Economic and Monetary Union

Rémi Bourgeot

-

Available versions :

EN

Rémi Bourgeot

On 6th March 2014 European Central Bank President Mario Draghi declared that the euro zone was "an island of stability."[1] He also often admits that Europe's recovery is fragile and slow moving in the face of a series of complicated economic and financial risks. We have therefore a world - that of the capital markets - in which the attractiveness of the zone does not simply depend on its economic situation nor on its perspectives, but on quite a different system of appraisal. And so, while less than two years ago, international capital markets condemned the euro zone in a chorus of conjecture about its breakup, that latter - having barely risen beyond the line that separates growth from recession - has become a privileged financial destination. It would be vain to try and understand this peculiar logic without taking on board the trends that make the financial universe tick and, in this case, the impact of the "emerging market rout" on the perception of risk in the euro zone. Equally it would be difficult to understand the quite extraordinary attraction exerted on the financial world by emerging markets between 2008 and 2013, without understanding the panic inspired by the euro zone - whose monetary crisis was triggered in the wake of the US subprime mortgage crisis.

Economic reality and investment fads

If capital flows can be triggered as quickly and as resolutely as this, it is because a specific mental structure has grown of which economic reality is but one pillar among others. This structure is based on a system of powerful symbols that, for the time of a bubble, enable an abstraction from economic constraints, leading to the belief that the collective financial trend is moving along with history and progress - spectra that are symbolically above outdated balance of payments rules. Moreover we are speaking here of economic reality in the sense of a specific psychological view, which can lag several years behind in relation to economic imbalances, which are often quite obvious however. Since 2007, it has been a fundamental constant in these three successive - or rather, overlapping - crises. The countries which have found themselves under the world's financial spotlights and which we finally declared to be in crisis, have all generally shared an extended period of current account (and trade) deficit. Although the current account deficit may cover varying economic situations we have to admit the importance of this measure and its dynamic in the ongoing crises.

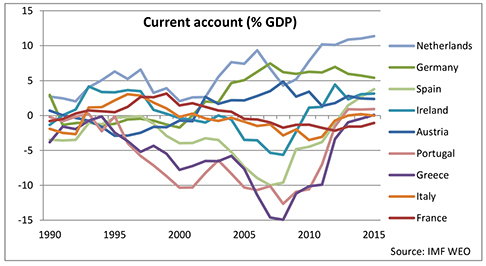

As far as the euro zone is concerned, the current account (and trade) deficits of southern countries grew during the first phase of its existence, until 2008, before contracting sharply under the effects of the crisis and varying phases of recession. The gaps which grew until 2008 were not really difficult to see. Neither were they excessively hard to understand, if we grant importance to the differences in inflation between countries in the same monetary zone and Germany's wage policy which aimed to separate wages from productivity growth so as to boost the country's market share within the euro zone[2]. We might note that the current account deficit levels mentioned here are significant, with Spain, Portugal and Greece rising above the 10% of GDP mark in the run-up to the crisis. Many challenged the idea of the current account saying it was outmoded, all the more so in a context of monetary union which it was imagined was united economically and politically by definition.

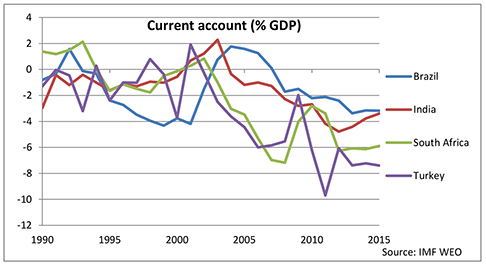

If we look at the economies in deficit among the major emerging, so-called "BRICS" countries[3], we can see that there has been a general drift in current account balances from the beginning of the 2000's to the present. However over the period in question, each of these countries experienced a period of improvement in terms of their external account - at the beginning of the 2000's - after serious monetary crises, in the case of some, like Turkey. Again with the severe recessions in 2008-2009, we note the start of an adjustment in the current account deficits of Turkey and South Africa. However the funds flowing into the emerging economies, with excessive current account deficits, encouraged - in a climate of low interest rates - an extensive wave of private debt, financed by international investors who despaired at the West's economic misfortunes and the low yields that resulted from loose monetary policies and the perception of risk crushing the sovereign yields of countries that were reputed to be safe. The superficial status of safe haven, haven of growth, or island of stability - although they might seem like a godsend for a time on the capital markets - are rather more a curse, worsening external deficits in a vicious circle maintained by exchange rate overvaluation - in real terms[4]. Moreover governments' focus on financial markets, which mainly escape their control, tends to mask the importance of problems of another order. In particular, these countries are experiencing deindustrialisation, in the same way as developed countries have done, but from levels of economic development that still lag well behind[5]. Long term, this trend towards weakening industry worsens structural current account deficits.

Debt Crises and the Quest for Liquidity

From a financial point of view, these current account deficits lead to the creation of debt in the countries in deficit vis-à-vis their trade and financial partners in surplus. Countries which set themselves a primordial goal of a massive, sustainable trade surplus condemn themselves, at the same time, to being the creditors of countries in deficit, whose solvency is weakened by long term economic imbalances, whether across an economic zone or the world. Here we see the paradox of countries which attract massive capital flows, thereby enabling them to feed increasing financial imbalances. If there is to be a greater trend towards investment in an economic area in international financial circles, then that zone has to be able to offer investment support in the shape of capital and debt. Foreign direct investments are just one type. These illiquid investments can offer long term financing for the development of local production sites, which can also draw benefit from a technology transfer on the part of the capital providing country. The unsettling downside[6] notably lies in so-called portfolio investments and the financing of the country's external debt, which can come in various shapes and forms. It is in this area that the essence of the paradox of fashions affecting capital flows is to be found.

The supreme principle which governs contemporary capital markets is called liquidity. However the very concept of liquidity, which enjoys an almost mystical aura, can lead to confusion[7]. "Global liquidity" has become a widely investigated topic, thereby describing a quantity which is difficult to define but which resembles what we might call money[8], in a very broad definition[9]. But above all liquidity is a quality, in a neutral sense. An asset's liquidity is typified by the possibility on the part of the holder to (re)sell a great quantity of it, by finding an immediate buyer and at a so-called market price which is barely affected by the transaction, if but insignificantly (the idea of market depth).

After a thirty year journey into financial liberalisation worldwide, the features of liquidity and depth[10] appear to be a claim that could not be any more legitimate on the part of investors, but the idea is in fact a singular one - whether we speak of capital or debt. In the world of debt, which is the focus of this study, the act of lending, on the part of the creditor is supposed to be driven by an economic calculation regarding the borrower's solvency and the appraisal of return embodied by the interest rate and its payment structure, in the face of the risk being run. The idea that private debt is traded massively on the markets in the shape of securities, thereby creating a constantly growing momentum, is not straightforward and in all events contributes to another financial logic, of which herding is an overriding aspect.

Liquidity and Financial Innovation

The "liquidity principle" is the focus of the idea of financial innovation, in close connection to the idea of risk. The securitisation of mortgage loans and particularly collateralized debt obligations (CDO), the epicentre of the American housing crisis, naturally comes to mind. But the quest for liquidity has shaped a wider share of the debt universe over the last thirty years. If we speak of public debt, the idea that this is almost automatically placed (except in periods of sovereign crisis) by primary dealers, a role undertaken by a select group of investment banks, serves as an audacious financial innovation. This innovation is older, to the point of now being an established norm. From the point of view of the supply of debt securities, we might wonder, with hindsight, whether this facility offered to governments to issue debt, without having to place it directly with households or major foreign investors (in high surplus countries), is not a condition for public debt overhangs[11].

As far as CDO's are concerned, the illusion regarding their so-called safe nature - until their collapse - came directly from the (precarious) liquidity of these securities, which was enabled both by their articulation around real estate collateral that was supposed to continually rise in value, and by their standardisation as they were sliced into tranches of various qualities[12]. For the markets of these securities to be liquid and deep, supply and demand has to match a logic of growth, both in terms of price and volume. The more this dynamic is crowned with success, the greater the volume of emission, to the extent that new categories of borrowers (the infamous "subprime" in the US housing bubble), as well as new categories of investors are drawn in, who a priori are increasingly disconnected from the underlying economic dynamic. This is how European banks came to take a significant share in financing the American real estate bubble and that the continent was infected almost immediately by the banking crisis. Without the continuous extension of the investor spectrum, there is no liquidity and no bubble. We return to the paradox of the very concept of liquidity. In the real world, the liquidity of a debt market is guaranteed by allowing it to rise constantly, even exponentially, so that while there is joy at the liquidity of the market in question, the underlying refinancing capacity continues to decline. Worse still, the veil of perfect liquidity masks the gravest macroeconomic dysfunctions since, for a time, it can help inflate the domestic demand of an entire country.

In terms of the euro zone, "the financial innovation" which enabled the financing of growing current account imbalances in the so-called peripheral countries, lay in the financial integration of the continent. The focus on public debt levels masked the vital part of the mortgage bubble which developed in Spain and Ireland. The debt bubble was founded on two powerful, symbolic pillars. The first comprised the imitation of the American bubble, and particularly the craze of mortgage securitisation. The second lay in European integration in the specific shape of the single currency. The combination of these two led to singular effects. Securitisation literally enabled Spain, as it did Ireland, to shed a share of the debt which was to prove toxic, selling it off to foreign investors to the extent that at the start of the US mortgage crisis, naïve observers were exclaiming that the Spanish banks had been spared. At the same time, monetary and financial integration led to the widespread internationalisation (and especially the Europeanisation) of the debt, both private and public, in Europe.

The European bond markets have enjoyed this dynamic of financial integration - which reversed as of 2008 - and convergence of interest rates for two decades, in an environment of ever increasing liquidity. The case of Italy is interesting since public debt, which soared in the 1980's - to stabilise above 100% of GDP - notably because of high interest rates implemented by the Bank of Italy in a bid to align the Lira with the D-Mark. This vast supply of liquidities was the delight of a generation of bankers and bond investors, since once the explosion of the European Monetary System had passed in 1993, the project of monetary union led to an unprecedented convergence of interest rates in Europe. This continuous suppression of interest rates and the general trend towards disinflation in developed countries, as of the 1980's, created an ideal environment for bond markets. Investors enjoyed prices that were trending upwards and a constantly rising mass, with the promise of the final eradication of exchange rate risk between European countries.

We note on the following graphs that the foreign ownership of Italy, Spain, Portugal and Greece's private and public bonds[13] had been a growing trend since the beginning of the data series in 1995, particularly in the banking sector. However there was also a notable acceleration in the internationalisation of these securities, as of 2005 when the illusion of the viability of the economic models developed in these countries was in full swing. We should recall that Spain, which was in the midst of the housing bubble, was set up as a model, notably due to its particularly low level of public debt. The first phase of the crisis in 2007 slowed the dynamic of financial integration in the euro zone. Hence there was stagnation or a slight decline in the amount of public and private bonds held abroad in Italy and Spain - with a dramatic decrease in Portugal and Greece. In addition to this, if the elements of external debt are split up into sectors (general government, banks, non-financial corporations), we see the significant weight of bank emissions in the external debt of Euro zone peripheral countries and notably their rise in the integration phase[14]. Reciprocally, during the period of crisis and financial segmentation we see in Spain and Portugal a faster decline in foreign owned private bonds rather than sovereign bonds.

Continuing the comparison with the emerging countries we note the appearance of a quite specific reciprocal kind of dynamism. Although the total external debt of the major emerging countries started to rise at the beginning of the 2000's we note a clear acceleration of this as of 2009 when the supposed economic superiority of emerging countries took on a new dimension, rising beyond the usual milieu of specialised investors. Hence emerging markets really do seem to have served as an alternative to Western economies - which were supposedly condemned by history.

(Please click on the graphs to view them at full size)

The new carry trade logic at the heart of the emerging markets' bubble

The financial engine of the emerging bond bubble is of archaic simplicity - the carry trade can however come in many shapes and sizes. The differences in interest rates between developed countries (at their lowest because of the safe-haven status of public debt, zero rate policies, and debt purchasing programmes by various central banks) and emerging economies, which are much higher, provide a clear incentive. Basically the carry trade comprises creating debt in a country with low interest rates to invest in a country with high return and where the currency ideally will rise in value. This incentive is the focus of the emerging market craze that has been driving capital markets along over the last few years. We should note the emergence of remarkable new trends. In China, Brazil and Russia we observe the phenomenal development of private offshore bond emissions, especially in the banking sector[15]. The mechanism comprises a company or a bank in one of these countries borrowing via a foreign market. This approach is a classic one if the loan is used to invest abroad or to hedge against exchange rate risks resulting from payments received in that currency. Conversely the explosion in the foreign-exchange reserves of these countries and their monetary base during this period seems to show that sums borrowed offshore notably via the emission of bonds have especially tended to be repatriated and converted into the national currency to be invested there[16], which has left the borrowing companies open to significant exchange rate risks.

Differences in interest rates between economic zones offer a financial and even an arithmetic incentive so to speak. However we simply have to appraise the world structure which enables the achievement of this phenomenon. The asset management industry is taking up an increasing share in this, due to the growing practice of bond emissions by major companies, in addition to traditional loans. The increasing influence of bonds emission cannot simply result from a financial incentive like the differences in yields between zones. Underlying this phenomenon is the desire for deep, liquid debts on the part of the bond market which can be exerted according to expectations that investors have developed regarding the public debts of developed countries. In this way, traditional purchasers of developed country debt - in the hunt for yield - turned with enthusiasm towards the emerging countries. They were convinced they would find the same liquidity conditions since the market volume rose with the soaring external debt of these countries (via the current account deficit) and prices were rising due to pressure on rates resulting from the dynamic of financial flows. The redirection of monetary policies towards the universal goal of disinflation via inflation targeting provided a serious argument to these long lasting bond rally illusions.

The effects of investment trends on economic policies: European dilemmas

As always the dynamic reversed very quickly once one of the main sources of liquidity, as it happens, the Fed's quantitative easing programme, began to fall short. Hence the economic "collateral" of these loans was quite rightly questioned - all the more so since imbalances had reached a spectacular level in recent times.

It is in this specific overall framework that we see the capital markets falling in love with the euro zone again together with its promises of economic and financial convergence, while loans to non-financial companies (bank loans) continue to decline. If we are aware of this balancing game between major zones and deep imbalances that have formed in the emerging countries over the last few years, we might adopt a new interpretation of the management of the euro zone. It appears that enthusiasm for the euro zone was just sitting in wait of a slight change in the economic situation to flourish again - whatever the remaining structural flaws. Hence not only has the widespread introduction of budgetary austerity in the euro zone, which aimed to contain soaring public debt, been counterproductive from the point of view of its first goal, but it has also delayed the reversal of investor confidence. At the time, governments felt that they had to respond immediately to what they thought was a supreme message from the markets regarding the way they managed public accounts. Austerity was supposed to respond to this expectation while the markets, the sap of which is debt, only required reassurance for them to take advantage of yields that had soared and therefore offered a superb opportunity for reduction - i.e. a bond rally. Initially it required the talents of a central banker - a fine connoisseur of the market psyche - to shake up their minds with the announcement of a virtual, potentially unlimited purchase programme of sovereign bonds.

As with any bond bull run, the one we saw as of mid-2012 in the euro zone has led to obvious undesirable effects. Firstly, from an economic point of view, we might deplore the overvaluation of the euro. This is a result of capital inflows towards a conservative zone in terms of monetary policy and which has a current account surplus in addition to underlying deflationist tendencies (which foster the nominal appreciation of the exchange rate), while providing substantial pockets of yield. Moreover it seems that market enthusiasm has deadened the desire for reform in the euro zone. The issue of Banking Union is by far the best illustration. Its aim was primarily to reduce the systemic feedback loop between banking and sovereign sectors in the euro zone. This meant managing the possible resolution of a bank without this causing major damage to the public finances of the country in question. Firstly the decision making mechanism - which is extremely complicated - is a problem as far as credibility is concerned. Moreover the capacity of a common fund, financed by the banks, will finally total €55 billion while the closure of the Anglo-Irish Bank alone cost €30 billion to the Irish State[17].

Market enthusiasm might be counterproductive as it encourages a weakening of its investment recipient, i.e. the euro zone's structure itself. Political dependency on market mood is also worsened by the transmission channel embodied by the rating agencies. From an institutional point of view, we see organisations like the IMF and various central banks (including the Bank for International Settlements) attempting to draft a vision in order to circumvent this mechanism. Thought is undoubtedly driven by the continued rise of European public debt subject to the weakness of the economic situation and also deflationist trends. Against this background, thought seems to continue at the IMF about sovereign restructuring[18]. It is increasingly clear that the IMF will no longer take part in bail-outs that are doomed to failure, as in Greece. Hence the IMF will only accept to lend money once restructuring has been undertaken and the country's solvency is guaranteed, so that its task solely lies in supporting a country's liquidity in the event of problems in accessing capital markets. At the opposite end of the scale of restructuring, Bundesbank experts contemplate capital tax plans for over-indebted governments to reduce their debt burden on their own, without asking for European solidarity[19]. At base it is also a means to remove responsibility from international creditors, since only the tax payers of the country in question would be asked to pay. On the contrary restructuring mechanisms acknowledge the shared responsibility of creditors and debtors in the debt crisis. This dilemma in reality reflects two diverging visions of capitalism.

Conclusion

Ebbs and flows which make the financial universe tick and which play an increasing economic role are of course part of a very different logic from the traditional links between creditor and debtor. It would be vain to try and deny this development, which lies in deeply rooted trends. However it seems vital that political leaders should not simply be swept along by the changing moods of the financial sector, bathing in glory with each opportunity given to the precarious enthusiasm of the markets for their country. Political thought has to address the development of long term economic solutions. An understanding of the system which underlies capital markets dynamics, of which debt creation is a vital element, could enable the refocusing of debate on real conditions for a new phase in European prosperity.

Appendices:

[1] Mario Draghi, ECB press conference, 6th March 2014, http://www.ecb.europa.eu/press/pressconf/2014/html/is140306.en.html. In answer to a question over the possible enlargement of the euro zone, he made the distinction between stability and prosperity. "The euro is an island of stability. It will also have to go back to being an island of prosperity and job creation, but certainly it is an area of stability"

[2] In a study for the Robert Schuman Foundation, we show that there has been no wage drift in the Euro zone's periphery prior to the crisis and that differences in competitiveness are the result of two factors (difference in inflation and wage disinflation as part of the Agenda 2010 policy in Germany). See: Labour Costs and Crisis Management in the Euro Zone: A Reinterpretation of Divergences in Competitiveness, European Issue, 23rd September 2013. http://www.robert-schuman.eu/en/doc/questions-d-europe/qe-289-en.pdf

[3] BRICS is the acronym for Brazil, Russia, India, China and South Africa. Then Turkey was often included in the group. For the time being, we exclude China and Russia which are in surplus from a current account perspective.

[4] To understand the deterioration of competitiveness, the real exchange rate should be looked at, as it takes account of inflation gaps between the country at stake and its trade partners. While assessing economic conditions, commentaries are often too focused on nominal exchange rates - which are less relevant to economic developments but match financial performance issues more strictly.

[5] See Dani Rodrik, "The Perils of Premature Deindustrialization," Project Syndicate, 11th October 2013. http://www.project-syndicate.org/commentary/dani-rodrikdeveloping-economies--missing-manufacturing

[6] Against this background, the growing, sometimes unsettling role played by investment funds in global finance mechanisms, alongside players like banks, is increasingly the focus of financial authorities' attention. See: Asset Management and Financial Stability, Office of Financial Research, September 2013 http://www.treasury.gov/initiatives/ofr/research/Documents/OFR_AMFS_FINAL.pdf

[7] See Jean-Pierre Landau, Global Liquidity: Public and Private, Federal Reserve Bank of Kansas City, August 2013 http://www.kansascityfed.org/publicat/sympos/2013/2013Landau.pdf

[8] "Global Liquidity Measurement and Financial Stability," ECB Financial Stability Review, December 2011 http://www.ecb.europa.eu/pub/fsr/shared/pdf/ivcfinancialstabilityreview201112en.pdf?f106ee38cb2296423ee29089c34fb332

[9] The weighted sum of bank deposits of non-financial corporations is a measure that can suit the concept of global liquidity. See: Kyuil Chung, Jong-Eun Lee, Elena Loukoianova, Hail Park and Hyun Song Shin, Global Liquidity through the Lens of Monetary Aggregates, IMF Working Paper WP/14/9, January 2014. http://www.imf.org/external/pubs/ft/wp/2014/wp1409.pdf

[10] The ideas of liquidity and depth, although different in the strict sense of the term, are closely linked. In what follows the term "liquidity" might cover the common core of the two notions, for the types of market which lend themselves to it.

[11] For a particularly pertinent analysis of these macro-financial develoments and notably the role played by liquidity read Jean-Luc Gréau, La Grande Récession (depuis 2005) (The Great Recession - Since 2005), Gallimard Folio Actuel, 2012.

[12] Once the liquidity illusion collapses, the quest for liquidity triggers the phenomenon described by Keynes, in his time, as "liquidity preference," i.e. the preference for genuine, unquestionable liquidity.

[13] Source: Bank for International Settlements, Debt Securities Statistics, March 2014. http://www.bis.org/statistics/secstats.htm

[14] Graphs per sector are presented in the appendices.

[15] Offshore securities are calculated as the difference between bonds (held abroad) by nationality and by residence.

[16] See Ajay Singh Kapur, Ritesh Samadhiya, Umesha de Silva, "Pig in the Python - the EM Carry Trade Unwind," The GEMs Inquirer, Merril Lynch Equity Strategy, 18th February 2014.

[17] We might be concerned about the under sizing of this fund. Moreover the resolution model is that of bail-in, with contributions being requested of private lenders and in extreme case, of depositors (accounts containing over €100,000). If bailinable assets and national funds (or in ten years' time a common fund), the government in question will have to take responsibility of the extra costs by borrowing from the ESM if necessary like Spain did in 2012 to finance the recapitalisation of its banking sector.

[18]An emblematic study of the theme of restructuring - published by the IMF - was undertaken by Reinhart and Rogoff, who previously did work which served as a scientific justification of the European austerity policy. See: Some Lessons Learned and Those Forgotten, IMF Working Paper WP/13/266, 2013. http://www.imf.org/external/pubs/ft/wp/2013/wp13266.pdf

[19] "Staatsfinanzen: Konsolidierung nach Vertrauenskrise" (State Finance: Consolidation after the Confidence Crisis), Monthly Bulletin, Deutsche Bundesbank, January 2014 http://www.bundesbank.de/Redaktion/DE/Downloads/Veroeffentlichungen/Monatsberichtsaufsaetze/2014/2014_01_staatsfinanzen.pdf?__blob=publicationFile

Publishing Director : Pascale Joannin

On the same theme

To go further

Businesses in Europe

Olivier Perquel

—

16 December 2025

Digital and technologies

Josef Aschbacher

—

9 December 2025

Democracy and citizenship

Florent Menegaux

—

2 December 2025

Democracy and citizenship

Jean-Dominique Giuliani

—

25 November 2025

The Letter

Schuman

European news of the week

Unique in its genre, with its 200,000 subscribers and its editions in 6 languages (French, English, German, Spanish, Polish and Ukrainian), it has brought to you, for 15 years, a summary of European news, more needed now than ever

Versions :