Economic and Monetary Union

Cyprien Batut,

Olivier Lenoir

-

Available versions :

EN

Cyprien Batut

Olivier Lenoir

The euro is a world currency. It is the official currency of 19 European States[1], and according to the June 2018 report by the European Central Bank (ECB) on the international role of the euro[2], it is by far, ahead of the pound, the yen and the renminbi, the world's second most important currency. The euro turned twenty on January 1st. Decided upon with the implementation of the Maastricht Treaty in 1993, its adoption aimed to consolidate the European market and support trade between its members.

Originally in 1999 many believed that the European currency would be able to compete against the dollar. Robert Mundell, the Nobel Economy Prize winner in that year declared in 2000: "it might be the most important historic event in the international monetary system since the dollar took over from the pound sterling in its role as dominant currency during the Second World War"[3]. The euro of Maastricht was launched with the positive auguries of the economists of the time: its function was the legacy of twenty years of economic literature, for example extremely influential papers by Kydland & Prescott (1977)[4] and Rogoff (1985)[5] marked its function.

I. Beyond Europe, what is the euro's position?

The euro offers several advantages in the economists' view:

● Its management is independent of political power and is guaranteed by a strong institution: the ECB. Its functioning rules were set by the Amsterdam Treaty of 1998. The mandates of its principle executives are long and separate from political cycles and the ECB's HQ is in Frankfurt, far from time-governed centres of power.

● It is stable: the ECB's only remit is price stability: article 127 of the treaty on the functioning of the European Union. Targeting inflation is its main weapon.

● It is central: the 11 founder countries of the euro area are major links in the world's economic and financial systems.

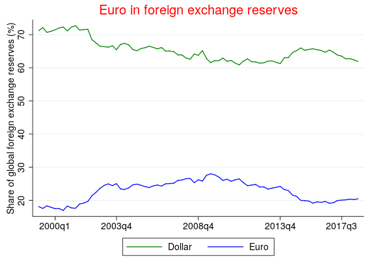

In the last quarter of 2017, the euro was used in 15.7% of world transactions, 35.7% of debt was denominated in it and it comprised slightly over 20% of exchange reserves in the world. But what seems to have been a success story is in fact one that is declining. The main gauges that enable an assessment of the global influence of a currency point in the same direction: the euro peaked in 2008-2009, at the height of the financial crisis, when world confidence in the dollar seem to waver. In 2008 Peer Steinbrück, the German Finance Minister at the time declared: "In ten years' time, when we look back 2008 will be deemed to be a fundamental break. I am not saying that the dollar will lose its status as a reserve currency, but it will become relative"[6] Nicolas Sarkozy, for his part, declared: "Tomorrow I am leaving for Washington to explain that the dollar - which after the Second World War, as part of the Bretton Woods system, was de facto the only world currency - cannot hope to remain so."[7]

Graph 1: the euro -store of value

Note : This graph shows the development of the share of currency reserves in dollars and in euro. Source : FMI

Note : This graph shows the development of the share of currency reserves in dollars and in euro. Source : FMI

Graph 2 : the euro as a unit of account

Note: This graph shows the development of the share of debt securities which are respectively denominated in euro and dollar. Prior to 1999 the share of the euro was the same as the ECU and of all the replaced national currencies. Source: BIS

Note: This graph shows the development of the share of debt securities which are respectively denominated in euro and dollar. Prior to 1999 the share of the euro was the same as the ECU and of all the replaced national currencies. Source: BIS

Although 2008-2009 marks the height of the euro, that summit was not so high. On the above graphs, prior to 1999, all of the currencies, which were to form the euro, were aggregated, the arrival of the euro led to their increased influence worldwide. But even in 2008, the share of the euro in world currency reserves never rose beyond 28% (graph 1) and although it supplanted the dollar for some years in the denomination of debt securities (graph 2), this is no longer the case today. Ten years on, 2008 did not constitute a fundamental break, but simply an interlude, preceding the reassertion in 2009, with Bernanke's quantitative easing, of the dollar as the world's reserve currency.

Ultimately the ECB considers that the euro's international position has never been as low (gauged by the average of the share of the euro in currency reserves and different types of bond trading: it has lost 3 percentage points since 2008 and was deemed at 22% in 2017.

Hence the euro has never managed to rival the dollar, including in the most strategic transactions. Jean-Claude Juncker recalled in his "Speech on the State of the Union" in September that "Europe pays for 80% of its energy import bills - worth 300 billion euro a year - in US dollars when only roughly 2% of our energy imports come from the United States." This leaves the countries vulnerable to American sanctions, as the situation in Iran has demonstrated. This is not the only reason: the countries of Europe would gain much if the euro had greater influence.

II. Why defend a wider internationalisation of the euro?

What would a euro with a higher profile in the international arena mean? Firstly, fewer transaction risks for European economic actors: if more transactions were undertaken in euro, then the foreign treasury flows of European businesses would not be so much at risk of suffering sudden changes in exchange rates. High exchange rate uncertainty can both discourage transactions, and also affect the weakest businesses' results without warning. Businesses, mainly SMEs with limited resources, would also benefit from reduced transaction costs because they would not need to convert the cost of their purchases or sales into other currencies.

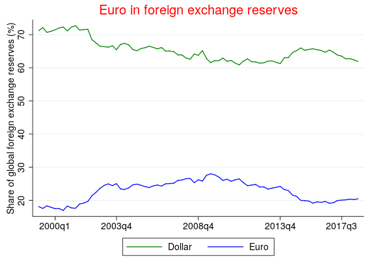

Moreover, a relatively high-ranking euro at international level would provide an even greater advantage. The domination of the dollar adds to the imbalances. Since the 1980's net investments have always been higher than net savings in the USA (graph 3). This means that American household savings are not enough to fund all of the country's activities: the remainder comes from abroad, notably via the purchase of American Treasury bills. In a world in which the dollar is a currency amongst others, such a strong demand for capital ought to lead to an increase in its remuneration (in other words, interest rates) which would encourage American households to save more. But this is not the case: due to the domination of the dollar investors accept ever declining remunerations and American households continue to consumer (notably imported products). This becomes a problem when it leads to excessive risk taking, as on the real estate market at the beginning of the 2000's.

Graph 3: Exorbitant "privilege"

Note: This graph presents the development in net investments (the difference between investment flows towards and from the USA) and net US savings (the difference between savings incoming and outgoing from the USA). The difference between net investment and net savings measures the needs of American funding from abroad. Source: Federal Reserve Economic Data.

Note: This graph presents the development in net investments (the difference between investment flows towards and from the USA) and net US savings (the difference between savings incoming and outgoing from the USA). The difference between net investment and net savings measures the needs of American funding from abroad. Source: Federal Reserve Economic Data.

This phenomenon was highlighted at an early stage by Valéry Giscard d'Estaing, whilst he was Economic and Financial Affairs Minister for General de Gaulle (1962-1966). He then mentioned the vital problem set by the "exorbitant privilege" which the dollar enjoyed. As the dollar is extremely liquid and mainly used across the world, agents prefer to purchase assets denominated in dollars, because they are more confident that they will be able to sell them easily in the future when they want to consume other products, or when they run into difficulties. The world demand for assets in dollars is therefore vast, which increases the price of these assets and reduces their yield. As a result, this colossal interest in assets in dollars guarantees Washington that there will always be stakeholders prepared to purchase debt securities in dollars. In brief the USA can remain in almost permanent debt at a very low cost, likewise American businesses and consumers. Economists Gourinchas, Rey and Govillot[8] illustrated that between 1952 and 2016 the overall yield of American assets exceeded the overall yield of American debts by 2 to 3% per year.

Hence, a more influential euro globally would be the promise of cheaper debt for both private and public players. A stronger world demand for liquidities in euro would indeed emerge via an increased demand for European private and public debt securities (because they comprise a major share of liquidities in circulation). A side effect would therefore be a reduction in their interest rates and as a result the cost of debt, to the benefit of all European players, whose fiscal constraint would then be slackened somewhat.

But for the European States there is also the issue of sovereignty. The Iranian case is symptomatic of this. American sanctions can affect any entity operating on American soil or if it is trading in dollars. Hence European banks have been threatened with sanctions because they have traded in dollars with Iranian businesses[9]. If the European Union wants to protect its economic relations with Iran it will exclusively have to use the euro in its economic relations with Iran, and more generally for its hydrocarbon imports. It is therefore the relative weakness of the euro in the international arena which exposes European businesses to sanctions.

Clearly an increased international role for the euro would go hand in hand with significant inconveniences of at least two kinds. On the one hand the increase in the volume and frequency of circulation and invoicing in euro in the world, a fortiori by stakeholders distant from the euro area, could reduce the power of control over the money stock and could render the resulting monetary policy more complex. On the other hand, the "exorbitant privilege" associated with a currency has to be set against the "exorbitant responsibility" that this implies, as indicated by Gourinchas et alii[10].Indeed, if economic stakeholders acquire assets that are reputed to be safe from a State which issues an international currency, then the latter plays the role of global insurer in the event of an economic downturn, which can go hand in hand with colossal economic transfers.

However, without denigrating them, many of Europe's leaders, who have held back for a long time regarding a decision about this, have recently expressed the opinion that the disadvantages associated with the international development of the euro were considerably subordinate to the advantages that Europe might gain from them. For example, in February 2019 the Director General for Economic and Financial Affairs at the European Commission, Mr Buti, as well as the Deputy Director, L. A. Montoya[11], maintained that to counter the possible costs of the internationalisation of the euro, the "ECB had now acquired the long-term experience necessary for monetary analysis and had developed a wide range of tools and instruments to complete an analysis of this nature." Reviewing the advantages and inconveniences, they concluded that the "advantages of a role like this are increasingly evident, whilst the initial fears of losing control over the monetary aggregates now seemed exaggerated." Although assessments like this should still be considered with great caution, it remains that these discussions show a lively interest in an international role for the euro within the European institutions.

III. What do Europe's institutions think of the euro's international role?

1. In Brussels, a question that has quickly become vital

On this issue it seems that attention regarding the international role of the euro was first drawn by various observations made by the President of the European Commission in his Speech on the State of the Union 2018. As he listed the various aspects of sovereignty, Jean-Claude Juncker focused for a while on the euro, declaring: "The euro must become the face and the instrument of a new, more sovereign Europe. [...] We must improve our ability to speak with one voice when it comes to our foreign policy"[12] The two latter sentences were not meant to be causal, although their proximity in words invites us to recognise a convergence of minds. In all events this stance laid the foundation for greater thought on the part of the Commission, the results of which were presented in December 2018.

Above all, within the EU, this means strengthening Economic and Monetary Union (EMU) and working towards deepening and making the capital markets more liquid to overcome national lines. This notably supposes the facilitation of immediate, safe payments between players in the various countries of the EU. These are all measures which together, with the ECB, form the heart of the reform of Europe's financial architecture.

Regarding the external dimension the Commission's proposals were structured rather more around a hypothetical method and suggestions than any really specific (subject to exceptions) aspects to be implemented. They notably spoke of the extension of the payment system in euro by other States or the promotion of economic diplomacy. Moreover, the Commission called for great vigilance regarding key sectors (transport, energy etc ...), in which the euro does not have a high profile. On this last point, recommendations, notably comprised the promotion of the use of the euro in energy transactions between Member States and third States or in market relations between European businesses.

These initial suggestions especially gave rise to consultations, as of January 2019, which are still ongoing, regarding the role of the euro in the liquidity of trading markets, in the area of energy, non-energy and non-agricultural raw materials, transport and in the international trade of agricultural products and basic foodstuffs. Hence, we shall have to wait a few more months to know the results of these still imprecise consultations which have led to the launch of real debate.

2. In Frankfurt, the start of interest which does not challenge independence in any way.

Since the Commission is a political institution, it was understandable that it would be the first to seize the difficult question of the internationalisation of the euro. However, in virtue of the total independence of the political choices that form its main role, we might think that the ECB would not be interested in this issue, which goes beyond its "main goal" [...] of maintaining price stability"[13]. And yet in view of the international role of the euro, the ECB's position seems to have developed.

Initially Frankfurt deemed that the internationalisation of the euro was the result of market forces and that due to its independence, it did not "intend to encourage or impede the development of the euro as an international currency"[14]. The consequence of the ECB's actions could only therefore be indirect, a guarantee of stability with the international community. When the members of the ECB, like L. Papademos in 2008[15] or B. Cœuré in 2015[16], spoke of the euro's international role, they only took into consideration primarily commercial and financial motivations.

However as explained in a recent article in the Grand Continent[17], the ECB's recent declarations bear witness to a change in the institution's line of thought. The first of these being the speech by Mr Draghi in January 2019[18], when the present President of the ECB showed strong attachment to the creation of strong "European sovereignty". A skilful way of speaking of aspects that go beyond the simple question of price stability. Draghi is not challenging the independence of the ECB, but shows that he supports developments in this direction at the Commission.

During a recent speech in February 2019[19], Benoît Cœuré, member of the Board, took the floor to speak on this vital issue. For the first time since its creation an eminent member of the Frankfurt institution recognised the existence of non-economic factors in the assertion of an international currency: the internationalisation of the euro would not just be the result of market forces, even if this component clearly remained. Cœuré spoke of work by economists Eichengreen, Mehl and Chitu, who maintain that geopolitical alliances with major countries are pushing the smallest foreign States to acquire more currency from the dominant States. Cœuré then pointed to the weaknesses of European Defence in this regard and concluded on the effects that the euro's increasing international role might have on how monetary policy is implemented, questions which go beyond the framework of this paper.

IV. What links are there between the euro and geopolitics?

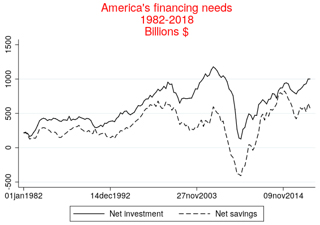

In a recent article, the first version of which was published in 2017, called "Mars or Mercury? The Geopolitics of International Currency Choice" Eichengreen, Mehl and Chitu[20]", offer readers a unique analysis, based on the Roman gods, Mars and Mercury. They explain that by focusing too much on trade and finance, of which Mercury is the avatar, we struggle to understand what defines the international dimension of a currency. However, by turning attention to diplomacy, war and geopolitics, therefore to Mars, the international monetary system becomes much more intelligible. Eichengreen, Mehl and Chitu test their hypotheses on the period preceding the First World War using data gathered by Lindert published in an article in 1976[21]. At the time there was no dominant currency, but a series of rival global currencies: the pound sterling, the French franc the German mark, followed by the American dollar and the Dutch guilder.

They note that the credibility of a State, and the structure of commercial transactions (by way of a common border or colonial possessions) are positively correlated with the share of its currency in the exchange reserves of other States. But it is only by integrating several geopolitical aspects (defence pact non-aggression treaty, neutrality or entente) that we can see the composition of the exchange reserves as a whole. Hence the existence of a geopolitical or military alliance increases the share of the currency of the allied State in the exchange reserves by around 30 percentage points.

Graph 4: Pecuniary and Geopolitical Motives

Note : Graph adapted from Eichengreen et al. (2017). It indicates the share of this currency in the currency reserves of a selection of countries and currencies before the First World War (black). This share is compared to that estimated when we only consider the pecuniary motives (light grey) and pecuniary motives plus military alliances (dark grey).

Note : Graph adapted from Eichengreen et al. (2017). It indicates the share of this currency in the currency reserves of a selection of countries and currencies before the First World War (black). This share is compared to that estimated when we only consider the pecuniary motives (light grey) and pecuniary motives plus military alliances (dark grey).

Currency geopolitics certainly exists beyond finance and trade. Eichengreen, Mehl and Chitu explain for example that the rise in the share of the German mark in the reserves of Austria-Hungary was concomitant with the signature of the Triple Alliance in 1882, whilst the massive use of the franc by the Russians was a result of the Franco-Russian alliance in 1894.

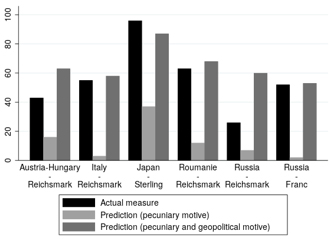

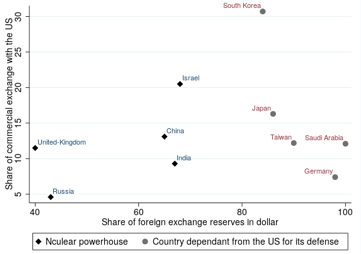

This geopolitical influence on currency is still topical, despite a more financialised, globalised economy. The domination of the dollar today is strongly linked to Mars. According to some rare accessible data more than 80% of the exchange reserves of States like Japan, Taiwan, Saudi Arabia and Germany, which are highly dependent on the USA for their security, are in dollars. However, Russia and the UK, which have the nuclear weapon barely have 40%. Eichengreen, Mehl and Chitu, deem that if the USA withdrew its military support from their allies, the share of the dollar in the reserves of these States would decline by 33 points.

Graph 5: Place of the dollar and nuclear power

Note : Graph adapted from Eichengreen et al. (2017). It compares the public estimates for a selection of countries of the share of the USA in bilateral transactions (ordinate axis) with the share of currency reserves in dollars (abscissa axis). The countries with the nuclear arm are marked by a black lozenge and those which depend on the USA for their defence by a grey point.

Note : Graph adapted from Eichengreen et al. (2017). It compares the public estimates for a selection of countries of the share of the USA in bilateral transactions (ordinate axis) with the share of currency reserves in dollars (abscissa axis). The countries with the nuclear arm are marked by a black lozenge and those which depend on the USA for their defence by a grey point.

International monetary issues must therefore be considered in the light of geopolitics. The dissemination of a currency also depends on the diplomatic and military weight of the issuing State. On the one hand, to the extent that the security and stability of a country depend in part on its monetary stability, the States should accumulate currency reserves denominated it the currencies of the most powerful States. On the other hand, in exchange for their security the latter can take advantage of the situation to demand greater financial resources of the weakest States from a military and diplomatic point of view. The financial centres of the most powerful States clearly benefit from this quid pro quo: London yesterday, New York today.

In the light of this work, the euro is noticeable for its geopolitical weakness. Indeed, the geopolitical, strategic and military tools that the Europe has are scant. Europe's defence projects will be long in coming, despite the launch in 2017 of the Permanent Cooperation Structure (PESCO), whose aim it is to promote European collaboration in the area of defence. And moreover, there is no need for a European army, and even less European nuclear weapons. Finally, Europeans often struggle to form a united geopolitical front. Over the last ten years, this has been divided on several occasions: over Libya, Syria and Ukraine etc...

Reading Eichengreen et al. reveals in fact that one of the euro's problems is that of its credibility: the economic credibility of the euro is strong, but its geopolitical credibility is not (that of the countries it represents). Without stronger credibility, the euro will only ever be second. Happily, there are some action-levers to hand.

V. In support of fresh political impetus fostering the international role of the euro

Of course there is a wealth of specific technical and institutional measures that would help to spread the euro beyond the Mediterranean and the Urals, which form the heart of joint action on the part of the Commission and the ECB today and which include, according to degrees of progress and the courage of the leaders, the strengthening of banking and financial union, the dissemination of secure European assets or even the improvement of a payment system in euro (the new Target II system). Slight changes in the ECB's attitude that we have seen in support of the issue will also foster a role like this, aiming firstly to reassure and host investors mobilising the single currency.

But above all, there are political measures that might be used to strengthen the euro's internationalisation, which are mainly independent of developments in the European financial architecture and which involve Europe and its relations with the outside world.

Firstly, trade agreements signed between the EU and regions or third States would benefit from the inclusion of clauses fostering and even imposing the use of the euro in relations that govern them. These major agreements, for example the one signed with Japan in December .2017[22], define trade and also strategic relations if necessary, between the Union and other States, and not specifically between businesses. Hence these are mainly agreements that cannot be replaced - since the State that wants to trade with the EU for certain reasons is not in the same situation as a business, which faces many potentially competing trade partners. It is therefore possible to include terms that favour the EU's position, with a reduced risk of a more accommodating competitor winning the contract. The European Parliament notably has its word to say during negotiations of this type. From this point of view, the Commission drew up similar ideas in December, but did not mention bilateral relations between Member States and third countries. More generally it is therefore the entire EU which would benefit from the inclusion of the requirement to use the euro in these agreements.

But there is more. In the light of recent economic work that we have quoted, it seems primordial to include in European democracy as it stands today, the goal of spreading the world use of the euro, whilst working to increase diplomatic positions themselves. Indeed, the EU has 139 relays comprising the European External Action Service (EEAS), which aim to promote European values and interests. Amongst these the promotion of the use of the euro might become an inescapable factor. On the one hand, it might mean drafting a communication strategy to show organisations and third States the advantages of that they might have in using the euro rather than the dollar within the multipolar monetary system: lesser dependence on the American monetary policy, reduced submission to decisions taken by the American government (particularly sanctions), the possibility of arbitration between two monetary zones (Europe and the USA) in the event of tension, reduced financing of the American policy in virtue of a reduced potential of the "exorbitant privilege". On the other hand, it would mean including the defence of transactions in euros, in the goals of the partnership instrument (PI), an EEAS tool, which enables the EU to cooperate with international partners.

***

These two factors might comprise the first foundation stones of a European diplomacy that is ready to spread the euro beyond Europe. These measures are obviously indissociable from the strengthening of the stability and the credibility of the European financial system, but they operate from another much more (geo)political perspective. The strengthening of European geopolitical power would therefore be an effective, vigorous means to provide Europe with the confidence it needs in the face of foreign stakeholders, in its stability and its durability.

Beyond these first steps, it is consequently the promise of greater European diplomacy, of Europe's ability to guarantee its own security and that of other regional or State players, of its determination to coordinate different visions to speak with one voice, which would be the main catalyst in the development of the euro's international role. Hence it is indeed a question of sovereignty, which calls for both the will of political actors and the strengthening of the institutions.

[1] Germany, Austria, Belgium, Cyprus, Spain, Estonia, Finland, France, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia and Slovenia.

[2] European Central Bank, The international role of the euro, June 2018.

[3] R. Mundell (2000) "The Euro and the Stability of the International Monetary System" in R. Mundell, Clesse A. (eds) The Euro as a Stabilizer in the International Economic System, Springer, Boston, MA.

[4] F. E. Kydland and E. C. Prescott, "Rules Rather than Discretion: The Inconsistency of Optimal Plans", Journal of Political Economy Vol. 85, No. 3 (June., 1977), pp. 473-492.

[5] K. Rogoff, "The Optimal Degree of Commitment to an Intermediate Monetary Target", The Quarterly Journal of Economics, Volume 100, Issue 4, 1 November 1985, pp. 1169–1189.

[6] B. Benoit, "Germany sees an end to US Hegemony", Financial Times, 6th September 2008.

[7] L. Phillips, "US Laissez-Faire to Battle European 'Social Market' at G20", EUobserver, 14th November 2008.

[8] P.-O. Gourinchas, N. Govillot, H. Rey, 2017, "Exorbitant Privilege and Exorbitant Duty", National Bureau of Economic Research

[9] Pour avoir plus de précisions, se rapporter au rapport de l'Assemblée Nationale n°4082 sur l'extraterritorialité du droit américain.

[10] Ibid.

[11] M. Buti & L. A. Montoya, 1st February 2019, "The euro: From monetary independence to monetary sovereignty", VoxEU

[12] J.-C. Juncker, Speech on the State of the Union 2018, 12th September 2018

[13] Protocol on the Statute of the System of the European Central Banks and the European Central Bank chapter II, article 2.

[14] Dr. W. F. Duisenberg (ECB President.), The euro: the new European currency, Speech delivered to the Council of Foreign Relations, Chicago, 1st February 1999.

[15] L. Papademos (ECB Vice-President), The international role of the euro: trends, determinants and prospects, Speech at the Economic Forum Brussels, Brussels, 15th May 2008.

[16] B. Coeuré (Member of the ECB's Board.), The international role of the euro: concepts, empirics and prospects, Speech at the University of Saint-Joseph, Beirut, 2nd October 2015.

[17] O. Lenoir, "Francfort-sur-le-Monde", Le Grand Continent, 3rd March 2019

[18] M. Draghi (President of the ECB), Introductory speech to the hearing with the Economic and Monetary Affairs Committee of the European Parliament (ECON), Brussels, 28th January 2019.

[19] B. Cœuré (Member of the ECB Board.), The euro's global role in a changing world: a monetary policy perspective, Discours Au Council On Foreign Relations, New York City, 15rh February 2019.

[20] B. Eichengreen, A. J. Mehl and L. Chitu, 2017. Mars or Mercury? The geopolitics of international currency choice (No. w24145). National Bureau of Economic Research.

[21] P. H. Lindert, The Payments Impact of Foreign Investment Controls: Reply, Volume 5, Issue 5, 1976

[22] Important documents communicated to the press are accessible on the Commission's dedicated page

Publishing Director : Pascale Joannin

To go further

Gender equality

Fondation Robert Schuman

—

23 December 2025

Businesses in Europe

Olivier Perquel

—

16 December 2025

Digital and technologies

Josef Aschbacher

—

9 December 2025

Democracy and citizenship

Florent Menegaux

—

2 December 2025

The Letter

Schuman

European news of the week

Unique in its genre, with its 200,000 subscribers and its editions in 6 languages (French, English, German, Spanish, Polish and Ukrainian), it has brought to you, for 15 years, a summary of European news, more needed now than ever

Versions :