Migration

Eric Maurice

-

Available versions :

EN

Eric Maurice

The Russian aggression against Ukraine triggered a massive response from Europeans and their Western allies. Instead of direct military intervention, which would have carried the risk of an armed or even nuclear escalation with Russia, the EU's response has taken the shape of sanctions against the Russian regime in many sectors of the country's economy, with the stated aim of weakening the government's ability to finance the war.

The five packages of European sanctions adopted since the end of February in coordination with the sanctions of the G7 countries, have "devastated the Russian economy", deems Commission President Ursula von der Leyen. The sanctions, in particular the exclusion of most Russian banks from the Swift financial messaging system, the ban on market transactions with the Russian Central Bank and the embargo on the sale of certain equipment, are having an impact because they rely on the economic and financial strength of the West and, conversely, on Russia's dependence on Western financial markets and foreign technology.

Yet, after two months of war, the Russian regime continues its offensive despite numerous casualties, several tactical defeats and the impact of sanctions. Sanctions have so far failed to stop the fighting, or even to change the behaviour of the Russian President. And for the Europeans there is the question of the final stage of possible sanctions, an embargo on Russian oil and gas, which would deprive the regime of about €100 billion a year (€99 billion in 2021).

In early April, EU High Representative Josep Borrell lamented that Europeans had bought €35 billion worth of gas from Russia since the war began. The reluctance of some member states, most notably Germany, to take the decisive step of an embargo highlights the fact that the other side of the EU's economic strength is its dependence on Russian hydrocarbons, which is hampering its decision-making capacity and leaves it at the mercy of supplies being cut off in retaliation for sanctions.

While the Commission claims to be geopolitical and the President of the Council considers the European Union's strategic autonomy to be "the aim of our generation", recent events have raised the question of its capacity to act through economic power and sanctions and its dependence on the outside world. They are forcing Europeans to rethink their relationship with the economy and trade.

From interdependence to dependency

The European Union, which for four decades has developed primarily around an economic community, has based its prosperity on trade between Member States and with the rest of the world. In the Treaty on European Union, it sets itself the objective of "encouraging the integration of all countries into the world economy, including through the progressive abolition of restrictions on international trade". In its conception of international relations, inscribed in the rules-based order established after 1945, "free and fair" trade and the interdependence that flows from it are a factor of peace and balance and are sufficient to define its role in the world.

The war in Ukraine, and before it the Covid-19 pandemic, have challenged this worldview, which had already been undermined by the rise of China and Donald Trump's tenure in the United States. The aggressive weaponisation of trade by Beijing and Washington has led the Europeans to accept a degree of protectionism, by introducing controls on foreign investment, strengthening their trade defence instruments, and even adopting additional taxes on products from their US ally.

Interdependence, with its benefits, has given way to the potential or proven risk of dependence. This was first demonstrated by the shortages of masks, medical equipment and medicines at the start of the pandemic in 2020. Europeans discovered that 40% of finished medicines sold in Europe and 80% of the active ingredients used in pharmaceuticals came from India and China and that security of supply was no longer guaranteed.

The war in Ukraine shows that the risk of dependence on Russian gas and oil is unacceptable. Germany, which for a long time defended its Nord Stream 1 and 2 pipeline projects with Russia as being purely commercial, is now realising that energy policy is a geopolitical tool. It had to suspend Nord Stream 2 the day after Moscow recognised the independence of Ukraine's breakaway provinces, two days before the country's invasion.

Europe is gradually realising that it needs to reduce its dependence if it is to guarantee its prosperity, make safe its interests and retain control of its decisions. During the Versailles Summit on10 and 11 March 2022, the heads of state and government decided to take "decisive action" to build "European sovereignty" and reduce the Union's strategic dependence. The priority is to "phase out" its dependency on Russian gas, oil and coal imports. But the effort is broader, covering critical raw materials, semi-conductors, health, digital and food products.

This effort began with the pandemic, when EU leaders declared their commitment to making European industry more competitive and resilient by accelerating the twin transitions of climate and digital technology. In October 2020, they asked the Commission to " identify strategic dependencies, particularly in the most sensitive industrial ecosystems such as for health, and to propose measures to reduce these dependencies, including by diversifying production and supply chains, ensuring strategic stockpiling, as well as fostering production and investment in Europe ".

Since 2021, the Commission has been conducting a regular "in-depth review of the Union's strategic dependencies". It has identified 137 products that are part of sensitive ecosystems and heavily dependent on foreign suppliers, with a particular focus on 6 strategic sectors: raw materials, batteries, active pharmaceutical ingredients, clean hydrogen, semiconductors, cloud and edge technologies.

The Versailles Declaration is part of this process. The European Union was already seeking to reduce the risks of external events and the instrumentalization of trade by other powers, and to retain its capacity to act in all circumstances. The war in Ukraine has brought an additional dimension, as being dependent reduces the ability to sanction, and thus to defend the international order based on our principles and values. From 2020 to 2022, the Union's objective has evolved from resilience to sovereignty.

Russian Hydrocarbons

In 2020, according to Eurostat, the European Union imported 57.5% of the energy it consumed, and was 83.6% dependent on imports for gas and 96.2% for crude oil. This dependence has increased in recent years, reaching 60.6% in 2019, the highest level in 30 years.

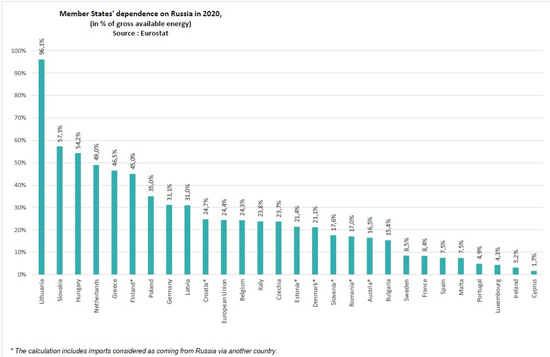

In 2020, a quarter of the EU's energy requirements came from Russia, which accounted for 41.1% of gas, 36.5% of oil and 19.3% of coal consumption. The statistical agency points out that Europe's dependence on Russian oil had decreased over the previous five years, since the first invasion of Ukraine and the annexation of Crimea. But the share of Russian gas increased slightly, since it lay at 40% in 2015.

Dependence on Russian gas is the most problematic, as it is used both to heat buildings and homes, to generate electricity for all sectors and to manufacture products such as hydrogen and fertilisers. Gas is used as a transitional energy between oil or coal and renewable energy. And so, the importance of gas in the Member States' energy mixes varies considerably, from 3% in Sweden (and even 0% in Cyprus), to 40% in Italy.

In recent years Italy has even increased its imports of Russian gas, from 18 million m3 in 2012 to 28.7 million m3 in 2020, plateauing at 32-33 million m3 between 2017 and 2019. In terms of volume it is Germany which is most dependent on Russian gas, since it increased its imports from 32 million m3 in 2011, the year that the pipeline Nord Stream entered into service, to 52.4 million m3 in 2020, with a peak of 62 million m3 in 2017. In 2020, Nord Stream, which links Germany directly with Russia, circumventing Ukraine, was the main line of supply towards the Union carrying 53 billion m3, ahead of the gas pipelines that pass through Ukraine (38 billion m3), Belarus (33 billion m3), and Turkey (5 billion m3).

Adopting different approaches both countries' exposure to Russia has led them to the same dilemma as far as further sanctions are concerned: German Chancellor Olaf Scholz opposes an embargo because it would "plunge Germany and Europe into recession", while Italian Prime Minister Mario Draghi accepts the risk, saying that "the question is whether we prefer peace or whether we want to stay all summer with the air conditioning on".

In Versailles, EU leaders agreed to move away from dependence on Russian gas, oil and coal "gradually" and "as soon as possible". The Commission is due to present a plan on 18 May to achieve this by 2030, but the avenues indicated by the European Council include accelerating the exit from fossil fuels and the use of renewable energies, diversifying supplies, developing hydrogen, improving the interconnections of European gas and electricity networks, increasing reserves, as well as a greater effort towards energy efficiency and "a more circular approach to manufacturing and consumption patterns". Decisions are expected to be taken on 30 and 31 May at an extraordinary European Council, when joint purchases of gas could be agreed in order to reduce the cost of the diversification of supplies.

By adding a security dimension the aim is to reinforce the logic of the Green Deal, which provides for carbon neutrality by 2050. The climate emergency, which does not exclude differences in approach between Member States, particularly with regard to the pace of the transition and the assumption of the social cost, is coupled with a strategic emergency, which does not simplify the challenge to be met but could motivate the political will of the Member States. This seems to be the view of the Commission, which points out that the "full" implementation of its "Fit for 55" target (the reduction of greenhouse gas emissions by 2030 by 55% compared to 1990) would reduce gas consumption by 30%, it suggests to take this further by increasing the planned production of biomethane and hydrogen and accelerating the deployment of photovoltaic and wind power capacity.

In the short term, the political will to sanction Russia must be balanced with the economic and social risk of an embargo on Russian gas and oil. On 17 April, the President of the Commission confirmed that her administration is preparing "smart mechanisms" to include Russian oil in a future sanctions package. And Germany has pledged to stop Russian oil imports by the end of the year. But a decision on gas seems out of the question, at least until Russia crosses a red line, such as using a chemical or nuclear weapon, that would force Europeans to act.

Diversifying supplies takes time, despite the intense commercial diplomacy conducted by the Europeans. The preferred option is liquefied natural gas (LNG), which is transported by ship and thus avoids the geographical constraint of pipelines that favours the closest suppliers, to the benefit of Russia. The United States, which has promised at least 15 billion m³ in 2022, Qatar, Egypt, and West African countries such as Angola and Congo are the most sought-after potential partners. However, LNG requires a technical infrastructure with which Europe is not sufficiently equipped to accommodate all the expected flows. Pipeline gas is still needed, and could come from Azerbaijan or Algeria, with Norway already at full capacity. In the meantime, the Commission presented legislative text on 23 March to oblige member states to use at least 80% of their natural gas storage capacity by 2022 and 90% in subsequent years. In the short term, this measure does not allow them to do without Russian gas and increases imports, and therefore revenues for Putin's regime. In the medium term, it protects the European Union from further price manipulation or supply disruptions, and provides gas until new supply lines are established in the long term.

The easiest resource to discard is coal. On 8 April, member states decided to implement an embargo on Russian coal and other solid fossil fuels from August, a trade estimated at €8 billion a year (compared to around €100 billion a year for oil and gas). While 9 Member States have already abandoned coal and 13 have set a date for doing so, coal accounted for only 10.5% of the European energy mix in 2020, with significant differences between States. Poland produced 70% of its electricity from coal in 2021. Due to its early withdrawal from nuclear power Germany produced 28% of its electricity in 2021 using lignite, and depends on Russia for 24% of its energy requirements. Russia supplied one third of the anthracite consumed, but this represented only 2% of the EU's energy requirements.

New technological dependencies

While fossil fuels, the basis of our economic prosperity inherited from the 20th century, represent the most urgent need in the current crisis with Russia, so-called critical raw materials and semi-conductors are key to the future sovereignty of the Union in technological, industrial and economic terms, as well as from a societal and democratic point of view.

The move away from fossil fuels and the transition to carbon neutrality, through the development of electric batteries or photovoltaic installations, increases the need for metals and minerals which Europe does not have, or does not have in sufficient quantity, and opens up new vulnerabilities in terms of supplies.

The digital transition, a corollary of the climate transition to develop a new European model, creates new dependencies in terms of materials and equipment. Europeans must be aware of and mitigate their new dependencies immediately. There is a risk of dependence on the political and regulatory choices of third countries, including hostile ones, which could impose their technological and governance model if Europe does not have the same capacity for innovation.

In September 2020, the Commission observed that "Europe's transition to climate neutrality could replace today's reliance on fossil fuels with one on raw materials", and it proposed an action plan stressing the need for measures targeting the "diversification of supply of primary and secondary sources, reduce dependence and to improve resource efficiency and circularity."

Since 2011, the Commission has been conducting a regular review of critical raw material requirements and dependencies. The first list, which focused mainly on price fluctuations due to demand from emerging countries, included 14 commodities. The fourth list, published in 2020, focused on the risk of supply shortages and includes 30 elements, including cobalt and lithium, which are essential for the development of electric batteries and on which the EU is 86% and 100% dependent in terms of extraction and processing. The 137 products identified in the in-depth review launched in 2021 indicate a much more comprehensive consideration of the EU's ecosystems and the scale of the task ahead to mitigate the vulnerabilities of the European economy.

While the issue of fossil fuels primarily involves relations with Russia, the issue of raw materials raises the problem of dependence on another power whose interests are largely contrary to those of the European Union, China. China supplies 52% of the products for which Europe is highly dependent on the outside world. Hence it provides 89% of the magnesium used by the automotive and electronics industries in Europe. It also supplies 90% of rare earths, considered by the Commission as a "vital issue for most industrial ecosystems" as they are used to make the permanent magnets used in electric motors, digital technologies or wind turbines. China controls 93% of the permanent magnet value chain and could, as it has done in the past, reduce its exports or subject them to high tariffs.

In Versailles, EU leaders called to secure supplies through strategic partnerships, strategic stockpiling, the development of the circular economy and the use of resources available in Europe. The European Raw Materials Alliance, launched by the Commission in 2020 and which includes partners from North and South America, Africa, Asia and Oceania, is already partly responsible for meeting these objectives. It has identified 14 mining projects to exploit rare earths in Europe and cooperation on recycling and industrial processing for the recovery of materials is being set up. While less than 1% of the rare earths used in Europe come from recycling, the objective is to develop recovery and processing to reduce external needs. The European Batteries Alliance, initiated in 2017, aims to supply 80% of lithium from European sources by 2025.

Digital and semi-conductors

EU leaders reiterated the roadmap already implemented in the digital transition: investment in artificial intelligence, cloud computing and 5G; strengthening standards on data, digital services and artificial intelligence; standardisation of key technologies such as 6G.

A key element, in addition to the supply of raw materials for the manufacture of electronic components, is the availability of semiconductors. However the European Union only represented 10% of the market share in the world in 2020, lagging behind the USA (47%) and South Korea (20%). According to the Commission it is heavily dependent on design, packaging and assembly, and lacks the capacity to manufacture the smallest chips, which are crucial for the development of advanced technologies. China, which is still an emerging power in the field, already controls some of the most advanced components, such as solar wafers, semiconductor materials used as building blocks in photovoltaic panels, of which it accounts for 96% of world production.

The EU is therefore seeking to build up the technological and production capacity to achieve a 20% share of the global semiconductor market by 2030. Launched in July 2021, the Alliance for processors and semi-conductor technology is supposed to lead to the identification of the requirements and bottlenecks, and to remedy them. The European Chip Act, presented in February 2022, plans to facilitate the pooling of public and private resources by mobilising €43 billion.

Access to raw materials and electronic components, which is crucial for civilian industries, is even more so for defence industries. The sanctions against Russia in the field of dual-use goods, semiconductors and quantum computing are a reminder of the importance, in terms of security and defence, of mastering technologies and securing supplies.

While not explicit in the Versailles roadmap, the issue has been taken on board in the Strategic Compass approved by the European Council on 24 March. Europeans note that "our strategic competitors are rapidly investing in critical technologies and challenging our supply chains and access to resources." and stress that "investing in innovation and making better use of civilian technology in defence is key to enhancing our technological sovereignty, reducing strategic dependencies and preserve intellectual property in the EU".

Member States plan to assess the risk to critical infrastructure supply chains in 2023 and to stimulate research and technological innovation, in coordination with the European Defence Agency (EDA). A Critical Technology Observatory, set up by the Commission, is responsible for monitoring strategic dependencies in semiconductors, cloud and edge technologies, quantum computing and artificial intelligence.

At the crossroads of the civilian and the military, a European Alliance for industrial data, the edge and the cloud was established in 2021 to support the development of secure cloud and edge technologies for both the public and private sectors in Europe. The Commission estimates that by 2025, 80% of data will be processed at the edge, i.e. close to the network that produces it, compared to 20% today. Controlling data processing and storage is eminently strategic and crucial in terms of sovereignty.

Health and Food

Since the Covid-19 pandemic, the European Union has extended its support competences in the field of health, in particular to strengthen coordination between Member States and with institutions in order to anticipate and manage crises with the creation of the European Health Emergency Preparedness and Response authority (HERA). It has committed to industrial policy by setting out a pharmaceutical strategy to finance and develop European innovation and production of medicines. The draft revision of the pharmaceutical legislation will be presented at the end of 2022 and the possibilities of funding are unclear for the time being.

Just as the pandemic revealed dependencies on pharmaceuticals, the war in Ukraine highlights the dependency of European agriculture on pesticides and fertilisers as well as on plant proteins used to feed livestock. This twofold observation revives the debate on the Commission's 2020 Farm to Fork strategy, which calls for a reduction in the use of pesticides and aims to encourage a reduction in meat consumption and thus in livestock farming.

Europeans must therefore find alternatives to mineral fertilizers produced from fossil fuels, such as nitrogen fertilizers, which contribute to gas dependency. The Commission is therefore suggesting to develop green ammonia produced from hydrogen. European agriculture is also largely dependent on Russian and Belarusian potash, a nutrient to improve yields. This had an impact on EU sanctions after the rigged 2020 presidential election in Belarus, as some of the potash, which is an important source of income for the regime, was excluded so as not to penalise European farmers. A total embargo was decided in March 2022 after the invasion of Ukraine.

***

From Russian gas to Chinese rare earths, the European economy, open to the world, is also dependent on essential products supplied by competing or hostile powers. Europeans have become aware of this vulnerability, and the effort undertaken by the institutions, the Member States and private players to reduce it in the six sectors identified in Versailles is complex and long-term.

The war in Ukraine and the Western sanctions also demonstrate the effort that Europeans must make to avoid becoming dependent in other sectors. In this respect the strengthening of the international role of the euro remains a priority objective in order to avoid the risk of being excluded from markets and other financial mechanisms. Efforts to discourage the application by European economic actors of US, and perhaps tomorrow Chinese, extraterritorial sanctions are part of this logic, as is the project for a tool against economic coercion put forward by the Commission at the end of 2021.

Europeans are aiming to develop an "open strategic autonomy", i.e. one that maintains a balance between sovereignty over technologies, supplies and capacity to act on the one hand, and the defence of free trade and beneficial interdependencies on the other. Whilst the WTO fears the fragmentation of world trade between geopolitical blocs, this balance seems both necessary and difficult.

Have contributed to this study: Monica Amaouche-Recchia and Justine Ducretet-Pajot, research Assistants at the Foundation

Publishing Director : Pascale Joannin

On the same theme

To go further

Climate and energy

Valérie Plagnol

—

22 April 2025

Freedom, security and justice

Jean Mafart

—

15 April 2025

Asia and the Indo-Pacific

Pierrick Bouffaron

—

8 April 2025

Democracy and citizenship

Radovan Gura

—

25 March 2025

The Letter

Schuman

European news of the week

Unique in its genre, with its 200,000 subscribers and its editions in 6 languages (French, English, German, Spanish, Polish and Ukrainian), it has brought to you, for 15 years, a summary of European news, more needed now than ever

Versions :