Africa and the Middle East

Alexandre Kateb

-

Available versions :

EN

Alexandre Kateb

At a time when China is openly courting the African continent, the outgoing president of the European Commission, Jean-Claude Juncker, pleaded in his September 2018 speech on the state of the Union for a "new alliance between Africa and Europe". This alliance would be founded on "investments and sustainable jobs"[1]. Previously, the summit between the European Union and the African Union, held in November 2017 in Abidjan, had insisted on the need to "provide young people with the skills and opportunities they need through the mobilisation of intelligent, targeted investments"[2]. German Chancellor Angela Merkel, for her part, wanted the deployment of a Marshall Plan for Africa. Finally, President Emmanuel Macron has committed to devote €2.5 billion to African start-ups and SMBs between now and 2022, within the framework of the "Choose Africa" initiative.

Does Europe have the means to achieve its ambitions? What should be the priorities of its African strategy for 2021-2027? The renewal of the European institutions provides an opportunity to give more tangible content to the Euro-African partnership. To do so the European Union must articulate more fully the logics of North-South and South-South integration, capitalising on the Moroccan experience, which has reconciled these two complementary approaches for several years now.

1. Position, philosophy and instruments of Euro-African cooperation

Until the year 2000, Europe-Africa relations were almost entirely based on development aid. Nevertheless, although it remains Africa's top financier, with €20 billion in annual aid sent to the continent, the European Union wanted to complete this approach with a deeper economic and commercial partnership. The Cotonou agreements set out a new structure for cooperation with ACP countries (Africa, Caribbean, Pacific), based on economic partnership agreements (EPA) with the various Regional Economic Communities (REC). The EPA with the ECOWAS was finalised in 2014. However, Nigeria refuses to sign it in its current form. The APE with the SADC was signed in 2016 on a basis of the strategic agreement between the European Union and South Africa. Other APE are in various stages of progress.

In the 2021-2027 multiannual financial framework, the European Commission proposed merging all the public aid mechanisms within a new Neighbourhood, Development and Cooperation Instrument (NDCI) of an amount of €89 billion, 22 of which for neighbourhood countries and 32 for Sub-Saharan Africa. The NDCI would absorb the European Development Fund (EDF), an inter-governmental cooperation instrument that dates back to 1959, through which most community aid to ACP countries transited to date. Over the period 2014-2020 the EDF thus granted aid amounting to €30.5 billion[3].

In addition to integrating the EDF directly into the European Union budget - which is a revolution in itself -, the Commission has planned to mobilise private finance, which is referred to as "Blended Finance". To do so the European Union can rely on the European Fund for Sustainable Development (EFSD), created in 2017 within the context of the External Investment Plan (EIP) This fund merged mechanisms with limited geographic cover, such as the African Investment Facility (AIP) and the Neighbourhood Investment Facility (NIP)[4]. Even before the launch of the EIP, the Europe-Africa fund for infrastructures, created in 2007, had already applied at Blended Finance type approach. Over the period 2007-2017, this fund paid out €739.9 million, in support of projects representing a total amount of €8.3 billion in renewable energies, transport and ICT[5].

Through the EIP, the European Union had set itself the objective of supporting external projects of a total amount of €44 billion by 2020, mainly in neighbourhood and Sub-Saharan African countries, based on own funds of €4.1 billion. The Commission proposes renewing the EIP over the period 2021-2027, with a target envelope of €60 billion. For this to have a real impact, it is imperative to define a strategic vision, together with a few priorities and a coherent action plan. Indeed, when faced with China which is offering Africans a multidimensional partnership based around the "new silk roads" concept, the European Union is having difficulty supplying attractive content for the alliance proposed by Jean-Claude Juncker, within the context of an equal to equal strategic partnership. A big story is missing, one which would transcend the technocratic approach and be a better embodiment of the partnership.

To do so we propose building a "Partnership for the Emergence of Africa", articulating the North-South and South-South cooperation logics more efficiently. Morocco, to which the European Union granted an "advanced status" in 2008, could be a driving element in this. As soon as he came to power, King Mohammed VI commenced active economic diplomacy. South-South cooperation was inscribed in the introduction of the 2011 Constitution[6]. Although trade with African countries represents only 5% of Morocco's overseas trade, the kingdom became the second largest African investor in Africa and the largest in West Africa. Many Moroccan companies are established in the region: banks and insurance companies, telecommunications operators, building firms, mining companies, food groups. A project for a gas pipeline from Nigeria to Morocco is under consideration and the kingdom has submitted its application to join the ECOWAS, after re-joining the African Union. This role as "leader" in South-South cooperation in Africa is consubstantial with the mutation in the Moroccan economy. To understand it, it is essential to take the measure of the latter.

2. The Moroccan experience: economic emergence and insertion in regional and world value chains

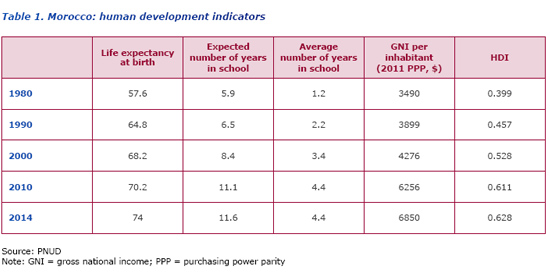

In the years 2000, much progress was made in opening of the Moroccan economy. Morocco signed free trade agreements with the European Union, Egypt, Tunisia, Jordan, the United States, Turkey and the United Arab Emirates. Between 1990 and 2012, customs duties fell from 64% to an average of 5% on imports of industrial products and from 66% to 19% on agricultural product[7]. Exports saw an increase of 10% per year throughout this period. Also, their composition changed. The shares of technology intensive products increased from 30% of total exports in 1993 to 45% in 2013. The economy's resilience was strengthened by modernisation of the banking and financial sector and the adoption of a proactive policy-mix. Growth was buoyed by the increase in non-agricultural income (pay rises and social transfers) and a lesser volatility of the agricultural GDP thanks to investments made in this sector[8].

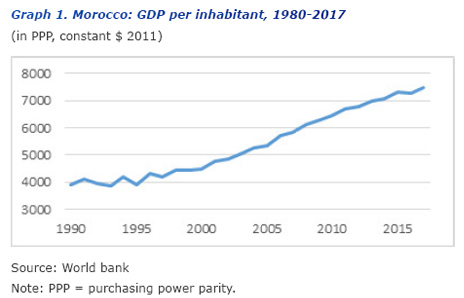

The rate of income poverty fell from 15% to 5% between 2000 and 2014. In rural areas it fell from 25% to 9.5%. The unemployment rate has been cut in half in urban areas, down from 22% in 1999 to 13.9% in 2016. Morocco has made considerable progress in terms of human development (see table 1) thanks to massive public investment in education, extension of medical cover (Ramed) and the connection of rural areas to the electricity grid and to drinking water supplies. The National Initiative for Human Development (INDH) and targeted monetary transfer programmes (Tayssir) have reduced poverty[9].

As from the years 2000, Morocco had numerous sectorial plans (Emergence Plan and Industrial Acceleration Plan, Green Morocco Plan, Fisheries Plan, Vision 2020 for tourism) and transversal strategies (National Logistic Strategy, Digital Morocco Strategy) which meant that public action was established long-term. King Mohammed VI surrounded himself with high level technocrats, to whom he entrusted the economic portfolios. This "managerial revolution" was accompanied by administrative de-concentration and decentralisation, through the advanced regionalisation policy, which transferred economic development jurisdiction to local level.

The State has put considerable investment effort into infrastructures. Between 1998 and 2013, public investment increased from 8% to 14% of GDP. Between 2005 and 2012, over 15,000km of roads were built, i.e. more than over the entire period 1990-2005. The Tangier Med port complex, inaugurated in 2007, is already operating at full capacity. Inauguration of the extension, Tangier Med II, should triple its capacity, taking it up to 9 million TEU (Twenty-foot equivalent unit) by 2020. It could therefore be one of the world's "top twenty" container ports and reinforce its position as Africa's top logistics hub. In January 2019 Morocco also inaugurated the first high-speed rail link in Africa, at a cost per kilometre amongst the lowest in the world.

In order to reduce dependency on energy imports, the authorities have removed subsidies on oil products and encouraged investment in renewable energies. The mega concentrating solar power (CSP) station to the north of Ouarzazate was inaugurated in 2012. Wind power already represents one tenth of electricity generation in the kingdom. When all energy sources are considered, renewable energies represented 35% of installed capacities and 16% of electricity generation at the end of 2017[10]. The objective is to take the shares of renewables in total capacities up to 52% by 2030. These projects, financed in part by "green bonds" have resulted in the emergence of national champions such as the NAREVA group.

A reconfiguration of production plant has also been commenced. The phosphates and derivatives sector have preserved its competitiveness thanks to better valorisation of these natural resources. But it is the automotive sector that has seen the most spectacular progress, as a consequence of the establishment, in 2012, of a Renault factory close to Tangier Med, followed by a PSA factory in Kénitra in June 2019. Over 200 suppliers have also come to Morocco in the wake of these two manufacturers. The automotive sector has already created over one hundred thousand jobs and it now represents the country's leading exports. The aeronautical industry has already developed around groups such as Bombardier and Safran (cabling, assembly). The contribution made by these new sectors to local added value remains limited, however, due to their dependency on imported parts and components[11].

In this respect, the low level of skilled labour available is the Achilles heel of the Moroccan economy[12]. Two thirds of workers have no qualifications and only one in ten workers has higher education qualifications. Also, human capital is not correctly valorised. Half of all young graduates from higher education are unemployed. The level of participation of women in the labour force is not more than 15% in urban areas. To this is added persistent spatial polarisation. Five regions concentre 60% of national production, reflecting a duality that goes back to colonial days.

To reinforce the competitiveness of Made in Morocco and counteract sluggish growth, Morocco must generate more productivity gains. The country is in an uncomfortable position between countries with low labour costs and countries with high technological intensity. To escape the trap of intermediate income, it is essential to invest in human capital and innovation by getting private stakeholders involved. The success of the Automotive Skills Training Institutes (IFMA) demonstrates that upstream involvement of companies is a determining factor in professional training. The same is true for R&D spending. The national R&D effort represents almost 1% of GDP - i.e. as much as in Brazil, Poland or Turkey - but this effort is borne two thirds by universities and only one third by business, unlike in the other countries mentioned. Nevertheless the start of a re-balance is being observed, with the establishment of private engineering and R&D centres in the country, such as the PSA group's Morocco Technical Centre (MTC) in Tangier, the MG2 automobile engineering centre (Joint-venture between Magna and Altran Technologies) in Casablanca, or Dassault Systèmes' "3D Experience" design platform in Fes.

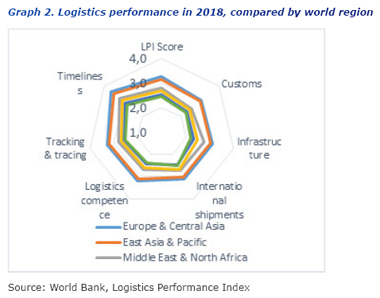

In addition, R&D is only one sources of productivity gains, alongside technical and organisational efficiency, the effects of apprenticeship ("Learning by doing") and economies of scale. The development of high intellectual content services (transports and logistics, IT, marketing and distribution, staff training, legal and financial advice) would enable Moroccan businesses to benefit more widely from these effects[13]. According to the OECD the services content in manufactured goods exported by Morocco is lower than the OECD average, which is around 35%. This is the case in traditional industries (textiles, food, chemicals), as well as in the automotive industry[14]. There exists therefore a major potential for creating new, skilled jobs and increase the productivity of existing companies. This is particularly true for transport and logistics services, which represent between 15% and 35% of a product's cost price. According to an IPEMED study, the rate of logistics sub-contracting is close to 20% in Morocco, whereas it is almost 70% in European countries[15]. Although Morocco has improved its maritime connectivity, it still has progress to make in terms of rail and road freight and multimodal logistics. In this respect it is important to accelerate implementation of the national logistics strategy launched in 2010.

This upgrading of production facilities is all the more necessary since the "fourth industrial revolution" would create an upheaval in the current activity models[16]. Although traditional value chains were based on a system of degrouping and hierarchical sequencing of industrial production, this could change in the era of Compufactoring - "connected" robotisation and increased production - thanks to innovations such as the Internet of Things, Big Data, Blockchain and Artificial Intelligence (AI). Vertically integrated chains could be substituted by platforms composed of myriads of network connected microbusinesses, as in the RenDanHeyi model of the Chinese group Haier[17].

3. Towards a partnership based on the articulation of North-South and South-South logics

Supporting connectivity efforts across the whole of Africa

We have referred to the importance of logistics services and to Morocco's insufficiencies on this level. This observation applies to many other African countries, which almost all, with the exception of Egypt and South Africa, show weaker performances than Morocco in this respect. This transpires at continental level and forces the capacity of these countries to become part of regional and world production chains. In September 2018, the European Commission published the elements of a strategy for Europe-Asia connectivity[18], in response to the Chinese New Silk Roads project, to which sixteen countries in Central and Eastern Europe, as well as Greece, had joined up. In view of existing requirements and the desire to bind the African and European continents closer together, it would be more relevant to define a Europe-Africa connectivity strategy by supporting pan-African connectivity in energy, both physical (maritime, road and rail transport) and virtual. Sub-Saharan Africa is still a long way behind in this respect, which is translated by poor logistics performance.

In energy terms, one of the main bottlenecks in Africa is caused by the poor interconnection of national electricity grids, which has a massive impact on economic growth, including in countries such as Nigeria and South Africa. In this respect the European Union could support the reinforcement of regional electricity grids in Africa, taking inspiration from the North Pool network that exists in Northern Europe. It could also combine the expertise of Spain and Morocco in renewable energies to accelerate the electrification of rural areas in Africa.

Insufficiencies in terms of physical connectivity continue to jeopardise development. Sub-Saharan Africa is the only region in the world where road network density fell over the period 1990-2011. Poor road connectivity deprives many producers of access to national, regional and world markets, and prevents them from benefitting from economies of scale. It is essential to complete the major transcontinental routes, like the trans-Saharan and the Trans-Sahelian. These two major highways could be connected to the Abidjan-Ouagadougou motorway and the Tangier-Abidjan-Lagos route. Finally, according to the AfDB, the cost of maritime services in Africa is still 40% higher than the world standard, due to congestion at existing port infrastructures. Greater integration between African ports and between the ports and their respective hinterlands would result in considerable positive externalities.

As for digital connectivity, its impact as a catalyst for development needs no further demonstration[19]. In 2020 over half a billion Africans will have access to broadband mobile internet. In 2017 the European Commission published a digitalisation strategy for development - Digital4Development (D4D) - centred on Africa[20] Amongst its suggestions are the networking of digital incubators and accelerators in Africa with their European counterparts, as well as innovative proposals to fill in the digital divide in remote areas (telecommunications towers powered by renewable energies, use of the TV/radio spectrum). A Europe-Africa digital Task Force is to submit its findings on this subject by the end of 2019. In the meantime, the European Union could take inspiration from the ICT "Impact sourcing" initiative started by Digital Divide Data (DDD), or the Rockefeller foundation's Digital Jobs Africa initiative, which aims to train 150,000 young Africans in digital jobs.

In order to support the Pan-African and Euro-African connectivity projects identified, the European Union could mobilise External Investment Plan (EIP) instruments. We suggest allocating €3 billion to the Europe-Africa fund for infrastructure over the period 2021-2027, articulating its action with the Africa Fund 5.0 launched in Marrakech in 2014, and based on the expertise of the Programme for Infrastructure Development in Africa (PIDA). This Euro-African connectivity strategy should be backed by joint EU-AU governance. This would allow for support for projects totalling €30 billion - or even much more - with priority given to the interconnection of electricity networks, the development of terrestrial and maritime logistics chains and the integration of African and European digital ecosystems.

Deploying integrated industrial sectors in Africa

Europe could give greater support to industrial investments in Africa, as is done by the Renault group in Tangier, by encouraging the creation of industrial sectors integrated at Euro-African level. Whereas China is gradually moving from the status of factory of the world to that of the world's leading market, the tens of millions of "outsourced" Chinese industrial jobs are the dream of certain African countries. However, Chinese manufacturer investments in Africa are still limited. With the exception of the Sino-Egyptian and Sino-Ethiopian free zones, Chinese manufacturing entities located in Africa produce mainly for local markets[21]. As for the United States, with the African Growth and Opportunity Act (AGOA), started in the year 2000 by President Bill Clinton, they have granted African countries access to the American market without any counterpart in return. However, the AGOA has not resulted in any real boost in American-African trade, which remains lower than both Euro-African and Sino-African trade. Also, the USA is more focussed on a few "top" countries such as South Africa and Nigeria.

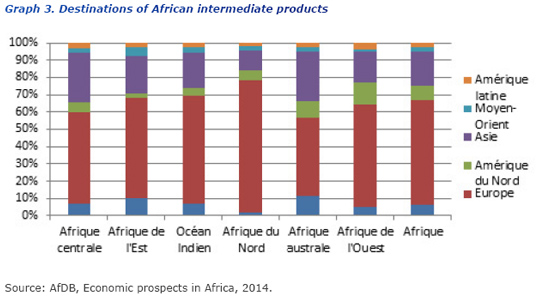

The creation of value chains is based on trade in intermediate products, and Europe remains the main supplier of intermediate products in North Africa, and rivals with Asian countries in Western, Central and Southern Africa. Europe is also the principle market for African intermediate products[22]. The European Union is therefore well placed to accompany Africa in its industrialisation, starting with agro-industrial transformation. In fact, agriculture concentrates 30% of direct jobs and provides 70% of African incomes. The sector represents all political, social, economic and environmental challenges. African farmers are the most impacted by the consequences of climate change. At the COP22 Morocco proposed an initiative for the Adaptation of African Agriculture (AAA) which was adopted at continental level. African agriculture remains, however, at a very low level of productivity and insufficient value is given to products at local level.

Through its subsidiary OCP Africa, created in 2016, the OCP group sought to remedy this situation by becoming a strategic partner of African farmers. Joint-ventures set up by the group in Nigeria and Ethiopia are an illustration of this new orientation. There is enormous potential for vertical and horizontal integration in this sector. The presence of "leading" companies that can play a role of aggregator is fundamental to set up production chains, notably within a context of low-level sophistication amongst basic suppliers (see diagram). The experience of the OLAM group, which has set up integrated value chains in Ghana and Nigeria is a perfect example of this[23]. Within the framework of the Green Morocco Plan, Morocco has also developed a logic of agro-industrial aggregation and integration, which has seen positive results.

In more technological and capital intensive industries (automotive, aeronautical, electronics, pharmaceutical and fine chemistry), which are highly integrated at world level, the Euro-African partnership could take its inspiration, the Euro-African partnership could take its inspiration from the industrial ecosystem set up between Japan and ASEAN countries in the '80s. Thanks to this "wild geese flying pattern", the nature of intra-ASEAN trade changed profoundly. The share of basic products (agricultural and mining) in this trade dropped, from 68% to 33% between 1980 and 1991. Mechanical and electronic components now represent two thirds of this trade[24]. The ASEAN Industrial Cooperation Scheme (AICO), set up in 1996, then boosted intra-regional industrial cooperation by granting preference to businesses established on site. This system persuaded many major Japanese industrialists to set up in the region. It is also based on a more modular, more horizontal integration logic enabling the emergence of local industrial players.

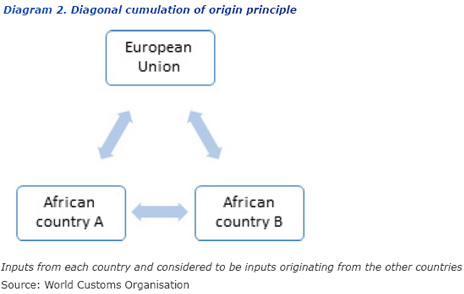

In the same spirit, the African Union could set up, with assistance from the European Union, Pan-African industrial and technological cooperation (AITCO). Whilst awaiting for the African Continental Free Trade Agreement (AfCFTA) to become operational, this scheme could be based on diagonal cumulative rules of origin between the various Regional Economic Communities (RECs) with which Europe has signed an EPA. It could encourage industrial cooperation between countries such as Morocco, Egypt, Nigeria and South Africa. European finance could be mobilised to create professional training centres - based on the model of Moroccan IFMA - and to support the certification of African companies to enable them to become part of industrial processes run by European groups. Note that the United States already applies, within the context of the AGOA, similar cumulation cooperation for African textile and clothing industries. The European Union applies this type of cumulation of origin between countries in the Agadir agreement. It could be extended on a bigger scale.

Organising the movement of talent and containing the brain drain

This reworked Euro-African partnership presupposes organisation of the movement of services, capital and skilled workers, within a context that valorises complementarities whilst avoiding the brain drain. Indeed, although they lead to an increase in exports and productivity, the impact of value chains on human capital is not unequivocal[25]. It may even be negative due to the effects of agglomeration that are well known to specialists of the new geographic economy. Within a region, the most advanced centres exercise an irresistible attraction on peripheral areas. Solutions to contain the brain drain phenomenon must therefore be sought. With this in mind the idea of a "Brain drain tax" was put forward in the '70s by the economist Jagdish Bhagwati[26]. It consists of taxing, for between five and ten years, skilled migrants established in host countries and paying the income from this tax back to the country of origin.

Another alternative consists of obliging young graduates to work for a few years in their country of origin after completing their studies. This "service bond" exists in Singapore, for example. In an increasingly inter-connected world, it is essential to combine this with more incentivising policies. The technological centres of Bangalore in India and Silicon Wadi in Israel developed thanks to Returnees from Europe and the Silicon Valley. The same is true for the high-tech megalopolis of Shenzhen in China. Greece has created capital-risk funds that target entrepreneurs in the diaspora, encouraging them to return to their home country. Ghana has succeeded in convincing the giant Google to open an R&D centre in Accra, given over to Artificial Intelligence (AI). These examples show that, with a little imagination, it is possible to transform "Brain Drain" into "Brain Gain.

***

Over the past few years, the African continent has relaunched its efforts of integration, through the reform of the African Union and the launch of the AfCFTA. By 2050 the population of Africa will have doubled. By relying on its increasingly well-educated youth, it could release its extraordinary economic potential. This transformation represents an historic opportunity for binding the African and European continents to each other, something that Robert Schuman wished for several decades ago. To achieve this, it is fundamental to articulate the North-South and South-South cooperation logics in order to encourage the emergence of an economic ecosystem that is both integrated and modular. Morocco's experience is edifying in this respect. The new European executive, after the May 2019 elections, should make integration with Africa a strategic priority. This is not only a stake for the future. It is an existential imperative for Europe, at a time when security and migration threats are intensifying. It is particularly true if Europe want to continue to have an impact in the world, when faced with giants such as China and the United States.

[1] Abidjan Declaration, 2017 Summit

[2] European Commission, Communication on a new Africa-Europe alliance for investment and sustainable jobs : taking our partnership for investment and jobs up a level COM(2018) 643 Final

[3] European Commission, Proposed European Parliament and Council regulation establishing the neighbourhood, development and international cooperation instrument, COM(2018) 460 Final

[4] European Commission, Vers une architecture financière plus efficiente pour les investissements hors de l'Union européenne, COM(2018) 644 Final

[5] BEI, Rapport annuel du Fonds fiduciaire UE-Afrique pour les infrastructures, 2017.

[6] PNUD, Tendances et opportunités sur l'avancement de la coopération Sud-Sud au Maroc. December 2013.

[7] BAD, Analyse de la politique commerciale du Maroc. Volume 1 : Impact de la politique tarifaire du Maroc sur la compétitivité, 2016.

[8] Moroccan Finance Ministry, Draft Finance Law for 2019. Economic and financial report, 2019.

[9] Chauffour J-P., Le Maroc à l'horizon 2040 : Investir dans le capital immatériel pour accélérer l'émergence économique, Banque mondiale, 2018.

[10] International Energy Agency, Energy Policies Beyond IEA Countries: Morocco, 2019.

[11] Jaidi L., Msadfa Y., La complexité de la remontée des chaînes de valeur mondiales : cas des industries automobile et aéronautique au Maroc et en Tunisie, OCP Policy Center, PP-17/18, April 2017.

[12] Haut-Commissariat au Plan et Banque mondiale, Le marché du travail au Maroc : Défis et opportunités, November 2017.

[13] Baldwin R., Global Supply Chains : Why they emerged, Why they matter, And Where they are going, CTEI WP 2012-13, Graduate Institute of International Development Studies, 2012.

[14] OCDE, Morocco in Global Value Chains: Results and statistical recommendations from the integration of Morocco in the Trade in Value Added Database, 2016.

[15] Gonnet M., Crozet Y., Majza B., Le Maroc, hub logistique entre l'Europe et l'Afrique ? IPEMED, Juillet 2017.

[16] CESE, Changement de paradigme pour une industrie dynamique au service d'un développement soutenu, inclusive et durable, Auto-saisine n°30/2017.

[17] Hamel G., Michelle Zanini M., The end of Bureaucracy, Harvard Business Review, November-December 2018.

[18] European Commission, Relier l'Europe à l'Asie - Eléments fondamentaux d'une stratégie de l'UE, JOIN(2018) 31 Final

[19] UNESCO, ITU, Broadband Commission, The State of Broadband: Broadband catalyzing development, September 2018.

[20] European Commission, Digital4Development: mainstreaming digital technologies and services into EU Development Policy, SWD(2017) 157 Final

[21] Brautigam D. et al. What kinds of Chinese "Geese" are flying to Africa? Evidence from Chinese manufacturing firms. WP No. 2018/17. SAIS, Johns Hopkins University, 2018. Gelb S., Calabrese L. et al. (2017) China light manufacturing and outward foreign direct investment into Africa and Asia, SET Background Paper. ODI, London, October 2017. Thierry Perrault, China in Africa : Phoenix nests versus Special Economic Zones, C.C.J. Occasional Papers, N°7, Paris, December 2018.

[22] BAD, Perspectives économiques en Afrique 2014. Les chaînes de valeur mondiales et l'industrialisation en Afrique.

[23] Nicolas F., La Communauté économique de l'ASEAN : un modèle d'intégration original, Politique étrangère, 2 :2017, IFRI, 2017.

[24] Geldenhuys K., Olam International. Creating competitive advantage at the origin of the supply chain, UCT Graduate School of Business, December 2008.

[25] Ross A., Does economic upgrading lead to social upgrading in global production networks? Evidence from Morocco. World Development, 46, 223-233, 2013.

[26] Baghwati J., Taxing the Brain Drain, Challenge, Vol. 19, No. 3, juillet/août 1976.

Publishing Director : Pascale Joannin

On the same theme

To go further

Africa and the Middle East

Louis Caudron

—

14 October 2025

Democracy and citizenship

Laurent Mayet

—

7 October 2025

Transatlantic Relations

Maxime Lefebvre

—

30 September 2025

Democracy and citizenship

Florent Parmentier

—

23 September 2025

The Letter

Schuman

European news of the week

Unique in its genre, with its 200,000 subscribers and its editions in 6 languages (French, English, German, Spanish, Polish and Ukrainian), it has brought to you, for 15 years, a summary of European news, more needed now than ever

Versions :