The euro, "this wretch, this mangy brute, the source of all misfortune"

supplement

Jean-Paul Betbeze

-

Available versions :

EN

Jean-Paul Betbeze

Economist, Member of the Scientific Committee of the Robert Schuman Foundation

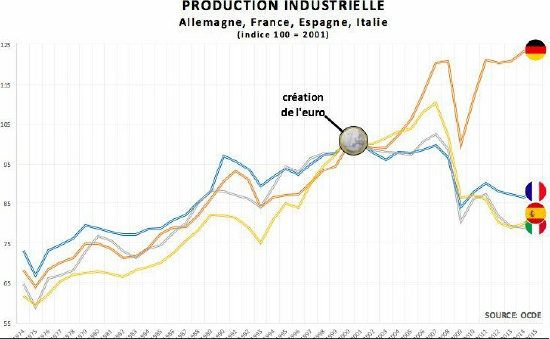

We recognise the donkey in the "Animals sick of the pest": the source of the virus according to La Fontaine. The graph presented by Marine Le Pen during the debate between the five candidates on TF1 on 20th March 2017 illustrates a modern donkey - the euro - the source of Europe's ills. The graph could/intends to show a link of cause and effect between the euro and the deindustrialisation of the euro zone's major economies, namely France, Italy and Spain, except for Germany, which benefited from it. This very simple approach deserves some... credit since it allows us to comment and criticise. Here are five observations.

1 - To say the least the graph linking the euro to industry output offers a limited view.

Indeed it does not cover industrial production in the UK, the USA or even China, which have all suffered the same fate - euro or not. Everywhere across the world industry output indexes have declined in the major economies with Germany being an exception since alone it has managed to maintain the share of industry in its GDP.

In fact we are witnessing a triple phenomenon: continued world growth - at a slower pace (the low point of 3% in the third quarter of 2016, is behind us), together with the spread of industrial activity in the emerging countries and also the industrialisation of services. Increasingly jobs in services are indeed benefiting from industrial innovation to organise and optimise their activities, and even host ones that were previously industrial. The 3D printer will soon be found in garages and repair shops, when dentists will use it to make prosthesis in their practices. To print a specific book high speed photocopying machines can now be found in some bookshops and that is only the beginning. At the same time the nature of industry is changing as it turns more to the services. Increasingly qualified workers, growing numbers of local or in-factory programmers, quality and wear and tear control, break-down risk detection, etc., industries are hosting service oriented, adapted activities and barriers are falling.

To understand these events and what growth will comprise tomorrow we have to adopt a wider vision than that given by traditional statistics (via historic and therefore date specific developments) and integrate businesses new strategic choices. Industry and services are changing the world over, chains of value are constantly modifying. And so it is not just the euro that is at issue here - we should think even less that we can settle everything by leaving it.

2 - It is not "Germany's fault".

Ultimately Germany interpreted the rules of the monetary economy game well, and these apply in any monetary economy. On the one hand internal devaluation is impossible (it is not possible to devaluate the "euro in the south" in terms of the "euro in the north", any more than it was possible to do so for the "rural Franc" in terms of the "urban Franc"). On the other hand, a currency polarises wealth between the most competitive locations and businesses to the detriment of others in the area where it is accepted. We must not forget that Germany started off badly in that game, with a trade deficit of around 2% of the GDP from 1970 to 1992, before reaching balance as of 1993, with a surplus rising to 6% of the GDP in 2016. To understand this turn-around, from a slippery path that was affecting German growth, employment and the satisfaction of the Maastricht criteria, we have to ask what happened in Germany to understand how a virtuous circle was born there prior to the euro, which then benefited from its support.

The strategic German choice of salary moderation underpinned by an adapted social, union and productive structure, came from Chancellor Gerhard Schröder. In 1997 the latter declared: "I do hope that France will decide to move over to the 35 hour week at a constant salary. It will be good for German industry!" Concerned about rising unemployment, Schröder presented the Bundestag with a series of reforms, the so-called "Agenda 2010" on 14th March 2003, during his second term in office, for the restoration of German competitiveness thanks to a liberalisation of the labour market, to a reduction in social benefits and retirement reform. These were the famous Hartz laws, against which initially there was a great deal of opposition, but which were finally accepted in Germany. We remember for example the almost inquisitorial measures that were used to force the unemployed to find a job, with income reductions and the so-called "mini-jobs". Long term these measures helped to reduce unemployment and organise wage moderation in Germany, with the cost of electoral collapse for Gerhard Schröder and the entry of Angela Merkel, who reaped the benefits of his policy. We are not dealing with wage devaluation here: it was the German correction of an internal excess in wages costs in its exposed sector, well before the major crisis of 2008.

However we cannot say either that this was the mechanical consequence of the trend towards the single market and the free movement of capital. No more than it is of Germany benefiting from a world investment cycle initiated by China. Nothing is automatic. The success of Germany's car production and also of its machine-tools and chemical industry, comes in fact from the constant strengthening of its big SME's (Mittelstand), of their profitability (stronger than France) with the enhancement of their own funds thanks to employee capital participation, in short the conditions of German social debate (Mitbestimmung). Hence, a virtuous circle has worked - it is productive (investment and constant improvement of quality), financial and social, based on the initial correction of a policy.

Of course the euro helped, firstly via interest rates, which were low on average and foreseeable, and exchange rates helped even more. Indeed although Germany entered the virtuous circle of growth via exports, by compressing its demand, it witnessed a rise in its trade surplus. If a euro-Mark existed it would rise making the progress and then the upkeep of German surpluses more difficult. Symmetrically the euro-Franc would decline given the French trade deficits. But in the euro area only the net balance emerges. It is significant, therefore the euro is strong, but this surplus is exclusively German, reduced by the deficits of the others. Therefore, the euro might be considered as under-valued by 20% in relation to Germany[1] and over-valued by 7% in relation to France.

The German virtuous circle has therefore become vicious for the others. The trade deficits of some function with the surplus that has become excessive in Germany, without it being easy to sanction the latter, in view of the errors of some and the reforms that others, including France, have not done ! In the European texts there are 10 "macro-economic imbalances" (five internal and five external) including a current account deficit below 4% and a surplus over 6% (Scoreboard for the surveillance of macroeconomic imbalances). This means reducing balances to move along a more stable, common path. We should therefore add that this does not mean asking for sanctions against Germany, since excesses lead to warnings and are part of budgetary discussions between the 19 euro area members about the ways and means to gradually reduce that internal imbalances. Both are on the German and French sides - but where should we begin?

To speak of German neo-mercantilism as Xavier Timbeau[2] does, means that we are forgetting the source of the excesses and the recent corrective dynamic on-going in Germany: wage increases in the services industry, reception of migrants, increases in Germany's defence spending, not to mention that this extremely specific industrial specialisation is risky. We witnessed this in the recession of 2008, far more severe in Germany than in France, this being mainly managed by employees and businesses and less by the public debt (unlike in France). We can see this also by the Chinese purchases of German industrial "pearls". We might add that this Germany is not consuming enough and saving too much (this is an accounting fact) and is also one that is not investing enough in infrastructures (according to many of the country's experts). But when it does so and it is now underway, we shall not criticise it for the additional competitiveness that it will gain!

3 - It is not the fault of Brussels or the ECB ...

Hence the euro area is not "an optimal monetary area" - as we read everywhere (which is true of all of them) and its creation is clearly a "political act" - as with any decision regarding monetary establishment. The polarisation of situations that is occurring at present to the benefit of Germany was also caused by the collapse of the Spanish real estate bubble, the inflation of Greek and Portuguese government personnel, inadequate banking supervision across the board, weak sanctions against excessive deficits (since France and Germany in 2003). A monetary zone cannot rely on a common currency, without strong supervision of the establishment of its national accounts, without the bold monitoring of the banks and the launching of a bank guarantee fund, without well-equipped regional and industrial policies and without a significant central budget. All of these deficiencies and failings, on the very creation of the euro, were limits set in the name of everyone's sovereignty and accountability. A miscalculation: in many areas sovereignty must be shared in a monetary zone, so as to be globally enhanced.

Hence Brussels manages a budget that is around 1% of the Union's GDP, whilst 5% would be necessary; it is a budget that is mainly linked to the CAP (three quarters) and for the rest, to policies of the past. "Brussels" therefore makes "remarks" and "criticises" but it does not have the budgetary means - not to sanction - but to promote its choices. This is why it is so badly criticised by the States, who for their part have reduced its ability to act!

As for the ECB, the only true federal entity in the system, it has recently been given the possibility of monitoring the banks and to publish its remarks (or most of them) about the latter, and, via its low rate policy it has enabled a reduction in the appreciation of the euro, the consolidation of the banks and the stimulation of credit again. Without exaggerating either, the ECB has reduced real rates and revenues, thereby attenuating what has been called "austerity" in Spain, Portugal and Greece - in fact the "over indebtedness" of the countries. It has done its utmost "within its remit", by extending its goal of price stability to around 2%.

Above all we cannot ignore the fact that the euro area is sub-optimal because it is incomplete. Hence, given the excessive deficits of the countries in the south with the major crisis and at the risk of the explosion of their banking systems, nothing had been planned to organise solidarity between States, and even less so by the euro area itself. Innovation and progress was called for and the budgetary and monetary solidarity measures stood the test in spite of everything.

To move forward, given the fact that the recovery now underway might further worsen disparities and entrenched mass unemployment (source of populism), we have to go further. Some have announced the collapse of the euro area (due to economic reasons like Joseph Stiglitz) or seem to want it (populism, Trump, Russia)? In reality the race between problems and solutions, more or less complete (as always) must lead to more courageous choices. The ECB will have to raise its short-term rates at some time or another, the long-term rates will rise, Germany's de facto caution of the financial systems of other countries cannot last forever, all the more so if tension rises in Germany. The "budget and treasury" pillar of Europe will become vital - it must be strengthened. The "research and innovation" pillar of Europe has to be consolidated, by strengthening the Juncker Plan. The "European Defence" pillar has to be created.

These are the three pillars that are missing from Europe at present. They are just rocking the boat, in the midst of a technological revolution that is threatening everyone's industrial and services choices (Germany first and foremost), but also the international policy of the zone at a time when the USA is the cause of concern and when security on the borders is a constant source of problems.

4 - French choices are now paying off ...

But it would be wrong to continue this biased trial against the euro and the others, ourselves excepted of course, without noting that some of our choices are finally paying off. France's market share in world goods exports in 2015 stabilised at around 3.1%, whilst it had been declining until 2012. France's market share in goods is said to have reached 3.3% in the first half of 2016. This stabilisation can be found in the volumes, which shows that it is not a question of valuation, linked to the exchange rate, but an improvement in French competitiveness over the last few years. Germany and the UK achieved 8.1% and 2.8% of world goods exports in 2015 and continue to make progress, but Germany has not recovered its pre-crisis level. The world has changed - even for the best amongst us.

Other sources confirm this nascent improvement. In the opinion of the UNCTAD[3], whilst the EU recorded a decline in FDI inflows of 18% in 2016, France experienced growth of around 5%, to a total of 46 billion $. France is one of the top 10 countries in terms of the reception of FDI flows totalling 46 billion $ against 179 for the UK and as much for the Netherlands. Other evidence according to Trendeo, suggests that over the last six months the French economy has "created" more factories than it has destroyed.

The explanation of this improvement is that the German solution is "working", in France too, but that time will be necessary. The tax break on competitiveness and employment (CICE) has enabled a slowing in labour costs and an improvement in France's cost/competitiveness in terms of its main European competitors. From the fourth quarter of 2012 to the first quarter of 2016 labour costs grew at a slower pace here than the average in the euro zone in industry (the building industry apart) (+ 4.2% in France against + 5.8% in the zone area). Over three years, 2002-2005, the nominal hourly labour cost increased by 4.9% in Germany and by 2.1% in France.

The euro area takes no quarter for strategic errors, those we thought we might catch up on with devaluations. France was working a 35 hour week whilst Germany was launching the Hartz bills (to correct its own errors), it was increasing its wages whilst it was losing in terms of competitiveness, it was falling into debt and increasing its administrative staff in support of employment. Now, with the CICE wage moderation (one "boost for the SMIC" at the beginning of François Hollande's five year term in office), as well as support to innovation and competiveness hubs, and the ECB's rates, a resilient banking and financial system, France is doing better but it is lagging behind and progress is slow.

5 - and if only we might continue on this path ...

The euro reflects the zone's cohesion. Each country has to adhere to the euro area's stabilisation via the reduction of differences in government deficit and especially in terms of competitiveness between its members. It is not the euro that is an incomplete currency, but rather the euro area. We might always say that it is not optimal: it is amiable. But today it has become dangerous and must not just be patched up, but completed. The Single Currency of course means a relinquishment of sovereignty but it also means moving towards more sovereignty in an ever wider economic and social entity, more powerful in a harder world. The euro is a means and especially a sign to complete and strengthen, to stop blaming others, especially Germany.

It is in this context that we should be worried about those who suggest we should leave the euro area or others who plan to increase the SMIC or even use part of the CICE to other ends other than the restoration of competitiveness, whilst it is already widely used for internal services in support of low wages.

Austerity is not the solution but wage moderation with social negotiation, participation in results, additional pensions and more training - to win in this changing world.The euro cannot do everything but it helps. However we cannot behave as if it did not exist.

[1] : 20% according to the Independant Annual Growth Survey, 5th report 2017 and Gregory Claeys, Debunking 5 myths about Exit, Bruegel, 2017

[2] : " L'Euro tueur d'industries en série ? Ce que révèle vraiment la graphique brandi par Marine Le Pen pendant le Grand Débat ", Atlantico, 22nd March 2017

[3] : Global Investment Monitor n°25

Publishing Director : Pascale Joannin

To go further

Gender equality

Fondation Robert Schuman

—

23 December 2025

Businesses in Europe

Olivier Perquel

—

16 December 2025

Digital and technologies

Josef Aschbacher

—

9 December 2025

Democracy and citizenship

Florent Menegaux

—

2 December 2025

The Letter

Schuman

European news of the week

Unique in its genre, with its 200,000 subscribers and its editions in 6 languages (French, English, German, Spanish, Polish and Ukrainian), it has brought to you, for 15 years, a summary of European news, more needed now than ever

Versions :