, 2013.

[45] Cf. Cécile Maisonneuve, Énergie : l'Europe en retard d'une révolution, Les Échos, July 24, 2013.

Publishing Director : Pascale Joannin

On the same theme

To go further

Africa and the Middle East

Louis Caudron

—

14 October 2025

Democracy and citizenship

Laurent Mayet

—

7 October 2025

Transatlantic Relations

Maxime Lefebvre

—

30 September 2025

Democracy and citizenship

Florent Parmentier

—

23 September 2025

The Letter

Schuman

European news of the week

Unique in its genre, with its 200,000 subscribers and its editions in 6 languages (French, English, German, Spanish, Polish and Ukrainian), it has brought to you, for 15 years, a summary of European news, more needed now than ever

Versions :