supplement

Bernard Bourget

-

Available versions :

EN

Bernard Bourget

The health crisis and the subsequent invasion of Ukraine by the Russian army has revealed the EU's dependence on agriculture and food, as well as in other strategic sectors such as energy[1]. Can French agriculture seize the opportunities offered by the new situation resulting from these major events to give it new life? As the French Presidency of the Council of the European Union enters its final month, this is an opportunity to take stock of the situation and prospects for French agriculture before the implementation of the new Common Agricultural Policy (CAP) in 2023 and the objectives of the European Commission's Green Deal.

The CAP for the years 2023-2027 and the European Green Pact

The CAP regulations for the next five years (2023-2027) were approved by the Council and the European Parliament at the end of 2021 after a long negotiation process that started in 2018 when the European Commission presented its proposals. During this negotiation in 2020 as part of its Green Deal, the Commission presented two strategies that directly concern agriculture:

- The "farm to fork" strategy, which recommends a 50% reduction in the use of pesticides and a 20% reduction in the use of synthetic fertilizers in agriculture, as well as a 50% reduction in the use of antibiotics in livestock;

- The Biodiversity Strategy which provides for the withdrawal of 10% of agricultural land from production to be set aside for enhanced ecological protection.

These two strategies were initially well received but they had little impact on the conclusion of the CAP negotiations. They were the focus of expert assessments[2] which have raised questions and objections, particularly with regard to the potential loss of income, which would lead to a decrease in exports and an increase in European imports of agricultural products. As for the target of 25% of land devoted to organic farming by 2030 set in the "farm to fork" strategy, it may prove difficult to achieve if there are no buyers, as the current saturation of the "organic" milk market in France has already shown.

The consideration of the environment in the new CAP had advanced, with:

- on the one hand, the strengthening of cross-compliance for direct payments by integrating the requirements of the previous programming period (2014-2020) for "green payments" which represented 30% of the direct payment envelope and the obligation for farmers to devote at least 4% of their land to non-productive areas, such as hedges, ponds or fallow land;

- on the other, the creation of "eco-regimes" in the National Strategic Programmes (NSPs), which are the main novelty and the backbone of the 2023-2027 CAP, to which at least 25% of the direct payments are due to be allocated.

Each Member State had to develop its own strategic plan and submit it to the Commission by the end of 2021. The presentation of the draft National Strategic Plans of four Member States (Germany, Spain, France and Ireland) at the meeting of the French Academy of Agriculture on 17 November 2021[3], demonstrated both their diversity and their commonalities. The main differences being:

- the important role given to the regions in Germany and Spain, while it is reduced in France

- the internal convergence of direct payments, which has already been achieved in Germany, but will only be 85% complete in Spain, Ireland and France in 2026 or 2027.

As far as eco-regimes are concerned, convergence prevails: the four countries are committed to ensuring that as many of their farmers as possible can benefit from them and will devote 25% of the CAP's first pillar appropriations for direct payments to them from 2023[4].

We shall have to wait until the end of 2022 to have an overview of the National Strategic Plans, but it is already possible to appreciate how France intends to use its NSP to support the ecological and digital transitions of its agriculture and to address the other challenges it is facing.

As for the "farm to fork" strategy, it has been increasingly challenged since the start of the war in Ukraine, which has led to a surge in the price of energy (oil and gas), cereals (wheat, maize and barley) and sunflower oil, as well as synthetic fertilisers, for which the European Union is highly dependent on imports from Russia and Ukraine.

Strengths and Weaknesses of French Agriculture

France is the EU Member State with the largest agricultural area, the greatest variety of terroirs and renowned productions, many of which benefit from designations or indications of origin. While its labour costs are high compared to Spain and the countries of Central and Eastern Europe, the price of land is much lower than in its German, Belgian, Dutch and Italian neighbours.

France's water resources are abundant and quite well distributed, but not widely used for irrigation, while droughts are becoming more frequent and severe.

French farmers benefit from an efficient agricultural research and training system. There are also many small and medium-sized food companies throughout the country, but fewer large food exporters than in Germany, the Netherlands and Denmark.

French agriculture is highly dependent on foreign suppliers of inputs (pesticides and fertilisers for crops, animal feed for livestock) and agricultural equipment, whose markets are dominated by large foreign companies. It is insufficiently organised or attentive to market developments; its relations with the large food companies and, even more so, with those of the distribution sector, are too often conflictual.

It also faces the problem of succession for older farmers.

Finally, it suffers from the hostility of organisations that greatly influence public opinion and that harm its competitiveness, in particular by delaying the implementation of new biotechnologies by a French seed industry that is nevertheless very efficient and a major exporter[5].

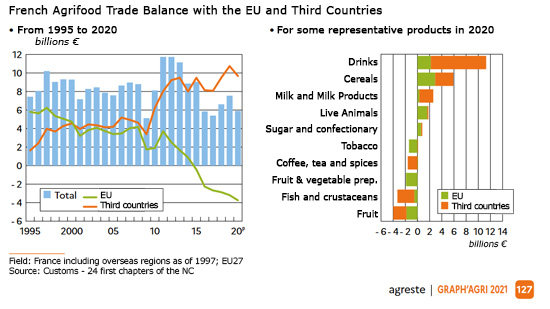

At a time of multiple crises, the deterioration of France's agri-food balance

After the two oil crises of the 1970s, the contribution of the agri-food sector to France's balance of trade grew significantly[6]. French agriculture and the food industry took full advantage of the tools included in the original CAP until the 1992 reform and the conclusion of the Uruguay Round of multilateral trade negotiations, which led to the creation of the World Trade Organisation in 1994.

It is in fact in Europe that France's agri-food trade has fallen into deficit since the mid-2010s. If it were not for wines and spirits, which have recovered their level since the abolition of the tax introduced by American President Donald Trump (2016-2020), the overall balance of France's agri-food trade would currently be in deficit. The two other items in surplus are cereals and dairy products.

With regard to cereals, prior to the war in Ukraine, French wheat exports were in strong competition with the Black Sea countries, Ukraine and, above all, Russia, which had once again become the world's leading wheat exporter. These two countries, which account for 30% of world wheat exports, have captured market share from France in the importing countries of the southern and eastern Mediterranean. France is also closely pursued by Romania and Germany on these markets. Since 2017, Ukraine has also benefited from its free trade agreement with the European Union to develop its exports of maize and sunflower to the European market.

France is handicapped by the size of its farms, which are much smaller than those of its competitors in the eastern part of the continent, and by higher labour costs. It is also handicapped by the large farms in the five eastern Länder of Germany (former GDR) a legacy of the communist era. Moreover, because of its aim to protect the competitiveness of its large farms reunified Germany has always opposed the capping and degressivity of direct payments according to the size of the farms proposed by the European Commission. France could therefore hardly apply capping and degressivity to its farms if these measures were not mandatory for all Member States.

As for French dairy exports, they are too dependent on China's uncertain market. On the European market, France competes with Poland, which has made good use of the resources made available by the European Union and has taken advantage of its low labour costs to become a major agricultural exporting power.

Poland also competes with France in poultry and pork production, as well as in apples, which used to be France's main fruit export, while the latter has a large overall deficit in the fruit and vegetable sector, especially with Spain.

Several other factors should be taken into account to explain the deterioration of France's agri-food trade position, such as a more restrictive application of EU environmental regulations, smaller sized farms or insufficient coordination between upstream agriculture and downstream agri-food stuffs; but the higher cost of labour remains a predominant factor in comparison with Spain and the countries of Central and Eastern Europe[7]. This is why the reduction of social and tax burdens on agricultural and industrial enterprises, especially the many agri-food SMEs, which face foreign competition, must be pursued.

Consequences and lessons of the war in Ukraine

The most serious consequence of the war in Ukraine is the reduced availability of wheat, leading to a surge in prices, which had risen already in 2021 reaching $400 per tonne in March 2022. It is however the poor importing countries, mainly in North Africa, which are the victims of excessive speculation in the wheat trade. It is difficult to assess at present under what conditions the wheat requirements of these countries can be met in 2022 by turning to other suppliers, in North or South America, in Europe, and especially France. India was even planning to export 10 million tons of wheat to partially compensate for the lack of Ukrainian wheat, before withdrawing this idea. Indeed, to ensure the "food security" of its population and to the backdrop of some exceptional heat waves, India announced a ban on wheat exports at the end of May and at the beginning of June a ban on the exportation of sugar. Export bans on foodstuffs, currently applied by some twenty countries - including Malaysia regarding chicken meat and Tunisia regarding fruit and vegetables - are further contributing to price increases.

The case of India is interesting, since to preserve its ability to build up strategic stocks, the country opposed the US in the Doha Round of multilateral trade negotiations, which led to the suspension of these negotiations.

The building of strategic food stocks should therefore be a priority for importing countries[8] ; it could also help the EU to protect itself from shortages in the event of disaster, as Switzerland does with its reserve stocks[9], and mitigate the impact of volatile world agricultural prices on its domestic market.

France, which is Europe's leading wheat producer and exporter, should focus on establishing confident and stable trade relations with North African countries and Lebanon, which were previously its main wheat buyers. The temporary suspension of the 4% fallowing requirement will mean that more than 4 million hectares will be cultivated in 2022 in response to an emergency situation, notably concerning sunflower crops. The war in Ukraine has also highlighted the heavy dependence of European livestock, especially in terms of pigs and poultry, on imports from the latter.

More generally, the suspension of the "farm to fork" strategy provides an opportunity for a review, to place it in a perspective, not of decreasing European agricultural production, but of a transition reconciling ecology and economy.

The reduction in the use of pesticides must be more qualitative than quantitative, focusing on the banning of products that are most harmful to health and the environment. It is also necessary to offer alternatives to farmers, which implies major research and innovation efforts, in particular in favour of biocontrol.

The reduction in the use of synthetic fertilisers can be achieved by developing precision farming and leguminous crops, as well as farming-livestock systems, within farms or between neighbouring farms.

As for the reduction in the use of antibiotics in European livestock farming, it must be supported by a ban on the import into the European Union of animal products from countries where antibiotics are still used as growth promoters, whilst this practice is forbidden in Europe.

Finally, the European Commission should present a proposal to ensure the development of new biotechnologies[10] to create plants that adapt to climate change and can do without pesticides.

The challenges facing French agriculture, food and agri-supply companies

Among the challenges facing French agriculture is first and foremost that of climate change and the agro-ecological transition. Agriculture is concerned by climate change in three ways: it must reduce its greenhouse gas emissions (methane and nitrous oxide), capture and store carbon, and adapt to the consequences of climate change (droughts, floods, storms, early frosts for vines and fruit growing, etc.).

The National Strategic Plan and the agricultural component of the recovery plan must contribute to the agroecological transition of agriculture. The "protein" plan deserves special mention, as it concerns the development of leguminous crops[11] which will not only reduce the use of synthetic fertilisers, but also the dependence of livestock farms on imported soya cake, while meeting growing consumer demand for plant-based food. The war in Ukraine should lead to an acceleration of its deployment.

The decision expressed at the end of the "Varenne de l'eau", which has just ended, to relaunch the construction of water reserves, will enable the development of irrigation[12] to cope with droughts and to make up, at least in part in the coming years, for the fact that France lags behind its neighbours in this area, notably Spain.

The overhaul of crop insurance, which will apply in 2023 at the same time as the new CAP, should help farmers secure better insurance against climatic hazards, provided that the margins offered by the new European regulation[13] are fully used by France, in particular for arboriculture.

The digital transition, associated with the robotisation of certain tasks, is also an important issue for the development of precision agriculture and thus the reduction of the agricultural use of water, fertilisers or crop treatment products. The revision of the European directive on biotechnologies should facilitate their use to strengthen the resistance of plants to diseases and improve the competitiveness of French agriculture.

Strengthening the competitiveness of French agriculture will also depend on the use of CAP provisions to support producer organisations and to extend this support to new sectors such as plant proteins. Regarding fruit and vegetables, the consumption of which should increase to meet nutritionists' recommendations, a recovery plan would be extremely welcome to reduce France's excessive dependence on imports, by making full use of the resources of the European school fruit and vegetable distribution programme.

The 50% increase in CAP funds for young farmers will mean that the French regions will be able to implement an investment policy adapted to local situations[14].

The French Presidency of the Council of the European Union set itself two objectives in the agricultural sector: on the one hand, the development of " low-carbon " agriculture at European level, for which France is a pioneer, yet highly dependent on the development of carbon prices, as well as the implementation of a carbon tax at the borders, which requires the unanimity of the Member States and, therefore, a negotiation that promises to be difficult. On the other hand, the application of the same environmental and sanitary requirements on imports as those imposed on EU producers ("mirror" clause). It is perfectly justified, but it implies the revision of current free trade agreements and of those in preparation.

The war in Ukraine is upsetting this agenda, because everything must now be done to avoid a food crisis in developing countries, the "hurricane of famine" about which the United Nations has been warning.

***

The decline of French agriculture is not inevitable, especially in the new European and global context, because it has many assets to develop, if it succeeds in its agro-ecological and digital transformations and takes better account of the expectations of consumers and citizens. The latter must be better informed and enlightened about the reality of farmers' situations and the complexity of their activity, which is linked to live organisms and is part of the long term.

The entire agricultural and food chain must be consolidated to face foreign competition, reduce its main deficits and regain market share.

[1] " Strategic dependencies, a question of sovereignty ", European Issue n° 630, Robert Schuman Foundation, 25 April 2022.

[2] Assessments by the EU Joint Research Centre, the US Department of Agriculture and the Dutch Wageningen University respectively.

[3] This session was recorded on the YouTube channel of the French Academy of Agriculture where it can be viewed.

[4] Member States have flexibility to spend less than 25% of direct payments on eco-regimes in 2023 and 2024.

[5] France is the third largest seed producer in the world, the largest producer in Europe and the largest exporter of seeds in the world ("Covid-19 and agriculture, an opportunity for the agricultural and food transition", September 2020.

[6] Agri-food being qualified as France's "green oil"

[7] A report by the Haut-Commissariat au Plan of 9 July 2021 published in the series entitled "Is France a great agricultural and agri-food power?"; FranceAgriMer report of June 2021 on the competitiveness of the agricultural and agri-food sectors.

[8] The analogy with oil stocks held by importing countries is apt.

[9] Bernard Valluis, Farm Foundation "Food security, for reserve stocks" 3 May 2022.

[10] This is genome editing (genetic scissors), for which Emmanuelle Charpentier was awarded the Nobel Prize in Chemistry, and which is used in human medicine, but is still prohibited for plant health.

[11] Pulses do not need nitrogen fertiliser, as they fix nitrogen from the air for their own needs and return some of it to the next crop.

[12] Irrigation methods will also need to be more efficient

[13] The so-called "omnibus" regulation lowered the threshold for triggering insurance from 30% to 20% of the farmer's loss of income and raised the maximum reimbursement rate to 70%.

[14] Aid for setting up in agriculture will be entrusted to the regional councils from 2023 under the French NSP

Publishing Director : Pascale Joannin

On the same theme

To go further

Digital and technologies

Josef Aschbacher

—

9 December 2025

Democracy and citizenship

Florent Ménégaux

—

2 December 2025

Democracy and citizenship

Jean-Dominique Giuliani

—

25 November 2025

Strategy, Security and Defence

Amiral (2S) Bernard Rogel

—

18 November 2025

The Letter

Schuman

European news of the week

Unique in its genre, with its 200,000 subscribers and its editions in 6 languages (French, English, German, Spanish, Polish and Ukrainian), it has brought to you, for 15 years, a summary of European news, more needed now than ever

Versions :