Education and culture

Gérard Pogorel,

Augusto Preta

-

Available versions :

EN

Gérard Pogorel

Augusto Preta

How COVID-19 is impacting the audio-visual industry

Streaming services are meeting the additional demand created by stay-at-home populations worldwide. Whereas television channels are enhancing their offer, combining linear programming and streaming, specialized streaming services are offering TV series, documentaries, and feature films across a wide variety of genres. Leading the way on the media scene, Netflix in 2020 now has 182 million paid subscribers in over 190 countries, with programming in ever increasing numbers of languages. Jointly with Amazon Prime, YouTube, Apple, Disney+, and multiple other streaming services offered by broadcasters in Europe, RAI, France Televisions, BBC, ARTE, to name just a few, it has become the main driver of online broadband traffic. The massive increase of online access to content makes good of operators' investments in networks and is providing the right incentive for the telecommunications industry to continue investing in next generation networks (5G, optical fibre).

In the crisis, the streaming platform model has changed the nature of the audio-visual industry (cinema and television). On the one hand, it is bypassing due to circumstances and for the foreseeable future the time window model which the oligopolistic film industry had established for itself; more and more films, which cannot be presented in cinemas are being played directly online. On the other hand, as conventional linear TV cannot rely on live TV shows anymore, news, sports and events, broadband is encroaching on broadcasting as it provides premium content.

To cope with the evolving landscape and the switch from broadcast to broadband, traditional vertical distribution deals between broadcasters and network operators, mostly providing linear or pay TV, now seem inadequate. New forms of consolidation are prevailing, bringing vertical and horizontal integration on a global scale. Mega mergers and acquisitions are leading to large transborder conglomerates with interests in telecom, cable, TV broatdcasting, video-on-demand, as well as content production and provision. They are directly competing with the streaming leaders Netflix and Amazon, as well as cash-flow rich Apple and Google. Netflix and other companies (Amazon, Apple) that do not own a vast content library of pre-existing premium programming, are becoming studios in their own right, engaging in a vast program of content production, as they entice big name producers and talent. Conversely, the trend now for Hollywood's great studios is to build their own direct-to-consumer platforms rather than cashing in licensing deals from Netflix and Amazon, as they have done to date with broadcasters. The jury is now out in terms of valuing which "converged" service provider will best serve their audience once the economy recovers. Production is temporarily at a standstill, and media services are offering what they already have in stock. But the future of the industry will depend of the relative success of the major initiatives, which took place in the months before the crisis.

The world before Covid-19: convergence strategies and transatlantic initiatives

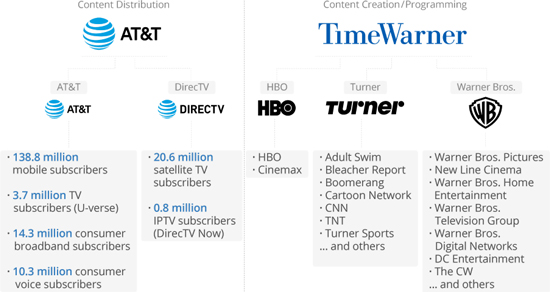

Three major consolidations took place prior to the current crisis: AT&T/Time Warner, 21st Century Fox/Disney, and Comcast/Sky.

The US$ 85 billion acquisition by US telco AT&T of Time Warner in 2018 opened a new era in the content access and distribution market structure. AT&T is a fixed and cellular network operator and video distributor (U-Verse and DirectTV). Time Warner is a media, broadcasting and video producer (CNN, TNT, and HBO) company. Both have a long history of finding the right slot in the internet age.

At a time when data suggested that "peak TV" is still not over, the merger has been a pre-emptive strategy to offer consolidated perspectives in the news and entertainment industry.

What is at stake with the AT&T/Time Warner merger?

Source: Companies infographic, 2018

AT&T and its now combined Warner Media Entertainment branch, are in a position to leverage their strong media assets, HBO, Turner and Warner Bros. AT&T intends to have their streaming services prove a worthy competitor to Netflix, Amazon, Disney and Apple and provide stronger distribution channels for its robust width of content and century old portfolio of films.

Telecommunications operators like AT&T are suffering from the current crisis, but they are among the least affected industries, as both residential customers and businesses rely heavily on communications, videoconferencing, and video streaming.

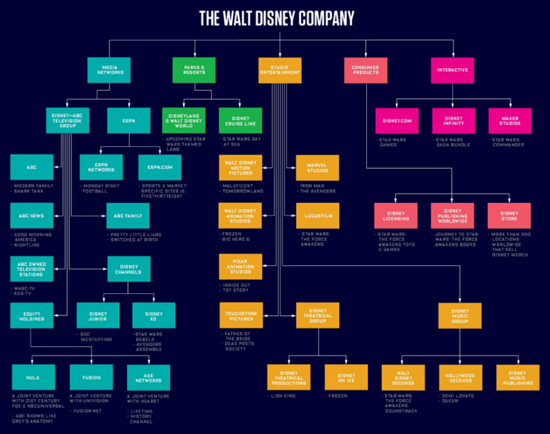

Disney in 2019 held a whopping 33% box office market share in North America. It had already completed a massive consolidation process with Pixar, Marvel, Lucasfilm (Star Wars) and National Geographic. Its Fox acquisition was finalised in March 2019. The Fox-Disney deal has created a behemoth film and TV studio, cementing Disney's position as the world's top entertainment company. The combined Disney ABC Studios and 20th Century Fox Television operations feeds content to its video streaming service Disney+. Launched onto the US market in November 2019, together with the Netherlands and Canada, it then expanded to Australia, New Zealand. It reached 10 million subscribers within its first two days of operations in the US. Set for global expansion, in 2020 it entered more European countries (UK, Germany, France, Italy, Spain and Ireland). In the spring of 2020, it totalled 55 million subscribers.

Disney has suffered heavily in 2020 so far, from the closure of cinemas in the USA and elsewhere across the world. Its strong creative portfolio should allow it to recover, but its expansion has been delayed by existing licensing deals in many countries.

Disney atteint tous les publics des médias

Source : Wired.com, 2019

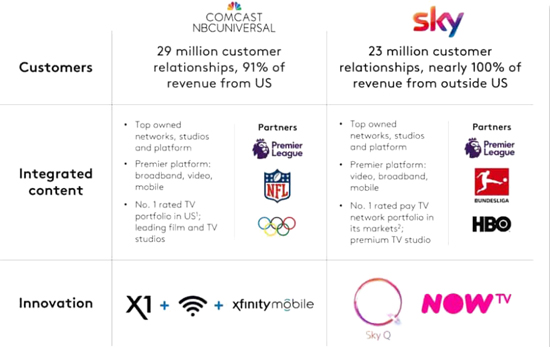

In an intense transatlantic battle Comcast and Fox went head-to-head in an auction for UK-based Sky. Comcast finally sealed an agreement in October 2018 to buy Sky for a total value of US$ 40 billion.

Comcast seems to have been more cautious in following Disney's footsteps and shifting its content away from Netflix and Amazon. Its entertainment division, including NBC Universal and HBO, will continue to license some shows to the major SVOD services. This is having a specific impact in Europe, with newly acquired Sky entity dominating the Pay TV sector in the UK, Ireland, Germany, Austria and Italy. Special agreements with Netflix have already been signed to include its offer in the Sky Q proposition.

Comcast acquisition of European pay-TV giant Sky

Network operator Comcast is proving to be relatively resilient in the current economic turmoil, as is the case in the AT&T-Warner merger.

A new global era for VOD?

The year 2020 and the COVID crisis might be remembered as a tipping point in the transformation of the global audio-visual landscape. Alongside conventional television channels, free or pay, often specific to each country, we are witnessing the ascent of a plurality in international direct to consumer subscription services, with ample financial means available for creation, production and marketing.

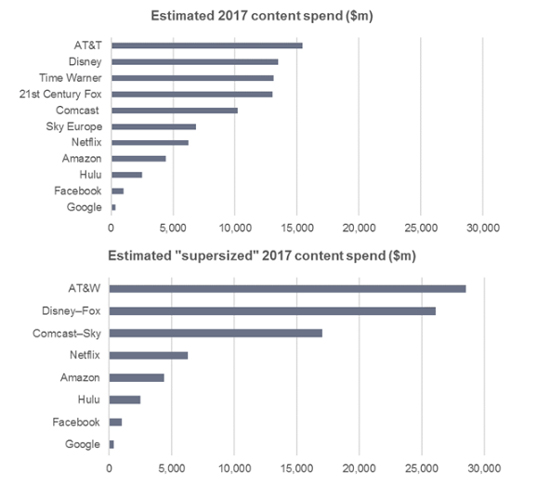

The effect of megamergers on content spending

Source: Ovum

The scene will now be increasingly global, as powerful actors with global ambitions emerging on all continents.

While China's film industry has been severely hit by the pandemic, the online entertainment market, including TV and streaming platforms, have been booming as people were confined to their homes. According to a report by Maoyan Entertainment, a local firm, as of March 15th 2020, the releases of 44 Chinese films had been cancelled or postponed, including 16 imported films.

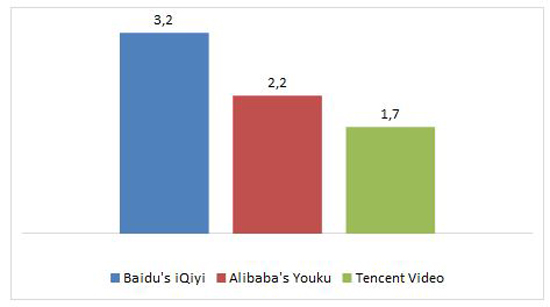

The Chinese market is dominated by three big streaming platforms: iQiyi, majority-owned by Baidu, the Alibaba-owned Youku (Alibaba is the world's largest retailer and e-commerce company, and one of the largest Internet-investment corporations in the world), and Tencent Video, owned by the Chinese multinational conglomerate Tencent, whose subsidiaries specialize in various Internet-related services and products, entertainment, AI and technology both in China and globally. Netflix has been ramping up Chinese production, mostly through Taiwan but is not present in the PRC. Tencent Video and iQiyi have already started to take their first tentative steps outside the Chinese market, in Thailand and Malaysia.

TV programming expenditure by Chinese online companies in 2018 (US$ Bln)

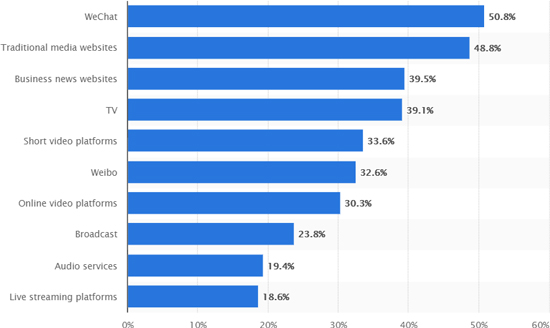

Increased digital media consumption after coronavirus outbreak in China 2020, by type

Source: Statista, 2020

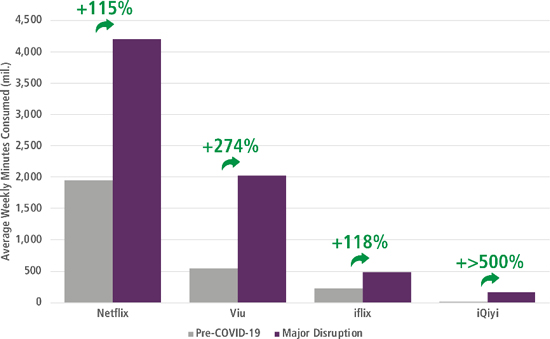

In most South East Asian markets Netflix is a leader, followed by Viu with its freemium service, while other players, such as HBO, iQiyi and Tencent are well placed to grow in the future, along with new entrants such as Disney+. Today, consumer spending on online video is almost 25% in aggregate of what customers spend on linear Pay-TV services. Increasing consumption on online video should encourage key local players and Pay-TV re-balancing.

In total, despite the negative impact of COVID-19 and the Chinese economic downturn, according to Digital TV Research, Asia-Pacific will have 417 million SVOD subscriptions by 2025, up from 269 million in 2019. China will have 269 million SVOD subscriptions in 2025, or 65% of the region's total. India will supply a further 45 million, more than double its 2019 total. The focus now is on how successfully SVOD platforms will be able to retain newly acquired customers in the second half of 2020 and to what extent AVOD platforms can capitalize on the expanded reach.

Top Regional online video platforms, South-East Asia

Source: AMPD Research, 2020

In Latin America, Brazil and Mexico boast an ample pool of creative talent and powerful home-grown actors. They play significant roles as creative powerhouses on the world scene.

Considering entire nations being shut indoors or with limited movements, Strategy Analytics now estimates that SVOD services will have 949 million paid users by the end of 2020, an increase of 47 million compared to pre-COVID-19 forecasts. China and the US currently make up 65% of SVOD subscribers. As a result, the market share of the two countries will dip to 55% in 2025. China will remain the largest market by 2025, while US will take second place with 342 million subscriptions, up from a 2019-end total of 125 million.

What these examples illustrate is that offensive media strategies can work under two conditions. The first one is an open creative content industry; where local talent has a card to play and can even hold the upper hand. The second one is securing a close relationship with telecom operators, as necessary distribution channels, and potentially cash-flow providers to match the considerable cash flow of big international OTTs. These conditions being met, the two-way magic of zero marginal cost networks operates, offering world content to the local market and opening the world market to local content in a way unheard of in cinemas and linear television.

Europe in the future audio-visual landscape

The big question for telecommunications operators and broadcasters in Europe will be how to confront and make the most of the worldwide developments to come. Telecommunications and broadcasting industries in Europe have long been segregated in silos, with companies reluctant to integrate across different skill sets and assets. Network operators now offer converged services comprising voice, data and content, the latter being the major growth factor.

In Germany, Deutsche Telekom chose a conservative strategy as a content aggregator rather than an exclusive media rights-holder. It signed deals with other companies, including Netflix and Amazon Prime Video. German broadcasters have made significant investments in high quality content, DT is possibly wary of gaps in management cultures.

Conversely in the UK, BT has pursued a content acquisition strategy. It grabbed the Champions League from Sky, spending £4.8 billion (US$ 6.1 billion) for the rights of the English Premier League, the Champions League and Europa League. It currently spends more than £700 million per year on top-tier international and domestic football. Competition has increased, with e-commerce giant Amazon winning a three-year broadcast package for the Premier League, while Sky would like to use the Champions League to boost its NOW TV streaming service. British broadcasters joint venture BritBox has been pitched as a cheaper additional streaming service for consumers who already subscribe to Netflix, with a focus on providing thousands of hours of archive material and classic box-sets by the two broadcasters. What was launched in 2017 as a platform showcasing the best of British content in the US and Canada, is now Britain's new weapon in the streaming wars.

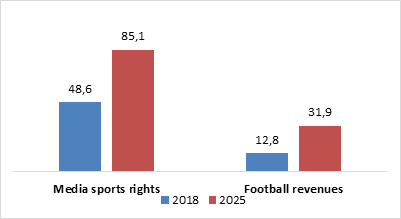

Quality premium content prices therefore are up, as illustrated by the increasing value of live sports events and EU football in particular (see graph below).

Sports rights revenues, 2018 - 2025 (US$ Bln)

Source: Rethink Technology Research données traitées par ITMedia Consulting

In Italy, in 2018, Mediaset signed a commercial agreement with Telecom Italia (TIM). From January 2019, TIMvision customers have been able to access Mediaset's free-to-air linear channels, leading TIM Vision to extend its business and make it more attractive. It has customers, it has a platform, therefore the goal is to feed it with very popular mainstream content, giving in return a better way to maximize the ad revenues for Mediaset in a better targeted and profiled online market.

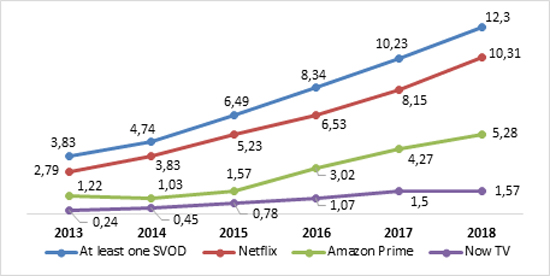

Subscription of SVOD households in UK (Mln)

Source : BARB

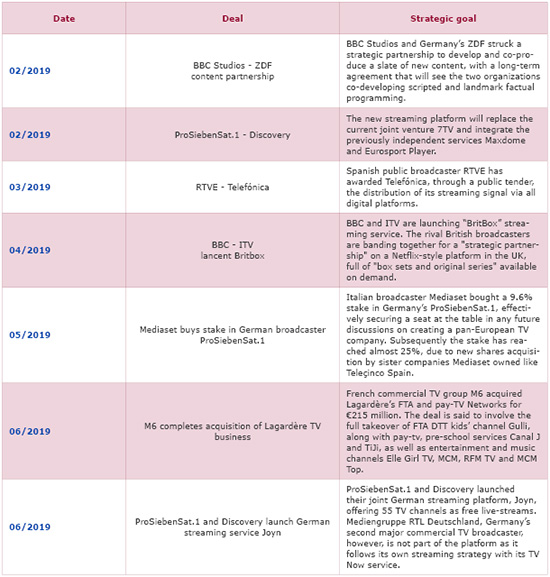

European broadcasters have struck a series of deals.

European broadcasters' main deals

Source: ITMedia Consulting

A few European-wide initiatives are under way. In 2017, Mediaset agreed to set up a joint trading platform for digital video advertising with European commercial broadcasters TF1 (France) and ProSiebenSat.1 (Germany), establishing in equal shares the European Broadcaster Exchange (EBX). The purpose was to address at scale the demand for pan-European by media agencies planning continent-wide video campaigns. It was the start of a strategic collaboration to drive forward the technological development of online advertising. The joint venture should allow reaching over 250 million people, a critical mass able to face the giants of the global web. With a higher ambition, in September 2019, Mediaset announced the establishment of an European wide media Group, MFE, based in Netherlands, including the Italian and Spain wholly owned TV companies and its stake in Germany based ProsiebenSat1.

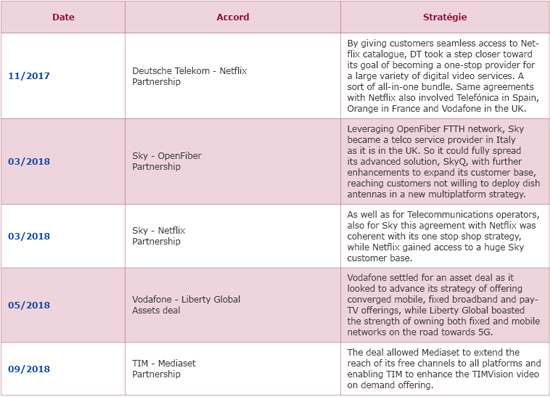

After the 2017 Vivendi/Telecom Italia/Mediaset project of a "Netflix of Southern Europe" was put on the back burner, the Vodafone/Liberty deal in May 2018 was a significant catalyst for the sector in Europe, potentially paving the way a consolidation across Europe along this business model. Similar deals involve all European operators, BT, DT, Orange, Altice, Free, Telefonica, etc.

Meanwhile, the European Public Service Broadcasters have also been active, joining forces at national and also European levels. RAI for example teamed up with France Télévisions and German ZDF in an alliance for the co-production of content for the three public television services of Italy, France, and Germany. Franco-German ARTE is asserting its European ambition by offering programs in 6 languages, without copyright limitations in Europe, unlike most other offers.

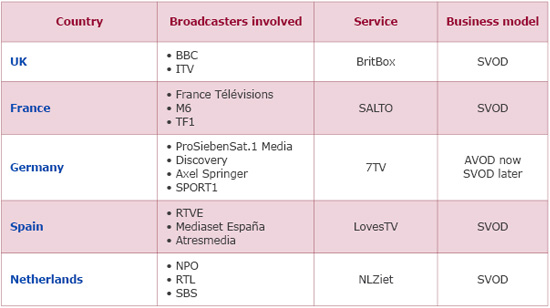

Main broadcasters' alliances in Europe

Source: ITMedia Consulting

In France the three largest French broadcasters France TV, M6 and TF1 will operate the joint online-video platform Salto, planned to be launched in 2020. Public-service broadcaster France Télévisions will stop selling shows to Netflix so it can keep exclusivity for its own home-grown equivalent, to keep strong French and also European fiction.

Evolution of VOD main platforms penetration in France (%)

Source: CNC - Harris Interactive - Vertigo

France has been a strong proponent of cultural diversity policies, with tax breaks and quotas to incentivize local players, contributing at the beginning to Netflix being a slower burn than in the UK or the Nordics. In theory, not working with Netflix might allow French broadcasters, which back around 75% of audio-visual creation in France, to maintain a strong foothold by having more market leverage. But in the French TV industry, where budgets and revenues have fallen flat, Netflix has been welcomed by producers, and broadcasters for bringing more money to the sector.

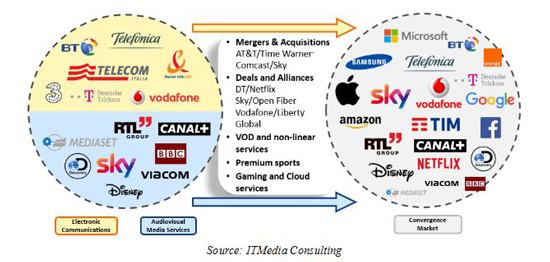

A challenge for Europe: strategies towards convergence

The current crisis highlights the technical know-how and resilience of telecommunications operators. It vindicates the economic and social importance of their investments in broadband networks. Licensing existing content was merely enough for telecommunications operators to beef up a nascent catalogue (note a couple hundred film catalogues just a few years ago). There will now be a strong incentive for operators to counter spiralling content procurement costs by leveraging their size and financial strength and taking control of content creation outfits, emulating vertical mergers like AT&T and Time Warner. The imperative will be a new diversified offer, attractive to a wider and ever more culturally open customer base growing exponentially around the world. This leap into huge multi-thousand video catalogues, with increasing content creation and production, is at the core of the 2018-2020 round of deal making, and more will be around the corner.

The telecommunications and broadcasting worlds are experiencing their day of reckoning with the linkage of large media and giant distributors, through mergers, acquisitions, deals and strategic alliances.

Major partnerships in the European arena

Source: ITMedia Consulting

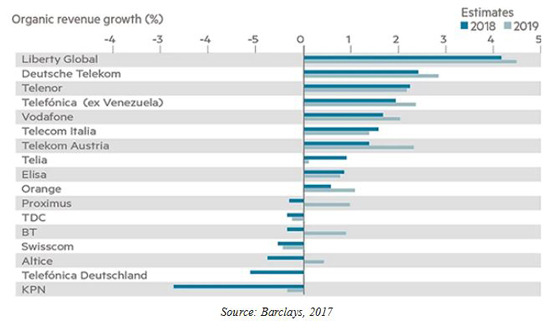

Telecommunications operators have remained in relatively good shape, as revenues are better than the economy as a whole, free cash flow has remained high, and regulatory constraints might be made lighter. For the future, Telecommunications operators cannot but feel that now is their moment to escape the "dumb pipe" curse of undifferentiated competition, commoditization, and pent down tariffs, and take advantage of relative financial strength and the superior growth in video content.

European telecom groups' sales

Source: Barclays, 2017

Telecom operators can count on a broad customer base, the quality of their networks and the shift in viewing to phones and tablets away from TV. By combining these assets with exclusive content, they can legitimately aspire to the role of core enabler of content enjoyment. The new challenge will increasingly be played according to a content portfolio and user experience capable of satisfying the needs of every single user in a personalized and simple way.

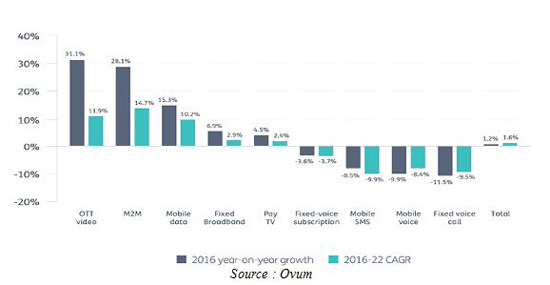

Telecoms and media services revenues network/media to 2022

Source : Ovum

Against this backdrop, the critical strategic alternative for telecommunications operators concerns the links to be established with content providers to secure the video traffic they crave to fill in their ever-expanding conduits. Relationships between network operators, broadcasting channels and video programming have long been fraught with recurring difficulties and conflicts. Both sides cannot help considering they must have the upper hand in the deals. Network operators boast the large customer base they have on offer, whereas content producers and media companies are proud of their unique ability to provide the enviable programming the viewers want. Both sides hold some of the truth. The balance of power in content production, provision and delivery today is complex, as we can observe parallel reinforcement trends on both sides.

For telecommunications operators, the shift from technology know-how and cost consciousness, to managing the creative talent has a mixed success record. The compatibility of competences is an issue, but the convergence trend is hardly escapable. How to define the activity mix, how to manage profitably not just portfolio-like, but by combining engineering know-how and art creation talents will be key.

A cultural aspect will become increasingly important for Europe in the future: the European creative industries already produce work that is very popular in each country of origin, with an audience significantly higher than the American ones. That can be extended outside their borders. Thanks to the Internet and to the new VOD services potential demand is growing. The challenge for "diversity" creations is to reach wider audiences. The breadth of the catalogue of national film and television productions and the marketing means limiting the possibilities of a direct relationship between national operators and international audiences. This raises the crucial question of the relationship of work of cultural diversity with international networks and platforms, most often of American origin.

We find, particularly in countries of "diversity", a tangle of rules created over time in a defensive spirit for local work, quotas, financial aid, various obligations concerning exclusive content or events said to be "of major importance", restrictions on mergers and acquisitions. These means, whose raison d'être must not be lost, are however to be carefully re-examined in the light of the new realities of the digital world. The recent controversy surrounding the definition of "cinema", initiated by Martin Scorsese, in the wake of the debate over the Netflix production Rosa at the Oscars, illustrates the potential contribution of platforms to creation.

We can see, particularly during this dark period, how the platforms, anxious to attract local customers for their international expansion, have brought welcome financial means to original cultural productions. International openness and the range of possible agreements between network operators and producers of creative work, managed with foresight, presents a historic chance for flourishing cultural diversity at international level, for increased opening of markets to different horizons.

Finally, the platforms are a privileged vector for financing and international expansion. The regulatory distrust of horizontal or vertical integration, as of exclusivity, which might have been justified when the range of work and events offered for audio-visual purposes was limited, is much less so today, while the offer, as well as the expectations of the public have widened and diversified. To succeed in the synergy of creations of cultural diversity and large international networks, in Europe, as well as in Asia and in Latin America, we should carefully re-examine the constraints weighing on the digital economy, in particular those affecting cross-border flows of data, capital and work.

The economic damage caused by the COVID-19 pandemic is dramatic and is affecting industries heavily.

COVID-19 is having a marked impact on media supply, consumption, and advertising around the world. Cultures, attitudes and politics have changed, technologies have advanced, and certain aspects of society had even regressed. Traditional broadcasters dependent on advertising are suffering.

Many broadcasters today are staring down the barrel of much bigger losses, with many contractual arrangements between rights holders, broadcasters, sponsors and advertisers unravelling, even given good will on all fronts. Demand for all forms of media, TV programs (broadcast and on-demand), short-form video, music streaming and online gaming, particularly in geographies currently under stay-at-home instructions, has surged. In some instances, VOD content has been offered for free or at a discount. It is clear COVID-19 is driving record levels of free trials, which should lead to extra sampling and thus give many services a shot they would never have had. It also means the cost of customer acquisition, which has skyrocketed in the streaming war, has plummeted, thereby increasing lifetime values.

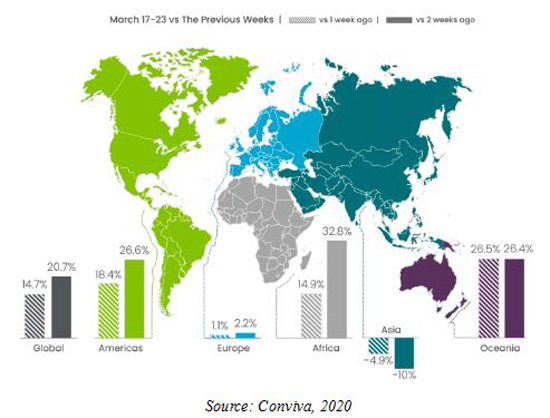

As more viewers have stayed home, watching screens throughout the day, the primetime peak has shifted with viewing spread more evenly across more hours of the day. Demand for content (streamed or live) is constantly increasing. New content creation, from live sports to sitcoms to films, has been largely turned off.

Increase in streaming viewing hours, by Region

Source: Conviva, 2020

The accelerated decline of both Pay-TV subscribers and Pay-TV advertising revenues will strongly harm all traditional media players in a time in which they find themselves most exposed. Telco operators, meanwhile, will focus on infrastructure upgrades to meet the increase in demand for broadband services but they might face setbacks with technicians making house calls. Operators are already asking households not to use all the bandwidth to stream video and play games during working hours, when that bandwidth will be needed. Speed upgrades will see an uptick as more users at home require more bandwidth and unlimited data usage.

Streaming is among the (few) winning businesses in the global lockdown. Since 2010, the Pay-TV ecosystem has seen nearly a 30% reduction in overall viewing hours and as much as a 60% decline among 12-35-years-old. Pay-TV is the largest recurring discretionary entertainment expense for the average household. This makes it one of the first places families will look when struggling with bills, unemployment, or other financial pressures, especially when they already have Netflix, Amazon Prime, Disney+, and significant free streaming offerings from national broadcasters.

Consumers are examining their personal finances as never before to determine what they can afford to buy and weigh what products and services provide the most value to their household. Household prioritization of paid entertainment services against other household services and product needs will determine if a free trial, promotional offer, or an exclusive piece of content converts to a paid subscription.

Policy strategy and regulation in the digital market in Europe

In 2018 and 2019, the EU completed the review process of three important pieces of legislation: Electronic Communications Code, Audiovisual Media Service Directive and Copyright Directive. The first two in particular are still subject to a sector specific framework, which is 20+ years old, dating from the age of analogue television and narrowband fixed copper networks.

The subsequent revisions leading to the new Directives now to be implemented at the national level keep the clear distinction between the two sectors, including the new services in the consolidated regulatory framework.

The changing playing fields

Source: ITMedia Consulting

In our view, while this represents a valued attempt to adapt the old legislation to the new reality in an evolutionary perspective, it does not give due consideration to the disruptive innovations that will reshape the communications industry in the next few years. In this perspective the new Commission and the appointment of an executive vice president for digital, opens the way to a new scenario in which the development of technological policy, the Digital Single Market, and a re-defined competition policy can now combine in an EU policy strategy for the next 5-year mandate.

In this framework the "Digital Services Act" to be proposed, requires a radical shift in the rationale of regulation of the relations between content providers and telecoms operators. A decade ago, for example, the emphasis was on monitoring access to exclusive content, in order to preserve a competitive landscape. Exclusive content was seen as potentially detrimental to competition. Content today is abundant, highly competitive, but it requires more and more financial resources and readily accessible distribution channels. It should encourage competition and pluralism, within the framework of the now broader, European definition of geographical markets. In addition, a solution will have to be found to end the fragmentation of the European rights market, a major obstacle to the promotion of a European offer.

The authors thank Paolo Nardelli, analyst at ITMedia Consulting, for its valuable contribution to this paper.

Publishing Director : Pascale Joannin

To go further

Gender equality

Fondation Robert Schuman

—

23 December 2025

Businesses in Europe

Olivier Perquel

—

16 December 2025

Digital and technologies

Josef Aschbacher

—

9 December 2025

Democracy and citizenship

Florent Menegaux

—

2 December 2025

The Letter

Schuman

European news of the week

Unique in its genre, with its 200,000 subscribers and its editions in 6 languages (French, English, German, Spanish, Polish and Ukrainian), it has brought to you, for 15 years, a summary of European news, more needed now than ever

Versions :