Economic and Monetary Union

Sébastien Richard

-

Available versions :

EN

Sébastien Richard

One year after its Latvian neighbour Lithuania will become the 19th member of the euro zone on 1st January 2915. An EU Member State since 2004, Lithuania first asked to join the Economic and Monetary Union in 2006. The Lithuanian authorities deemed that the euro would strengthen the country's political weight within the European Union. The single currency is also considered as a new buffer in protection against the country's powerful neighbour, Russia. However problems in controlling inflation then the impact of the economic and financial crisis of 2008 deferred the prospect of accession since the country no longer fulfilled the convergence criteria.

The economic impact of joining the European Union

The prospect of joining the European Union and then effective accession in 2004 carried the country's economic growth along until 2008. The receipt of European funds was one of the reasons for the Lithuanian economic boom. However it was not the only one. Lithuania's integration into the single market especially enabled it to assert its own assets:

· The competitiveness of its labour force;

· An advantageous tax regime like its Latvian neighbour. Corporate tax lies at 15% and is set at 5% on SMEs;

· Its geographic position, which enhances the attraction of a country, which to date was considered as a transit area between the continent's east and the European Union. In this capacity Klaipeda is a leading interface with Russia. The Lithuanians are also the leading foreign investors in the Russian enclave of Kaliningrad.

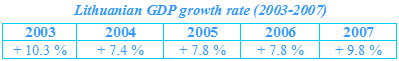

Hence Lithuania was able to achieve some remarkable growth rates, reaching nearly 10% in 2007 just before the world economic and financial crisis started.

(Source : Eurostat)

(Source : Eurostat)

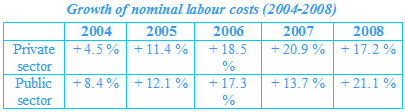

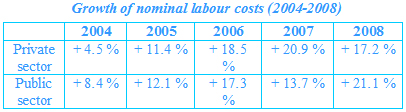

This significant rise in activity was not without effect on the development of wages, both in the private and public sectors. The increase in nominal wages was constant between 2004 and 2008. Again accession to the European Union played a role in terms of this increase. Here it involved limiting Lithuanian emigration, which was facilitated by the opening of the borders to other EU countries in the same way as it had affected Ireland. The increase in the minimum salary during this period was clearly part of this goal. Fear of losing the labour force also led to a change in paradigm in terms of wage negotiation: collective, sectoral negotiations gave way to individualised dialogue that moved in support of wage increases. The rises granted in the public sector also became a reference for the private sector.

(Source : French Senate)[1]

(Source : French Senate)[1]

The impact of developments in wages was twofold: a certain disconnection between remuneration and productivity that affected the country's attractiveness and its competitiveness and in increase in inflation. It was in the light of the latter criterion that Lithuania's bid to join the Economic and Monetary Union was rejected in 2006.

(Source : Eurostat)

(Source : Eurostat)

Failure in 2006 and the issue of inflation

It should first be remembered that the adoption of the single currency is the logical goal for any EU Member State, except if it benefits from an exemption clause, like Denmark and the UK. Membership of the Economic and Monetary Union by a candidate country would appear self-evident once the convergence criteria are respected.

Article 140 of the Treaty on the Functioning of the European Union defines four criteria that are to be respected in view of joining the euro zone, which are stipulated in Protocol 13 regarding the convergence criteria annexed to the Treaty:

· the achievement of a high degree of price stability; the rate of inflation cannot be over 1.5% of the three best performing Member States in terms of price stability;

· the sustainability of the government financial position; the Member States cannot be the focus of an excessive deficit procedure, i.e. if the State has a public deficit over 3% of the GDP or its debt is over 60% of the GDP;

· the observance of the normal fluctuation margins provided for by the exchange-rate mechanism of the European Monetary System, for at least two years, without devaluing against the euro,

· the durability of convergence achieved by the Member State with a derogation and of its participation in the exchange-rate mechanism being reflected in the long-term interest-rate levels: this cannot rise over the average of the three countries selected for the calculation of increased inflation of 2%.

Article 140 of the Treaty also provides that the Commission and European Central Banks' reports, which are used to take decisions at the European Parliament and the Council regarding a candidate, have to take on board other pertinent factors, such as the development of wage costs, development of the balance of payments and market integration..

Regarding Lithuania the European Commission issued a negative opinion on 16th May 2006 insisting on the fact that inflation was not under control[2].Although the government deficit was not over 0.5% of the GDP and the government debt 20% of the national wealth, inflation totalled 3.8% at the time of assessment. This opinion was followed by the European Council on 15th and 16th June 2006.

The European Commission was concerned about a worsening in the situation due to the increase in wages and the ensuing rise in domestic demand as well as rising energy prices in a context of recurrent tension with Russia from whom Lithuania imports, gas, oil and electricity. Like its other Baltic neighbours Lithuania is still an enclave from an energy point of view: because it is not connected to European networks, energy supplies depend as a consequence almost exclusively on Russian oil and gas pipelines. Moreover Lithuania is connected to the Russian electricity grid (UPS). This dependency affects inflation. In Lithuania the latter is still imported to a certain degree since it is related to the prices of agricultural raw materials and especially to energy. 16% of Lithuanian household income is devoted to heating costs.

Response to the crisis for the country to be able to join the euro zone

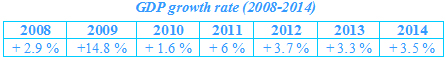

Overheating that was evident in 2008 made the economic crisis that struck the country at this time even more acute. The economic slowing seen within the countries on which it was economically dependent - Germany, Russia, Sweden - plunged the country into a rapid, brutal recession like that witnessed in neighbouring Latvia. After increasing by 2.9% in 2008, the GDP contracted by 14.7% the following year. An increase in unemployment went hand in hand with this sudden downturn. Unemployment lay at 4.3% in 2007 but in 2010 it totalled 17.8%. The downturn in the economic situation affected government accounts directly. The Lithuanian government deficit totalled 9.4% of the GDP in 2009 and 8% the following year. An excessive deficit procedure was then launched against the country.

Unlike Latvia, which at the same time also faced a major bank crisis, Lithuania refused international financial assistance[3]. Whilst it maintained its aim of joining the euro zone rapidly it chose not to devaluate its currency, the litas. A currency depreciation would have weakened the respect of the exchange rate stability criteria. The Lithuanian authorities maintained parity with the single currency - 3.4528 litas for 1€ - and gave preference to internal devaluation. This involved a combination of significant reductions in government spending, tax hikes, an improvement in competitiveness and support to export companies. Hence Lithuania was able to respect two other convergence criteria: the sustainable nature of the government's financial position and the achievement of a high degree of price stability.

The respect of the first criterion was enabled by a reduction in civil servants' wages - ranging from 5 to 45% - depending on the post occupied. Symbolically the President of the Republic reduced his salary by 45%, his ministers by 40%. A similar rate was retained for the civil service directors. Teachers' wages were reduced by 5%, State pensions were cut by 15%. At the same time VAT was increased by 3 points and a certain number of excise duties were reassessed. It is not surprising that in these conditions the government deficit was reduced to 3.2% of the GDP in 2012 and then to 2.1% in 2013. The same level was expected at the end of the 2014 financial year. The excessive deficit procedure was lifted on 21st July 2013. Although the debt has practically doubled since 2006 it still lies at 39.4% of the GDP, below the threshold set by the Treaty.

A 20% adjustment in wage reductions in the private sector, together with a vast reform of the labour market to align salaries with competitiveness helped moderate inflation. Hence, during the period of reference, selected by the European Commission to assess Lithuania's bid to join the euro zone, i.e. May 2013 to April 2014, the average inflation rate in Lithuania lay at 0.6%. This is below the reference rate selected by the Commission for the period: 1.7%.

Beyond the respect of the two convergence criteria internal devaluation enabled the country to recover growth sustainably, which was boosted in part by exports. It should rise to 3.5% at the end of 2014, in other words to a level equivalent to that recorded in 2013. Unemployment also decreased to 11.3% in 2013. It is estimated at 10.8%, below the EU average (11.7%).

(Source : Eurostat)

(Source : Eurostat)

The return of growth also fostered a decrease in long term interest rates. This reduction was vital for the assessment of the last criteria in the Treaty, the sustainable nature of convergence reflected by interest rates. Whilst it was close to 15% at the height of the crisis the 10 year rate progressively dropped to 5.2% in 2012, then to 3.6% in 2014. The rate is below the reference value established by the European Commission - 6.2% - in the convergence report. Easing like this in the rate allowed the Lithuanian authorities to refinance its debt at an acceptable level in 2013, the year when it had to borrow 2.2 billion € on the markets, around 7% of the GDP.

Since Lithuania has respected the four criteria the European Commission gave a positive opinion to the request to join the euro zone on 4th June 2014[4]. The Council approved this request on 23rd July last. Membership on January 1st 2015 will not obscure the reticence of the European Central Bank about the control of inflation. Indeed in its convergence report, published on 2nd June 2014 it notes that increases in world food and energy prices is leading to rising inflation rates[5]. The energy issue is not without consequence given the Russian/Ukrainian crisis and Russian response to the sanctions implemented by the European Union. More generally the problem of sanctions, which Lithuania supports, raises questions about the long term for a country that is economically dependent on Russia. The support provided by the Lithuanian authorities to the countries in the Eastern Partnership - Ukraine, Moldova, Georgia, Armenia, which led to the organisation of the summit of 28th and 29th November 2013 in Vilnius, already led to retaliatory measures on the part of Moscow. This involved the transit of Lithuanian lorries over the Russian borders into the Kaliningrad enclave or the sale of Lithuanian dairy products on the Russian market.

The catching-up process caused by accession to the euro zone might also lead to a rise in the inflation rate. Indeed we should remember that GDP/capita levels, prices and wages are below those seen in the Economic and Monetary Union. Hence whilst inflation is due to lie at 1% at the end of 2014 it may almost double to total 1.8% in 2015. In this case it is not surprising that 48% of Lithuanians are still against adopting the euro, which in their opinion is synonymous to price increases.

The European Central Bank's new governance rules

The reform of the Council of Governors

The accession of a new member to the euro zone also means a change to the way the European Central Bank and more precisely, the Council of Governors, its decision making body are governed. Indeed the latter defines the euro zone's monetary policy and takes decisions about leading interest rates, reserve supplies and the definition of monetary goals.

The Council of Governors meets twice monthly and comprises:

· Six members of the Bank's board (president, vice-president and four members). They are appointed by the Council of the European Union according to their authority and their experience;

· The Governors of the Central Banks of the Member States of the Economic and Monetary Union, whose number will total 19 with the entry of Lithuania.

It takes decisions by a simple majority, with the ECB President's vote being preponderant in the event of an equal outcome. Only so-called patrimonial decisions, whether these involve an increase in the Bank's capital or the use of exchange reserves, are taken with a two-third majority of the governors. The board does not take part in this vote. The votes of each of the Central Banks are, in this event, weighted according to the countries' participation in the ECB's capital.

This mode of governance has been in place since 1992 via protocol 4 in the statutes of the European Central Banks system and of the ECB annexed to the Maastricht Treaty. It seemed to be the best adapted to an Economic and Monetary Union comprising a maximum of fifteen members. The enlargement of the European Union and the perspective of a concomitant widening of the euro zone led the Council of the European Union to put forward a revision of this system. The aim is to avoid the over-representation of the governors of the national Central Banks to the detriment of the board when monetary policy measures are being adopted. When the euro zone only comprised 12 members the decision taken by the Council of the European Union on 21st March 2003 changed the voting regime within the Council of Governors, thereby introducing a rotation system. This became effective when there were 16 members of the Economic and Monetary Union. It only involves monetary policy decisions.

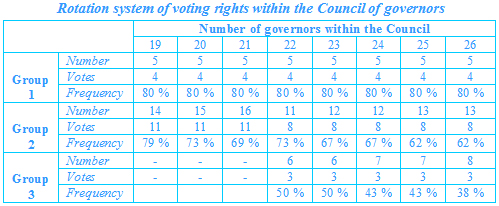

The system is progressive:

· The voting right of the governors of the Central Banks has been limited to 15 at first and the number of votes by the board has been maintained. The governors of the Central Banks have been divided into two groups with this in mind. The governors from the five biggest economic powers in the EU are in the first group. Economic power is defined in terms of a country's GDP and, to a lesser degree in terms of the total consolidated assets held by the financial institutions. Germany, Spain, France, Italy and the Netherlands comprise this group which has four votes. The second group comprises the other Member States and has 11 votes;

· When 22 countries are members of the euro zone the second group of governors will be divided into two parts. The first will comprise half of the total number of governors and will have 8 votes. The second part will comprise the remaining governors and will have 3 votes. The group comprising the five main powers will still have four votes.

At the same time an equal rotating order has been introduced, in which each governor regularly loses his right to vote. Regarding the main powers each of them can only vote two months in the year. The governors who do not have the right to vote do however take part in the debate prior to the decision on monetary policy being taken.

(Source : Banque centrale européenne et Natixis)[6]

(Source : Banque centrale européenne et Natixis)[6]

The ECB's rotation system is similar to that of the American Federal Reserve. The open market's Federal Committee, which is the equivalent of the Council of Governors, only includes five of the 12 regional reserves banks. The Committee also comprises 7 members of the Board of Governors, the Federal Reserve Board. It remains that unlike the ECB, the annual rotation is not totally equal since the regional bank of New York has a permanent right to vote. The chairmen of the regional banks of Chicago and Cleveland vote one year in two and 9 chairs vote one year in three.

Deferred implementation until the entry of the 19th member

The decision of 21st March 2003 however gave the Council of Governors, acting by a two thirds majority, the possibility of deferring the implementation of the new system until the entry of the 19th member of the eurozone. This precaution was a matter of simple arithmetic: in a euro zone comprising between 16 and 18 members the frequency of the vote by countries in the group of five powers is slightly lower than that of the countries in the second group. This was a source of concern in Germany. Due to this the Council of Governors decided on 18th December 2008 to use this clause. Hence although the new system should have entered into force with the accession of Slovakia, the 16th eurozone member on 1st January 2009 it would only become effective on the integration of Lithuania on 1st January 2015.

Unlike what might have happened in 2009 the weight of the group of the five biggest economic powers remained the same. Unlike the ECB's estimations the 14 other countries will only have 52% of the vote in contrast to 56% if they had been 13. The frequency of voting within the first group totals 80% whilst in the second group it is due to decrease as the euro zone gradually grows. For its part the board is strengthened since it will have 29% of the vote in contrast to 24% in the present system.

Although the new system does not really weaken the major economic powers of which Germany and France are a part, the present governance method however does not guarantee them any extra weight. Hence the Bundesbank found itself isolated at the time of the unlimited purchase of sovereign debt bonds (Outright Monetary Transactions) of the countries placed under financial assistance.

Conclusion

The accession of the 19th member, a year after Latvia, confirms the euro zone's power of attraction, even though it is not approved by the entire population. The effort undertaken by Lithuania to check the economic and financial crisis that struck in 2008, whilst maintaining its goal to join the euro zone, deserve acknowledgement. Particular attention should however be paid to the Lithuanian economy both in terms of the monetary impact on prices and of the sanctions adopted by the EU against Russia. Like its Baltic neighbours Lithuania is still enclaved being both on the periphery of the EU and on the front line in terms of its Russian neighbour. This geographical situation leads to certain consequences that can be likened to a form of dependence which is dangerous in times of political crisis.

At the same time Lithuania's integration into the euro zone will lead to the reform of the ECB mode of governance. The introduction of a rotation system comparable in part to that introduced in the USA enhances somewhat a more federal view of the euro zone.

[1] Crise économique, euro, Russie, énergie : les défis européens de la Lettonie et de la Lituanie, Information report n°346 (2010-2011) by Yann Gaillard, published on behalf o the European Affairs Committee at the French Senate.

[2] European Commission Report on Convergence 2006 : http://epp.eurostat.ec.europa.eu/tgm/table.do?tab=table&init=1&plugin=1&language=fr&pcode=tec00115

[3] Sébastien Richard, Latvia's membership of the Euro Zone. European Issue n°298, Robert Schuman Foundation, 23rd December 2013.

[4] Rapport de la Commission au Parlement européen et au Conseil - Rapport de 2014 sur l'état de la convergence (COM (2014) 326 final), http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=COM:2014:0326:FIN:FR:PDF

[5] Banque centrale européenne, Rapport sur la convergence de juin 2014, http://www.ecb.europa.eu/pub/pdf/conrep/cr201406fr.pdf

[6] Rotating of voting rights in the governing council of ECB, ECB Monthly Bulletin, July 2009 and Alan Lemangnen, La BCE vers un système de rotation des droits de vote : ne varietur. Special report - Recherche économique n°24, Natixis, 18th February 2014.

Publishing Director : Pascale Joannin

On the same theme

To go further

Freedom, security and justice

Jean Mafart

—

15 April 2025

Asia and the Indo-Pacific

Pierrick Bouffaron

—

8 April 2025

Democracy and citizenship

Radovan Gura

—

25 March 2025

Strategy, Security and Defence

Stéphane Beemelmans

—

18 March 2025

The Letter

Schuman

European news of the week

Unique in its genre, with its 200,000 subscribers and its editions in 6 languages (French, English, German, Spanish, Polish and Ukrainian), it has brought to you, for 15 years, a summary of European news, more needed now than ever

Versions :