Economic and Monetary Union

Jean Arthuis

-

Available versions :

EN

Jean Arthuis

1. From torpor to crisis: the end of all illusions

[1]

Disappointing results on the whole

The single currency can show a series of satisfactory results to its credit. It immediately put an end to competitive devaluation that was so damaging to growth and employment. The euro fostered a period of moderate inflation and greater economic integration, thanks to the removal of exchange rate related risks and the reduction of transaction costs. It rapidly rose to international status: having become a reserve currency, the euro is the second most exchanged currency in the world and in terms of debt issuances, it is the most privileged alongside the dollar.

Although the euro is doing well, the euro zone for its part, is experiencing a deep crisis that is marked by atone economic activity and major internal imbalances. Significant differences remain within the zone (labour costs, unemployment rates) and divergence in competitiveness between the euro zone countries restricts the EU's economic and monetary adjustment capacities. With regard to trade the EU is still the world's leading export power of course and the euro zone's aggregated current account is balanced for the greater part, but this masks some quite significant differences.

The end of all illusions: the currency is not the base of a growth strategy

The crisis can largely be explained by the lack of distinction in terms of sovereign risks: overall the euro zone was seen to be representative of an homogeneous risk. With the promise of the euro, the decrease in interest rates in some States was extensive. The period of low interest rates had a powerful sedative effect over our economic policies. The Member States did not take advantage of this period to consolidate their public finances and prepare for the future.

The financial and then the sovereign debt crisis brought the market players out of their blind consensus: the difference in spreads once again became the indicator of differences in competitiveness between our countries and doubts about our public finances were again the focus of investors attention. This led to the drying up of liquidity access on the financial markets between the autumn of 2009 and the spring of 2010, in Greece, then in Portugal and Ireland.

However, quitting the euro would not lead to prosperity – far from it. Whilst some have been calling to quit the euro, we should remember the extent of the damage that the relinquishment of the single currency would represent for our economy. It is believed that quitting the euro and returning to the franc, followed by devaluation, would cost the French economy up to one fifth of its national wealth.

A political crisis: a State-less currency

The period of turbulence that we are experiencing is above all the reflection of a deep, political crisis over the future of the Economic and Monetary Union. Together, European leaders (11 initially and now 17) have been struggling to draw up a coherent, effective policy mix in a monetary zone that is not optimal. The major challenge set by the euro was to create a single currency in a State-less universe. The project was an ambitious one: first economic and monetary and then political integration. Contrary to what was implicitly hoped, nothing has yet happened because the European political project has not become a reality.

The Stability and Growth Pact, a pact of complacency

In the absence of a European State and any applicable governance, we had to draw up "co-ownership" rules of the euro zone – a set of budgetary regulations designed to satisfy convergence criteria that were defined in the Maastricht Treaty. Experience is confirming that the creation of rules is not a solution to everything and they cannot replace policy. Solemn engagements by the signatories did not stand the test of reality and traditional political contingency.

However was the Pact we concluded in 1996 and 1997 "stupid", as one President of the European Commission was to qualify it some years later? Certainly not. It was based on sound economic foundations: the goal was to prevent the implementation of lax budgetary policy in one country from penalising the others because of its effects on interest rates across the entire euro zone.

But this procedure was not applied when it should have been, particularly in 2003 against France and Germany. After this unfortunate episode the Stability Pact was reformed in 2005: whilst the basic rules and principles were maintained, the new Pact aimed to integrate better the situations of individual States in order to match the logic of the economic cycle.

The euro zone has therefore been lax in applying the rules it had provided itself with. All of the players in European governance have their share of responsibility in this, whether it is direct or indirect. It has to be admitted that the collapse of the Santer Commission in 1999 heralded the start of a long term weakening of the European Commission. In part this explains why the Member States had no incentive to undertake virtuous budgetary policies at the top of the cycle, when economic growth was strong. After a good start, there was budgetary laxness (also known as "consolidation fatigue") at the beginning of the 2000's, after qualifying, sometimes after a bitter battle, for the single currency.

The duplicity of the Greek Public Accounts

The effective implementation of the Stability Pact also demanded the cooperation of the government players and presupposed the sincerity of the Member States. The institutions responsible for the supervision of public finances – the European Commission, the Ecofin Council, the European Central Bank (ECB) – issued warnings quite early on regarding the Greek statistics. The ECB's convergence report on Greece in 2000, before it entered the euro, already revealed that "improvements in transparency and the quality of the statistical data would help support budgetary supervision" of the country. On two occasions, after there was political change (in 2004 and then in 2009), Greek statistics were found to be false and the data given by Greece was the focus of significant adjustment. The duplicity of the public accounts damaged the country's credibility in terms of it undertaking a sustainable budgetary policy. It was only at the end of 2009 that the ratings agencies downgraded the Greek sovereign debt. In view of its economic base Greece was, in all likelihood, not ready on January 1st 2001, to become the 12th euro zone State. The country therefore accumulated problems as it joined the euro zone and continued to do so due to the poor supervision of its public finances and due to a lack of supervision on the part of its partners.

Incomplete rules from the outset

There were at least four problems inherent to the economic governance rules that limited them:

- the debt criteria was void of all operational features;

- peer supervision, that was limited to budgetary positions did not focus on macro-economic imbalances (cf. the Spanish and Irish examples), notably in view of relative competitiveness, current account balances or export market shares;

- the financial sanction mechanism included in the Stability Pact is not adapted given its pro-cyclical nature;

- the Pact did not include any measures regarding the action to take in the event of a crisis. Hence there was a feeling that nothing had been prepared for when trouble occurred. This is why the ECB and the IMF found themselves involved in a "Troika" of circumstance, alongside the European Commission.

The initial structure – poorly designed governance

The expression "economic governance of the euro zone" was challenged for a long time and rejected by Europe's leaders. Some speak of reticence on the part of our partners (particularly Germany) who might have seen this as an attempt to gain political control on the ECB. The problem also reflects the States' refusal, including that of France – to acknowledge the need for a real sharing of sovereignty within the euro zone.

2. From lucidity to action: nascent wisdom

New Rules for the Future

Over the last two years, in order to emerge from the crisis European leaders have drawn up new rules designed to support the mid-term future and stability of the euro zone.

First in September 2010, the European Commission put forward a package of six texts. The Six Pack, which entered into force on 13th December 2011, deals with the flaws in the Stability Pact and includes some additional rules. The Pact's preventive and corrective chapters have been revised. Emphasis was placed on supervising debt control and not just the deficit. An average annual reduction of 5% (over three years) in the difference between the debt level and the threshold to respect – equal to 60% of the GDP – is now required. The new measure now means that sanctions fall earlier and more automatically. Finally the Six Pack extends the supervisory perimeter of the States to excessive macro-economic imbalances in order to prevent differences in competitiveness within the euro zone. This is a major step forward which might have prevented Ireland and Spain's situations from deteriorating further. A series of economic and social indicators will be specifically monitored: public and private debt, property prices, unemployment rates, current accounts, real effective exchange rates etc. Again sanctions have been planned against any euro zone Member which does not take the necessary measures.

The application of these rules requires the continuous supervision of Member States' budgetary and economic policies. This management is based on regular dialogue between the Member State and the community institutions: the "European Semester". France's first experience of the European Semester demonstrated the limitation of this exercise: cumbersome procedures and the formal nature of Parliament's consultation did not lead to decisive progress for the European coordination of national economic policies. However dialogue between national and European instances is an effective preventive tool to reduce divergence within the monetary union.

On 23rd November 2011 the European Commission suggested going further in terms of supervising euro zone Member States' budgetary policy. One of the two texts put forward aims to manage national budgetary policy ex-ante before the launch of preventive and corrective procedures as planned in the Growth and Stability Pact. In order for the exercise to be credible the text plans for projects to be drawn up based on independent growth forecasts, which would be a decisive step forward. Finally it plans for the inclusion of a rule governing structural budgetary balance in a binding national text, which should be of a constitutional nature and for an "independent budgetary council" to check that this rule is being implemented

A treaty focused on budgetary discipline at the service of stability

Finally 25 Member States signed the new pledge on the 2nd March 2012 (the UK and the Czech Republic both announced that they would not sign the treaty): this international treaty sets out the euro zone's determination to re-establish budgetary and macro-economic balance. In its final version the treaty intends each Member State to include an imperative budgetary rule in its Constitution. This rule is to govern the national budgetary process so that budgetary balance is part of an adjustment trajectory towards a mid-term goal set for each country in agreement with the European Commission. The new treaty plans that structural deficit, cyclically adjusted and excluding temporary measures, will not exceed 0.5% of the GDP, except in exceptional circumstances or in a period of severe recession. To this end it has been planned to introduce an automatic corrective mechanism into national law. If one of the States taking part in the treaty does not respect this fiscal rule the case may be brought before the EU's Court of Justice.

New Crisis Management Tools for the Euro Zone

It appeared that Europeans were providing a timid, disordered emergency response to the sovereign debt crisis. The test regarding the euro zone's ability to settle the crisis came in February 2010 when Greece, which was facing market pressure, encountered real funding problems. The rather late European response might then have seemed hesitant. The theatrical nature of the summits between Heads of State or government led to great expectations. The multiplication of these so-called "last chance" summits under the pressure of the market may have led to a feeling that Europe was powerless in the face of the crisis. When the single currency was being designed nothing was planned to counter a liquidity or solvency crisis of one euro zone Member State or another. It was necessary then to create a crisis management instrument in the midst of the storm, which started in Greece and then threatened to destabilise the entire euro zone.

The forced emergence of governance specific to the euro zone

The crisis led to the euro zone's first summits. It was under the French presidency that the euro zone Heads of State or government met for the first time on 12th October 2008. Although until then the idea of meeting only between the euro zone Heads of State or government had been inconceivable, the need for it has now been acknowledged: the specific kind of solidarity that has resulted from sharing the same currency justifies concerted action on the part of all 17 of these Member States. This was one of the points in the treaty that was finalised on 30th January 2012 (article 12).

Although the Commission has made – a timid-step towards taking specific care of the euro zone countries via the appointment of a Vice-President of the European Commission, whose explicit job is to take care of the euro, this trend has encountered political opposition however, especially on the part of States that have not adopted the euro. Some eminent members of the European Parliament suggested the establishment of a specific sub-committee for the euro zone within the Parliament's Economic and Monetary Committee (ECON). This encountered internal opposition.

A movement underway – community initiatives to prepare for the future

Various initiatives have been taken on a community level to prepare for the future. In spite of the hostility of some States with regard to pooling public debt within the euro zone, the European Commission published a green paper on 23rd November 2011 on the feasibility of introducing "stability" bonds that would be issued jointly by euro zone Member States. It is to the European Commission's credit for having initiated debate. The European Commission also made the most of its power of initiative, over which it enjoys the monopoly, to contribute to finding solutions to the crisis: it took a fiscal initiative via the proposal for a tax on financial transactions (FTT). Commissioner Barnier, who is in charge of the internal market and services, has also provided new impetus to the single market. This is the goal of the Single Market Act that primarily aims to put an end to the fragmentation of the internal market and to do away with impediments to the circulation of services as well as to support innovation. The Commission is mainly focusing its efforts on SME's which have been hard hit by the crisis (Small Business Act), the EU's fiscal regulation (Common Consolidated Corporate Tax Base), the mobility of workers or intelligent infrastructures (energy networks, broadband Wi-Fi networks). Finally the European Union has prepared a financial regulation programme to honour its commitments taken as part of the G20. Several steps forward have been made in the area of European banking supervision, the regulation of market structures and many financial products and also the monitoring of the ratings agencies. Hence there has been movement on all sides by the European Commission, which deserves praise.

These initiatives will only achieve their goal ie help towards increasing economic growth if the European Commission carefully avoids drawing up directives and regulations that impede business competitiveness, in contradiction with the goal of stimulating growth, or launch further public spending, in contradiction with the goal of consolidating public finance. Incidentally the Commission also has to take a critical look into how structural funds are allocated and the effect of these on local public finances. Given the domino effect of co-funding operations that are covered in part by European funds, the EU's structural funds have sometimes led to unproductive local spending.

Structural work by the Member States to emerge from the crisis

National dynamism can be added to the work undertaken by the European Commission in terms of emerging from the crisis. In the countries where I have been (Germany, Spain, Italy, UK, Greece) as it is the case all over Europe, specific attention is now being given to budgetary consolidation and structural reforms. Budgetary consolidation programmes and the inclusion of rules into the national normative framework have become realities in several Member States. German leaders have included the goal of a return to balance, with a structural deficit below 0.35% of the GDP by 2016, into their constitution (structural balance achieved by 2020 in the Länder). Budgetary consolidation has also become a concern acknowledged by the public authorities in France. The Italian government has launched a vast structural reform programme and a new austerity plan called "Salva Italia" should lead back to budgetary balance by 2013. Concerned about the macro-economic effects of consolidation the President of the Council launched a second plan in January 2012: "Cresci Italia", which is designed to revive growth by addressing, as a priority, the lack of competitiveness and infrastructures. In September 2011 Spain adopted a budgetary rule by including the obligation to respect the balance of public accounts in its Constitution. This rule limits the Central State's structural deficit to 0.26% of the GDP and that of the regions to 0.14% of the GDP. Finally a huge effort has been made in Greece to reform the State. A "Task Force" was established in September 2011 to provide Greece with the technical assistance it needs to complete the EU/IMF adjustment programme. Some initiatives, notably French and German, are contributing to this directly. This work, which is convergent and coordinated, is a clear and extremely positive contribution to the reforms started in Greece.

3. For stability and sustainable growth: euro zone specific governance

The effective coordination of budgetary positions and the macro-economic situation of euro zone Member States calls for a specific type of governance that is supported by a coherent institutional structure. This evolution, which at present applies to the 17 countries which have adopted the euro, may be extended to the States that will join the euro. The UK and Czech Republic's choice not to sign the Stability, Coordination and Governance Treaty of course confirms that since the Maastricht Treaty, Europe has moved along on two levels, with two spheres of partners: the euro zone, which has 17 members today and which targets a common policy mix and the EU with 27 members (and in the future 28 with Croatia), sharing a single, integrated, internal market.

An assumed sharing of sovereignty at the service of stability and growth

Genuine public accounts are an absolute pre-condition. The Six Pack plans for substantial improvements in the production of European statistics. My proposal is for Eurostat to be an independent European statistics agency. This might lead to the establishment of a European network of National Statistics Agencies that would be on a par in terms of statistics with the European System of Central Banks (ESCB). Short term, the European statistics framework could be improved, by making, for example, the code of good practice a part of European law.

In order to take budgetary and macro-economic dialogue further I believe it is necessary to normalise and harmonise assessment and presentation methods with regard to national budgets, so that all of these budgets can be aggregated to establish a consolidated euro zone budget (local and social finances included). This would foster better coordination of budgetary work for each major public policy.

Since caution about economic hypotheses is one of the conditions for the efficacy of any rule on budgetary balance we must also ensure that macro-economic forecasts on which draft budgets rely are independent and genuine.

I also suggest that the Council is given the opportunity to adopt political sanctions, which are more credible than financial sanctions, which cripple a State that has already been weakened. A scale of political sanctions should be defined so that the rules are respected; these might range from the adoption of a public recommendation addressed to the State in question, to the suspension of the right to vote in the Ecofin council.

Finally it seems appropriate to involve Member States' budgetary departments in the work undertaken by the Ecofin/Eurogroup.

A political initiative must be launched to define a clear, coherent horizon. A five year budgetary consolidation programme should give the euro zone a mid-term prospect. The return to balance of all euro zone countries must be targeted at the end of this period. Nothing says that some States will not reach this target sooner. The determination to consolidate public finance must go hand in hand with a structural reform agenda and growth policies. The European Council that met in Brussels on 1st and 2nd March 2012 is trying to do this. In any event the respect of the priorities defined by the Europe 2020 agenda calls for greater cooperation between partners regarding the quality of public spending and the synergies that might result from this. This means that euro zone Ministers will have to turn the budget around together to stimulate future spending and potential growth.

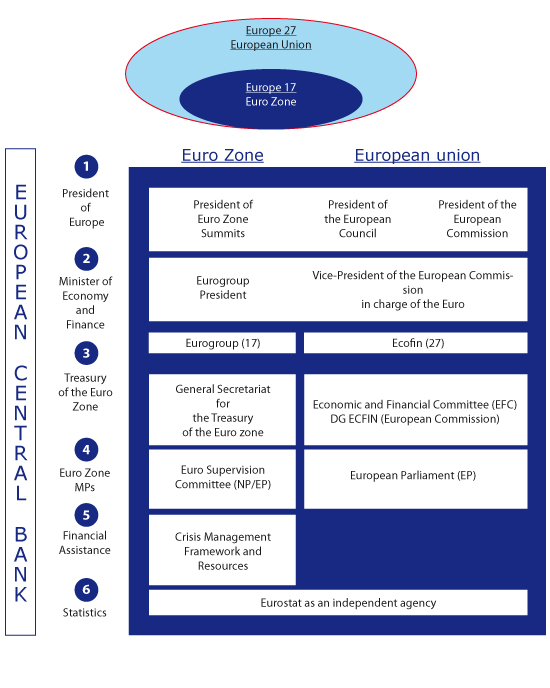

A need for legibility and coherence: simplifying the institutional structure

It is now quite obvious that if Europe wants to have any influence over matters in the world its citizens have to be able to understand it and the same goes for third parties, whether these are international partners or financial market players. Economic and financial confusion is too often the norm in Europe. The issue of legibility in terms of the outside world is therefore primordial: we must move towards a simpler institutional system, which respects the community method. With this in mind I believe it wise to opt for a "nested" system in which a leader takes responsibility for the euro zone and for the entire European Union.

The need to identify a European leader has rarely been as obvious as it has been during this time of crisis. To clarify the institutional structure and Europe's voice in the outside world, the merger of the position of president of the European Council and the President of the European Commission now has to be taken on board. The President of Europe, President of the European Council, President of Euro Zone Summits and President of the European Commission would be the natural link between the two spheres, the euro zone and the internal market. Enjoying double legitimacy, the President of Europe would assume both the role of driver, guide and legislative initiator, he would coordinate the Member States' positions and be Europe's representative with regard to European citizens and to third parties (sovereign and financial markets). The European President would come from one of the countries in the "first sphere", ie the euro zone. The candidate for this post would be put forward by Heads of State or government and be approved by indirect suffrage, via a congress comprising national parliamentarians and MEPs. I doubt very much that Europeans are ready to elect their president via direct universal suffrage.I propose the appointment of a euro zone Economy and Finance Minister who would take on the position of Eurogroup president (for the 17), president of the Ecofin Council (for the 27), and of Commissioner responsible for the euro. His job would require total availability and would call for independence to protect him from coming under suspicion of having conflicting interests. The position cannot therefore be given to a minister who already holds a national post. This configuration can be compared to the one adopted in the area of foreign affairs and security policy. This economy and finance minister would have the same status as that of "High Representative of the Union for Foreign Affairs and Security". It must however be noted that although foreign policy goals have not been clearly established, the euro zone finance minister's roadmap is quite clear. A euro zone citizen, he would notably be responsible for stepping up the supervision of Member States' economic and budgetary policies, the preparation and follow-up of euro zone summit meetings, the communication of the Eurogroup's decisions and representing the euro zone in the outside world. Moreover the Eurogroup's status has to be made official and it should be provided with real decision making power. The Eurogroup cannot be left in a state of ambiguity as it stands in the present texts.

The Minister of the Economy and Finance of the euro zone needs a dedicated administrative base in Brussels, which is responsible for the preparation and carrying out the macro-economic and budgetary supervision of the Member States as part of the European semester and the new procedures that have been planned for in terms of coordinating budgetary policy in the EMU. The creation of a General Secretariat for the Treasury of the euro zone is required. This would be the equivalent of the European External Action Service from an economic and financial point of view. This proposal means strengthening the European Commission's present resources in terms of economic analysis, via the recruitment of experts from euro zone Member States (Treasury, Budget and Social Security Departments).We have to ensure the lasting establishment of crisis management, assistance and recovery mechanisms. It is time to implement the recently negotiated European Stability Mechanism. I also recommend the establishment of a rapid intervention force. The experience of the Task Force that was mobilised to come to Greece's aid, as well as that of the Commission's other services involved in the Troika comprise the base for a mobile international force in times of need. Turning to the IMF or the ECB will be part of the past.

However from a financial point of view, discussions over Eurobonds seem somewhat premature in my opinion: without sound, proven governance, a precipitated pooling of our debts would appear to be more like palliative measures. Financial solidarity can only be organised on the basis of sustainable confidence between all European partners. The European Stability Mechanism is an initial tool towards pooling debts. Democratic Legitimacy: guaranteeing the permanent involvement of national euro zone parliaments.The significant strengthening of the community institutions' prerogatives in the management of national budgetary procedures can only work with the full and long term involvement of the national parliaments. The Stability, Coordination and Governance Treaty plans for their involvement together with that of the European Parliament, in the governance of the euro zone. Any type of democratic alibi would detract from the ambition expressed here.

I propose therefore to convene a euro supervision committee. This permanent body would comprise representatives of the national parliaments and MEPs dedicated to this task.

National MPs from euro zone Member States would be appointed in limited numbers (less than one hundred in all), by their respective chambers. They would come from competent, permanent economic and financial affairs committees and would be totally focused on this mission. Their job should be acknowledged and valued within the chambers of which they are a member and to which they would report. The supervision committee would also find support within the appropriate representation of the European Parliament thereby guaranteeing the plurality of political trends and the diversity of the Member States.

The euro supervision committee, which would not enjoy any legislative power, would have prerogatives of supervision and assessment. Supervision would focus on Member States' respect of the new rules defined to enhance budgetary coordination and discipline. The committee would hear Member States' government leaders, the Minister of the Economy and Finance of the euro zone, the President of the European Central Bank. It would report any possible shortfalls in the respect of the rules and would give as much publicity to this as necessary in order to put an end to any form of complacency. It would adopt initiative reports, issue opinions or resolutions on the procedures planned for within the context of the European semester. This might also target draft budgets which the Member States would have to submit to the European Commission, as well as opinions drawn up by the European Commission on each of these drafts. Finally it might express what it thinks of the sustainability of the adjustment programmes in the Member States that are receiving financial assistance.

Conclusion

As far as the past is concerned, which I am tempted to call "the reckless years" of the euro our responsibility is a collective one: it is not only European governance that is in the balance but also our national and local governance ie the way we govern, decide, arbitrate and implement reforms. The sovereign debt crisis marks the end of an era and has made us aware that States that chose to adopt the single currency took a one way ticket towards political integration. They now have to assume this: the euro is taking us towards shared sovereignty. This means that we absolutely have to provide the euro zone with its own specific type of governance.

The path we are following has no room for democratic alibis. The advent of budgetary and economic federalism calls for careful and therefore permanent supervision, by the national parliaments of the euro zone Member States together with the European Parliament.

[1] This text is a short version by French Senator Jean Arthuis delivered to French Prime Minister François Fillon on 6th March 2012 on the future of euro area.

Publishing Director : Pascale Joannin

On the same theme

To go further

Freedom, security and justice

Jean Mafart

—

15 April 2025

Asia and the Indo-Pacific

Pierrick Bouffaron

—

8 April 2025

Democracy and citizenship

Radovan Gura

—

25 March 2025

Strategy, Security and Defence

Stéphane Beemelmans

—

18 March 2025

The Letter

Schuman

European news of the week

Unique in its genre, with its 200,000 subscribers and its editions in 6 languages (French, English, German, Spanish, Polish and Ukrainian), it has brought to you, for 15 years, a summary of European news, more needed now than ever

Versions :