Industry

Franck Lirzin,

Christophe Schramm

-

Available versions :

EN

Franck Lirzin

Christophe Schramm

1. A review of the situation: a Union marked by macro-economic and internal industrial imbalances.

Globalisation and more particularly, the rise of the Asian powers has led to far reaching changes to the geography of world trade. However, although the USA witnessed a decline in its share in international trade 27.8% to 11.3% between 1955 and 2010, the EU has been more successful in maintaining its rank, its share contracting from 23.9% to 14.6% [2]. China's share in world trade rose from 9.7% to 14% between 2005-2010. More surprisingly the European trade deficit with the rest of the world is slight, lying at around 0.5% in 2011; the euro zone even registered a small surplus of 1.1 billion euro in October 2011 [3]. Europe is still the world's leading market and the leader in chemical, pharmaceutical products, as well as machine-tools and cars.

Although the situation in the European Union is flattering seen from the outside, from within there is much greater contrast. Whilst some Member States have registered high trade surpluses over the last few years, for example Germany (151 billion € in 2010) and the Netherlands (67 billion in 2010), others are suffering worrying deficits, especially France (-72 billion €) and the UK (-53 billion €). The EU is therefore burdened by major macro-economic imbalances linked to differences in the competitiveness of various Member States within Europe and also with the rest of the world. Member States' results also determine their ability to rise to the major challenges which they all face, such as climate change, energy and ecological issues and demographic development.

Although these imbalances have arisen for various reasons they have become apparent since the creation of the single market and the single currency. At the same time some territorial imbalances and inequalities have deepened within the Member States themselves (increase in unstable work – part-time places – in Germany, a deepening of differences between neighbourhoods in France).

Although for a long time the consequences have remained hidden, the euro crisis has indeed brought them to light: those countries that are not as competitive within the Union and which have not succeeded in exporting enough are falling into debt with the rest of the Union and the world. This debt can be private, as in Ireland or public, as in Greece. Evidently this situation is untenable long term: Ireland's foreign debt, including both private and public debt with the rest of the world represented nearly 12 times its GDP [4] in 2011, Greece's public debt lay at around 144.9% of the GDP PIB [5] in 2010. At the other end of the scale the most competitive countries have witnessed a rapid recovery in their economic and budgetary situation. Germany, with its healthy export industry and public finances has become an economic safe haven, with a capacity to borrow at historically low rates (under 2% in comparison with over 10% for Greek loans).

If Member States did not use the euro did not then they could implement monetary policy instruments to devaluate their currency: imports would decrease, because they would be too expensive, whilst exports; being sold cheaper would improve. The flexibility of the exchange rate would lead to the absorption of these imbalances. However, in a monetary zone like the euro zone, other adjustment mechanisms have to be activated. In the USA economists suggest that labour mobility will lead to balance between supply and demand in the various States: one person losing his job in Chicago might move to New York and find another. The movement of labour within the EU is a more infrequent occurrence.

Another solution might be to introduce a fiscal and budgetary union policy with far greater redistributive impact than that operated by the present cohesion policy:

• the weakest States might obtain credit on the financial market by taking advantage of a guarantee provided by the Union as a whole and therefore obtain more favourable funding thanks to the budgetary situation of the strongest States;

• in exchange all of the States would commit to joint rules regarding their revenues (fiscal harmonisation) and spending in order to guarantee the sustainability and convergence of their public finances. This would imply a major transfer of sovereignty as far as the States' finances are concerned over to the European level.

• a much bigger European budget – by means of greater contributions by the Member States or greater own resources on the part of the Union – would complement the common monetary union with a more active investment policy to counter unemployment and poverty, notably in the poorest Member States, and above all to promote competitiveness and economic development across the entire Union. These investments might replace or complement national investments when it can be proved that the community level provides real added value.

These solutions are now emerging: Herman van Rompuy has proposed a budget for the euro zone that would make it possible to compensate for cyclical macro-economic imbalances; Member States including France are ratifying the European Treaty on Stability, Coordination and Governance whilst the European budget is being negotiated and is due to be defined by the start of 2013.

2012 will have witnessed decisive progress in the creation of a clear framework for the European economic policy. The solution of a return to national currencies has been discarded for the time being, whilst fiscal and budgetary union is still a long term prospect. The next step would be the implementation of real, practical investments and a community policy to revive European industry. In response to the damaging impact of the crisis and to develop the territories' competitiveness the European Union must therefore re-establish the balance of internal trade by pragmatic means and the development of export activities – primarily industrial – in the indebted countries and by strengthening internal consumption in those countries with major trade surpluses vis-à-vis their neighbours. Member States must not simply coordinate their economic policies but also develop an industrial investment and development policy common to all European regions. This ambition can only become a reality if a genuine strategic vision of European industrial policy is taken on board, together with thought about the States' regional industrial geography.

A development like this also implies ending criticism – that has dominated Europe wide for a long time – that national State intervention to influence domestic output simply leads to inefficiency, a reduction in competitiveness and the promotion of lobbying and the creation of factories for the manufacture of unwanted products rather than innovation. Indeed debate can no longer just be restricted to simplistic "for's" and "against's" to industrial policy; it has to focus on the conditions and the governance required to avoid errors and to guarantee the success of a European industrial policy.

2. The Geographic Organisation of European Industry

The creation and stimulation of the common market in Europe is still the heart of the European project, as the European Commission's communication on the "Single Market Act" adopted in April 2011 bears witness, as it aims, via a series of measures to revive the European economy and create jobs. Thanks to the increasing freedom of movement of men, goods and service, as well as capital, businesses which want to develop in Europe are increasingly pitting territories against one another in order to decide which will bring in the greatest profit. They way they decide involves a number of factors, some specific to the business sector and others which are shared by all industries.

2.1. Harmonisation of the economic environment

If businesses want to extend their activities or develop new ones, they pay great attention to the environment in which they are established. The ideal environment for a business would be to have stable, simple regulations, free, fair competition, low capital and profit tax, a competent workforce and moderate salaries, recruitment facilitated by a flexible labour market and the establishment of competent training schools, an ecosystem of partner businesses (for sub-contracting) and R&D institutes (for innovation), attractive living conditions for the workforce, the support of both local and regional authorities, and even start-up subsidies.

Although these conditions are impossible to meet entirely public authorities do have a major role to play however in improving the quality of this environment: in France, for example the national level can influence the fiscal and regulatory framework, as well as labour market rules, whilst the regions can influence professional training, workforce living conditions, start-up subsidies and establishment schemes (business incubators, subsidies).

The quality of the economic environment, i.e. the ease with which business can be undertaken, varies greatly between European countries: according to the World Bank ranking [6], Sweden lies 3rd, whilst Greece takes 90th position, with Germany and France lying 19th and 29th respectively. The European Union therefore has to play a role, both in the coordination of national economic policies, notably in terms of harmonising labour market regulations, administrative procedures, market and funding access [7], the respect of competition or taxation rules and also in providing impetus to strategic industrial investment and development policies in view of helping the poorest territories make up for lost ground.

Although harmonisation is a major stake in turning Europe into a harmonised economic area where businesses can set up in Portugal or Poland according to equal conditions, other factors, specific to the various sectors play just as an important a role in attracting economic and industrial activity.

2.2. Geographic selection criteria

Over the last few years economic research has revealed the links between economy and geography, notably highlighting the importance of the link between transport and transaction costs, spatial agglomeration (businesses grouping together at market centres to reduce transport costs) as well as the territorial distribution of innovation sources and the creation of know-how in an economy [8]. In practice other factors should also be taken into account in the various areas of economic activity.

2.2.1. Raw materials, a leading vector in industrial establishment

Since the start of the industrial era the presence of raw materials has conditioned industrial establishment. Since the means of transport was limited, businesses had to locate near their resources. The steel industry developed close to iron ore deposits and coal mines; the purity of Alpine water attracted chemists, the forests in the north did the same for the lumber industry.

This dynamic has shaped Europe's industrial landscape. But the improvement of transport systems and the emergence of European and even world markets, for a number of raw materials (oil, gas, coal, wood etc ...) has done away with the functional link between industry and territory. Often only history remains: some places have succeeded in using pre-existing industrial know-how to develop new industries. Hence seaplane builders established on the coast in Cannes have become the world specialists in satellites (Thales Alenia Space), whilst the glass specialists in Iena have developed the manufacturing know-how for the manufacture of solar cells. This ability to convert is a decisive factor for the upkeep of industrial activity and the rise of new ones in a specific area.

The geographic reshaping of the manufacturing chain might lead us to believe that de-industrialisation is taking place in some places and that in others activity is reviving again, but we have to be careful to distinguish between European de-industrialisation (transfer of activities outside of Europe), the re-deployment of the manufacturing industry between European countries and the transformation of the value chain (outsourcing of services to businesses), because the answers to provide differ from one situation to another.

2.2.2. The role of logistics

Industries whose transport costs are prohibitive will seek proximity with their clients. The manufacturers of building materials for example have to establish themselves near work sites: they cover the territory by optimising transport times. Other industries, whose markets are global, for example in micro-electronics, will position themselves in logistic hubs, particular in ports which enable them to export. The major markets are metropolitan, and businesses need easy access to them, which implies the impact of metropolitan concentration as well as the clogging of logistic networks.

Transport and also energy, telecommunication infrastructures, are a decisive factor in the choice of location: they depend of course on the investments made by the public authorities (roads, waterways, ports, airports) and also on the geography and the size of the market.

France and Germany represent 145.1 million inhabitants, i.e. 29% of the European Union's total population: businesses have an interest in positioning themselves close to this major market, because of transport and also so that they can be closer to their clients and to be able to understand their needs. The most isolated regions, on the periphery of these major internal markets, will not enjoy this competitive edge.

2.2.3. The network effect

A final detail about industrial geography: the concentration of activities [9]. Industries have an interest in being close to one another: it is easier for them to work directly with their sub-contractors, with universities and laboratories and to share tools with other businesses (technological platforms etc ....). This concentration provides increasing returns of scale. Indeed geographic proximity increases opportunities for trade and intellectual creativity: a business that is in daily contact with a great number of players in its region will have a greater opportunity to innovate, to make satisfactory partnerships and develop the necessary competences. The most famous examples of these manufacturing and innovation "clusters" are in the USA, in Silicon Valley, that initially made IT businesses famous, or in Sweden with the hub that developed around biotechnologies in Malmö.

Obviously businesses select their area of activity according to the competences that are already established there. It is better for a microelectronic industry to develop its activities in Grenoble, where there are already far more factories, a hub of competitiveness, universities, and laboratories specialised in micro and nanotechnologies than elsewhere. Time strengthens territorial specialisation, which becomes a comparative asset. Movement can be increased and even initiated by public investment [10], as in Rousset near Aix-en-Provence, where ST Microelectronics and ATMEL set up business in 1985 due to the quality of the utilities, which received public financial support. These industrial policies lead to the creation of technopoles which form a territorial network.

2.2.4. Centripetal and centrifugal forces

These phenomena lead to two antinomic trends. The first, which is centripetal, tends to focus all innovative players in one region, where the impact of the intellectual and technological spillover and the possibilities of sharing the work force are greater. The second, which is centrifugal, counters the first trend: some businesses avoid grouping together in technopoles which push prices up (rents and salaries) and increase competition with the other established companies. This is especially true for less competitive businesses, which are then pushed towards the edge of the economic cluster. Hence we witness the creation of a productive and innovative heart that is surrounded by a less innovative periphery which consumes less. This dynamic is true to varying degrees on a European, national and regional level.

3. The present weaknesses of European industrial geography

3.1 Major disparity between Member States and Regions

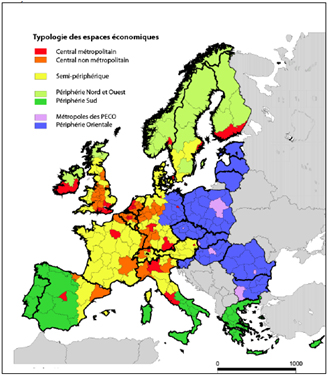

Map SEQ "Carte" \*Arabic 1

Map SEQ "Carte" \*Arabic 1

Source : Grasland C. & G. van Hamme (2010), La relocalisation des activités industrielles : une approche centre / périphérie des dynamiques mondiale et européenne, EuroBroadMap Project 2009 – 2011 of the DG Regio and DG Research (map adapted by Vandermotten & Marissal, 2004)

We can analyse the dynamics behind the location of industrial activity on a European and also a national level, by categorising economic activities in 271 of the Union's regions (Map 1). The central countries, like France and Spain, have concentrated their productive and innovative centres around their capital and peripheral areas. Some regions such as Catalonia, the Basque Country and Rhône-Alpes, have also succeeded in asserting themselves. On the other hand some countries whose structure is federal in nature like Germany, Belgium or Austria, and also Italy, the UK and Ireland have succeeded in creating economic areas that are more widespread across their territory. Activities in the northern Member States are located on the south coast whilst the peripheral States in the south and east seem clearly to be at a disadvantage.

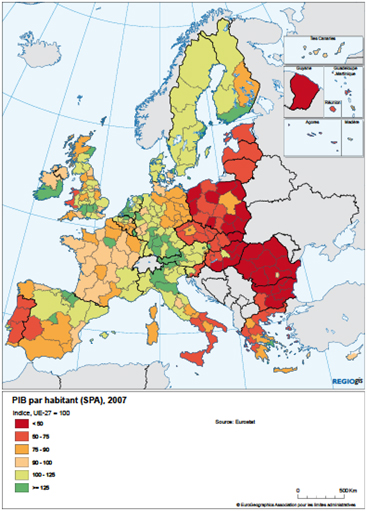

The analysis of wealth levels corroborate these results by and large (Map 2). Seen from a wide angle we can clearly see a main axis starting in London, even Dublin which passes via Benelux, along the Rhine ending in the north of Italy grouping together regions that are oriented towards the most productive, the wealthiest, and the most innovative tertiary activities. A second axis can be seen running from the south of Finland, via the south of Sweden and Denmark which joins the first axis. The rest of Europe seems to be on the periphery, notably the countries of Central and Eastern Europe, Portugal, part of Spain, Italy, Greece and even Ireland.

Map 2

Map 2

Source: European Commission (November 2010), Investing in the Future of Europe – 5th report on Economic, Social and Territorial Cohesion

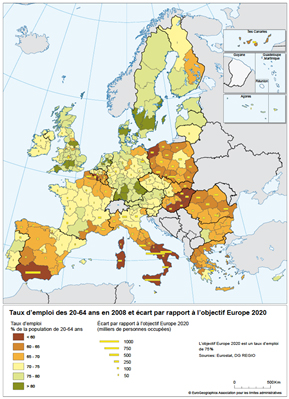

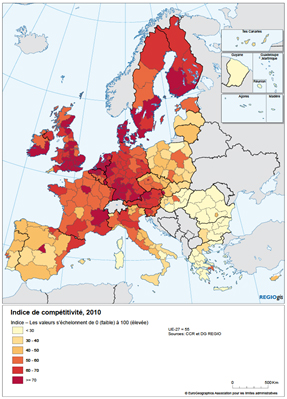

Similar territorial splits can be seen by studying employment rates of the working population (Map 3) and the Competitiveness Index [11] (Map 4).

The ten regions at the top of the competitiveness ranking all lie in the northern or western Member States. Six of them are region-capitals. Major differences are to be seen within a country, notably in Belgium and Italy. The regions which do not score as well in terms of competitiveness lie in the south east and do not include any major cities.

Map SEQ "Carte" \*Arabic 3

Map SEQ "Carte" \*Arabic 3

Source : European Commission (November 2010), Investing in the Future of Europe – 5th report on Economic, Social and Territorial Cohesion

Map SEQ "Carte" \*Arabic 4

Map SEQ "Carte" \*Arabic 4

Source : European Commission (November 2010), Investing in the Future of Europe – 5th report on Economic, Social and Territorial Cohesion

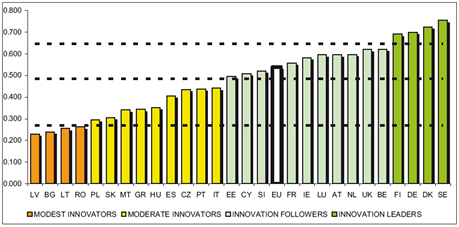

These differences also emerge in the Member States' ability to innovate. As the last innovation scoreboard illustrates (published by the European Commission in 2011 – graph 1) Europe's leaders in terms of innovation have results gauged by a composite indicator that is sometimes three times higher than that in less innovative countries.

Graph SEQ "Graphique" \*Arabic 1: innovation results in the 27 EU Member States (2011)

Graph SEQ "Graphique" \*Arabic 1: innovation results in the 27 EU Member States (2011)

Source: Innovation Union Scoreboard 2011

3.2. An inadequate European policy

It can now be seen that many States pursue industrial policies in one form or another [12]. Indeed governments try to foster the development of industries with high value added per worker, high wages and employing high technologies. [13]. Does the same apply to European policy in this area?

The harmonisation of economic frameworks – labour market, training, education and research, environmental protection – is not enough to lead to convergence in all regions. Geographic factors, whether this means market access or territorial specialisation, must be taken into account in the design of any European industrial policy.

The Treaty on the Functioning of the European Union clearly anticipates shared competence between the Union and the Member States, which "shall ensure that the conditions necessary for the competitiveness of the Union's industry exist" (Title XVII "Industry", article 173). The Union's role must be limited to promoting the coordination of Member States' action and the achievement of this goal thanks to policies and actions that it undertakes under other provisions of the Treaties. Finally article 173 states that the said title "shall not provide a basis for the introduction by the Union of any measure which could lead to a distortion of competition or contain tax provisions or provisions relating to the rights and interests of employed persons."

In practice this means that the DG for Businesses and Industry at the European Commission has not developed a coherent, integrated view of the various industrial sectors and limits itself to a role in which it coordinates the policies undertaken by other sectoral DGs which impact on industrial development. It is especially the DGs responsible for competition, the internal market and individual sectors such as energy, transport, ITs and communication that have knowledge of sectoral stakes. Hence the Union's industrial policy has to be undertaken via the action and means of other European policies, notably the cohesion policy and the regional policy.

Although this policy was designed to promote the Union's economic, social and harmonious territorial development by reducing disparities between the various regions and the backwardness of the least favoured regions (article 174 TFUE) [14], it supports the growth model included in the "Europe 2020" strategy that integrates the need to settle social and employment problems faced by Member States. Article 174 defines zones that deserve "particular attention" under the cohesion policy:

• rural areas,

• areas undergoing industrial transition,

• severe and permanent natural or demographic handicaps such as the northernmost regions with very low population density and island, cross-border and mountain regions.

In the period 2007-2013, around 355 billion € [15] (mainly as part of the European Regional Development Fund (ERDF) and the European Social Fund (FSE)) were allocated to three goals:

• Goal 1 "cohesion" aims to accelerate the closure of the economic gap between the least developed countries and regions with a budget of around 251 billion €. Its priorities target physical and human capital, innovation, the knowledge society, environment and administrative efficiency. We might quote the example of the high speed rail link between Warsaw and Lodz or the installation of optic fibres in Polish rural areas.

• Goal 2 "regional competitiveness and employment" targets regions' competitiveness, attractiveness, as well as employment. The regions involved are those not covered by the "convergence" goal, with funding of around 49 billion €. This goal enables the funding of business R&D projects and even provision to people who experience difficulty in finding work of adapted training to re-integrate the labour market.

• Goal 3 "territorial cooperation", funded to a total of around 8 billion €, aims to promote cooperation between European regions and the development of joint solutions in areas of urban, rural and coastal development, economic development and environmental management. For example border regions between Italy and France work towards sharing the means to prevent natural risks.

The cohesion policy also covers the cohesion funds introduced for the countries which joined the EU in 2004. The community strategic guidelines for the period 2007-2013, adopted on 6th October 2006, define the principles of the policy that should be used as a base for national and regional programmes set out by the Member States and then approved by the Commission. Every national programme sets a series of priorities which must fall in line with operational programmes on a national or regional level. In the new Member States an operational programme devoted to research and innovation was introduced, targeting competitiveness clusters in the least favoured regions.

It is now easy to understand the main source of tension that the cohesion policy is subject to in regard to the industrial development goal. With everything focusing on the inclusion of the least favoured regions, therefore those with the least competitive and innovative industrial network and environment, it has to foster competitiveness and employment in these regions [16]. However, it has to be said that innovation is important to all regions, whether they are on the leading edge of research or not. The Union has seen, in the second event which involves most European regions that emphasis has to be placed on the assimilation and spread of innovative practices that are developed elsewhere, rather than highlighting radical innovations.

Although the cohesion policy has had significant effect on the territories which have benefited from it, notably by way of the funding of major infrastructures, it has struggled to impact business competitiveness in these areas and the orientation of means towards high potential sectors. Apart from the red tape, ex post assessments have revealed problems linked to the disbursement of available funds. Hence of the 217 billion € in commitment appropriations for operational programmes in 13 Member States [17] that benefit from the regional policy fund over the period 2007-2013, only 54 billion € (43%) had been allocated by 31st March 2012 to real operations or projects. The ratio varies between 52% and 12% depending on the country. The share of payment appropriations is even lower [18]. Many reasons have been quoted for this extremely disappointing rate of use of European funds: slowness of procedures, lack of national and regional resources to guarantee an effective implementation of the programmes; disagreements between the Member States and the Commission over priority investment areas and sectors; local and/or regional political issues over the commitment of funds. Moreover the general incentive value which the European funds hold for businesses is still a subject of debate. Hence the European Court of Auditors observes that the financial instruments in the ERDF set in place to help SMEs are not very effective [19]. Finally assessments of the cohesion policy have revealed a need for a greater concentration of resources in order to achieve critical mass and tangible results.

For the period 2014-2020, the European Commission is proposing that the cohesion policy anticipate a budget of 336 billion €, greater thematic concentration in support of competitiveness as well as a re-organisation of the regions eligible for aid into three categories:

• Less developed regions (GDP below 75% of the European average): proposed budget of 163 billion €;

• Regions in transition: (GDP per capita between 75 and 90%): 39 billion €;

• More developed regions (GDP per capita over 90%): 53 billion €.

The cohesion fund, with its 69 billion €, is to be reserved for the Member States with a gross domestic income per capita of less than 90% of the European average. 12 billion € are also anticipated for territorial cooperation (cross-border, transnational, inter-regional).

The measures put forward seem to be moving towards simplification and greater orientation towards growth, innovation and competitiveness factors. However by maintaining the main goal – which is justified – of guaranteeing cohesion between the Union's regions, it is highly likely that they will be not enough to rise to the challenge of creating a real European industrial policy.

The rigidity of the present European model, based on the single currency, low workforce mobility and a low level of fiscal transfer makes it necessary to have an economic policy that aims to support industries in various territories, from the most developed to the weakest.

However it should be remembered that any industrial, territorial policy mechanism will be slow and that the "relocation" of industry can only occur over time, no matter how pro-active the public authorities are. Reconversion can occur in a fertile environment but it is much harder to create a new sector ex nihilo. Other sectors of activity can help towards balancing trade, for example tourism and agriculture. Not all regions are suited to or have the means to industrialise and finally it is not possible to eradicate the centre/periphery relationship [20]. At best public policies can try to attenuate this by improving the periphery and by organising economic geography to enable balanced transfers.

3.3. Examples of Industrial Policy success on the adoption of a territorial approach

3.3.1. The re-deployment of the car industry between the east and south east

In the 1970's the car industry was concentrated in the US, Japan and in Western Europe. In 1975 exports represented three quarters of the world's exports in the sector (75.3%); in 2005 they represented half (54.3%) [21]. The dominant position was retained, notably in Europe, which is still the world's leading exporter of cars.

Several factors explain these developments. Increasingly the markets are to be found in Asia and the emerging countries. The western countries are saturated and the car industry, although significant in volume grows on an average rate. However since number of cars is directly proportional to a country's wealth, the GDP growth rate of the emerging countries is opening up major opportunities to the industry [22]. Industrialists may therefore have an interest is positioning their manufacturing centres closest to the markets, both to minimise transport and manufacturing costs and also to adapt to the specific nature of local demand. Hence Renault, which imported cars into China, found it difficult to enter the market there but in 2012 it hopes to obtain the Chinese authorities' go-ahead to produce cars locally, thereby joining German manufacturer Volkswagen, which already has several factories in China.

Within Europe a similar trend is underway. As of the 80's Spain successfully entered the car industry, and this was the beginning of the spread of output capabilities across Europe. It was above all in the 90's that the car industries, notably German, started to relocate a major share of their activities towards Central Europe (Czech Republic, Slovakia and Poland). These countries present numerous assets: geographic and even cultural proximity (Czech Republic), low labour costs, including a qualified workforce, and an industrial infrastructure, inherited from the Communist period, that might prove useful.

Portugal, where many manufacturers have set up their factories (PSA Peugeot Citroën, Renault-Nissan and Volkswagen) now finds itself in competition with the countries of Central and Eastern Europe. The car industry represents 7% of the Portuguese GDP and employs 40,000 workers, playing a major role in the trade balance. The government supports this strategic sector, notably via a Centre for Excellence and Innovation in the Car Industry (CEIA) [23].

Although Europe represents more than half of the electric car market, the Portuguese car industry might find second wind. But the strategies implemented by different manufacturers, notably the Germans, towards developing in an area of excellence in the centre of Europe might also enable Eastern Europe to take the lead in these new technological markets.

The issue of the geographic location of manufacturing activities in Europe emerges clearly via this example. In the context of the present crisis, how can a country like Portugal both bear up to competition on the part of the countries in Central and Eastern Europe (and also China) enhance its export capabilities and also undertake an austerity policy? Coordination, not only of European economic policies but also of the economic players in situ is necessary to find solutions to this question.

3.3.2. The development of production facilities for renewable energies

Since the start of the 2000s renewable energies, particularly the production of wind and solar power have risen sharply in Europe, under the impetus of extremely proactive national policies in support of these energies via their purchase tariff and an ambitious European goal (20% of renewable energies in terms of final energy consumption in 2029, a goal that is specific to each Member State).

These policies have gone hand in hand with a sharp development of industrial activities in the production of masts, nacelles, turbines and wind-generator blades as well as solar panels. Some Member States, including Germany have succeeded in creating real industrial fields and also hundreds of thousands of jobs [24]. However international competition, especially from China, is threatening this development – notably in the solar sector where there has been an overcapacity – to the point that no European player features amongst the world's top 10 suppliers of solar equipment since the closure of the German company Q-Cells in April 2012.

Some lessons can however be learnt from these developments: the first to enter the market which was pulled along by demand were able to develop a competitive advantage before mass production took over; the harmonious development of R&D together with industrial production notably enabled the Germans to remain on the leading edge in terms of results and innovation in order to stand out from their non-European competitors; and above all the establishment – either geographic or sectoral – of new industries has succeeded where competences pre-existed in another industrial "eco-system". This is the case in the region of Jena which had a long standing tradition of optical glass production; the city ports in North Germany and Scotland have succeeded in converting their infrastructures to adapt rapidly to the needs of the offshore wind industry; EADS has started to manufacture wind turbine blades, taking advantage of its knowledge of the aerodynamics of aeroplane wings; and finally Areva and Siemens have invested heavily in thermodynamic solar technology given their expertise in the resistance of materials to high temperatures developed thanks to their nuclear activities.

This analysis converges with the result of more theoretical studies showing that net of the effects of major historic domestic market competitiveness, the green industrial policy delivers better results when it uses pre-existing industrial production capabilities rather than trying to create new ones. [25].

4. For a European Industrial Policy with a territorial dimension

By gradually creating a common market and the single currency the European Union has made it necessary to re-organise industry in Europe and this is still lacking. As Robert Mundell analyses in his theory of optimal monetary zones, apart from how open economies are (relatively wide in the euro zone) and manufacturing mobility factors, (quite limited), structural features, notably sectoral diversification, are vital in making a monetary union beneficial and sustainable. But in spite of endogenous factors that are working towards the creation optimal functioning conditions, the euro zone is suffering a lack of political will in terms of reorganising the economy in support of greater integration and diversification, particularly in regard to national industries [26].

In order to overcome the euro zone crisis long term and as a complement to the progress achieved towards budgetary federalism, new economic and industrial policy tools have to be invented. These tools must not be used as a miracle solution but as a means to adapt to the complex reality of the regions. Value should be given to differences between the regions in order to capitalize on them thereby avoiding the careless implementation of ineffectual formulae.

4.1. A strategic European industrial plan

To develop this integrated vision it seems appropriate, together with the major European industrial sectors, to introduce a "Strategic Industry Technologies Plan" [27]. This would make it possible:

• to rally all European players in the sectors involved as well as the Member States;

• to identify the strengths and weaknesses of every sector;

• to set strategic goals together for the next ten years on the basis of global, sectoral and territorial economic analyses and an assessment of the role played by each industry in terms of the competitiveness of the European economy. This plan should detail the position each industry aims to adopt in terms of globalisation taking territorial in the various Member States into account;

• to write a 5 to 10 year research, development, demonstration and implementation roadmap for the sector with a precise definition of priorities and requirements [28]. This should be the focus of wide debate with the Member States, Parliament and all of the parties involved in order to assess trends and create a consensus on possible funding requirements.

The monitoring of the implementation of this plan and the sectoral roadmaps would be the responsibility of the European Commission. In order to ensure global coherence the Commission would have to re-organise its services to make industry a transversal issue – closely linked to R&D – which is followed directly by the General Secretariat.

The next multi-annual financial framework should take on board finance requirements that result from the SIT plan. In order to enhance intra-sectoral competition thereby stimulating innovation and growth, any subsidy emanating from the European budget must not focus on a limited number of businesses in a given sector [29].

In line with the aim to bring greater focus to the cohesion policy for the period 2014-2020, some of these funds might be devoted to industrial priorities identified in the SIT plan and the sectoral roadmaps in the Member States involved.

The European Investment Bank should receive a mandate to help the sectors identified in their priorities by strengthening is presence in the field to work alongside businesses and projects.

The debate over the SIT plan guidelines and the comparative advantages of each Member State should also lead to discussion over fiscal policy coordination so that they can be aligned with the States' sectoral strategic choices.

4.2. Towards a territorial network of knowledge and competence

All regions have adopted specialisation strategies to make the best of their constraints and their history, but these specialisations can sometimes encounter competition from those in other regions, which weakens the entire sector, as with eco-technologies, - or even an entire country - as with car manufacturing. Regions could work better together as some are already doing, as part of the exchange of private initiatives or of European inter-regional cooperation programmes: this would prevent a certain type of intra-European competition; they would increase their work together with other economic and academic players.

European cluster networks already exist in various areas, for example the EDC Alliance (European Diagnostic Cluster Alliance) in terms of medical devices. They facilitate a partnership that enables all territories to develop and acquire new technologies whether they are at the centre or on the periphery. These networks help towards spreading knowledge, which we know is important in eradicating the distinction between the centre and its periphery. The spontaneity of these networks has to be maintained and thereby avoid burdening them with too much community bureaucracy.

These networks are the first stage in mapping competences which the European Commission should develop and which will then enable public decision makers to see all of the opportunities open to them. Every industrial policy that relies on a logic of regional development must indeed have detailed knowledge of the industrial and technological map. A map like this would provide information about the strategic orientation of the SIT Plan and also help focus public action on high potential territories and technologies, as well as work with private and public players.

4.3. European Centres of Innovation and Industry

The existing clusters could be transformed into European centres of excellence, the choice of these centres being made according to the comparative advantages of a territory, possibly by setting an additional condition that at least two Member States cooperate together (cf EADS in Toulouse and Hamburg). Hence we might encourage "enhanced cooperation" initiatives between regions or between States for which there are convergent industrial interests. In the energy sector convergence like this might exist in the area of electricity or gas, in certain renewable energy technologies, the storage of electricity or electro-mobility. France and Germany could play a major role in this.

Many States have established centres or clusters bringing together laboratories, training institutes, incubators and businesses in a given sector, and by providing access to devoted services (financing, human resources, export aid). These centres are mainly national (cf. technological research centres in France). They would benefit from "Europeanisation" to become "European centres of innovation and industry" (CEII) [30].

These centres might have their own legal structure facilitating the establishment of international businesses, the mobility of European researchers and workers, thereby enabling privileged access to European financial resources. Attractive tax incentives designed in a harmonised European framework would be an undeniable advantage in encouraging businesses to set up in peripheral zones. Specific status enjoyed by workers or researchers, enabling them to travel from one country to another would be a major step towards greater mobility. Finally, the European Commission should supervise the network of centre to set up joint European projects. This should help to spread the work undertaken by the European Innovation and Technology Institute established in 2006 and its KICs: Knowledge and Innovation Communities).

Conclusion

By removing the obstacles to the exchange of goods, services, capital and people the common market has brought about results: the living standards of European regions are converging in spite of major disparity in the beginning and Europe is the biggest market in the world.

But the euro zone crisis has revealed the unsustainable nature of territorial disparity in terms of industry, innovation and competitiveness. Geography and the comparative advantages of different areas are shaping economic relations and business opportunities; the history of each territory shapes its future development. The Treaty on Stability, Coordination and Governance within the EMU is setting the base for the coordination of economic policies. An approach to industrial policy based purely on competition does not take on board the complexity of what is at stake. To continue its industrial integration Europe has to be aware of the major differences that exist between sectors and regions and the potential that their interaction represents.

To settle the euro zone crisis adjustment policies are needed to take on board regional differences and which can use them to their best advantage. The aim must not be total convergence but complementarity in view of economic growth by using everyone's strengths and weaknesses. In spite of lesser mobility and geographic specialisation and in spite of the probable continuation of some kind of "national preference" Europeans can overcome the "innovation gap", notably as far as the US is concerned thanks to networking and cooperation between the regions involved [31].

In all events the development of Europe via a new industrial policy is one of the conditions for the coherence and sustainability of the euro zone.

[1] A first version of this text came from work undertaken in the spring of 2012 as part of the "Innvoation and Production in Europe" mission, co-directed by G. Klossa, Chair of EuropaNova, which gave rise to the report "Le nouvel impératif industriel" - (The New Industrial Imperative) - Ministry for the Economy and Finance 2012).

[2] Source : WTO, Eurostat

[3] Source : Eurostat

[4] Source : Joint BIS-IMF-OECD-WB External Debt Hub

[5] Source : Eurostat

[6] Doing Business Report, 2011

[7] Cf. the "Small Business Act" for Europe adopted in June 2008 and designed for SME's

[8] See Thomas Farole, Andrés Rodríguez-Pose, Michael Storper (February 2009), Cohesion Policy in the European Union : Growth, Geography, Institutions, Report Working Paper, London School of Economics

[9] See notably the work by Michael Porter on this issue.

[10] See Aghion P., M. Dewatripont, L. Du, A. Harrison & P. Legros (2011), Industrial policy and competition, GRASP working paper 17, June 2011. The authors show that industrial policy can be beneficial if it creates specialisation in high growth sectors, by forcing competiveness, thereby encouraging innovation. The fiercer the competition in a sector, greater the necessary level of innovation and greater the benefits of the growth policy.

[11] This index measures institutions, policies and factors that influence the level of a region's productivity and its ability to offer its residents high revenues, which are rising as well as quality living standards. This index is based on 69 indicators. It ranges from 100 to 0, from the highest productivity rate to the lowest in the EU.

[12] See the report by the Spence Growth Commission (2008): http://www.growthcommission.org/

[13] See Paul Krugman, Maurice Obstfeld, Gunter Cappele-Blancard (2012), Matthieu Crozet, Economie internationale, 8ème édition : The authors explain that a policy like this does not take on board however that only value added per capital unit counts, which means that the so-called "advanced" industrial sectors like telecommunications, aviation have a value added per average work unit. In a more sophisticated manner governments target the technological spillover and technological externalities of certain high tech industries. Finally public policies can help national companies to increase their profit at the expense of foreign competitors. However the experience of the last few decades of industrial policy show that these policies demand a capacity to take on board huge amounts of information which, in practice, seems difficult.

[14] The Lisbon Treaty strengthened the inclusion of territorial cohesion. Article 4 of the Treaty on the Functioning of the European Union (TFEU) and article 3 of the Treaty on European Union (TEU) now mention territorial cohesion amongst the Union's competences. Regarding implementation title XVIII of TFEU (articles 174 and those that follow) is now devoted to " social, economic and territorial cohesion " whilst title XVII of the treaty establishing the European Community (prior to the Lisbon Treaty) only described a " social and economic cohesion " policy.

[15] This entails around 51 billion € per year, which should be compared to the 73.5 billion € in State aid handed out by the 27 Member States in 2010 (source : Eurostat).

[16] See Riccardo Crescenzi, Andrés Rodríguez-Pose, Michael Storper (2008), The Territorial Dynamics of Innovation: A Europe-United States Comparative Analysis : " (...) the Lisbon Agenda shares the somewhat contradictory goals of 'making Europe the most competitive knowledge-based economy in the world', while, at the same time, promoting territorial cohesion. "

[17] Bulgaria, Cyprus, Estonia, Greece, Hungary, Latvia, Lithuania, Poland, Portugal, Czech Republic, Romania, Slovenia, Slovakia.

[18] Source : European Commission

[19] Source : European Court of Auditors (2012), Special Report n°2, Financial Instruments to support SMEs co financed by the European Regional Development Fund, published on 27th March 2012

[20] Economic concept developed at the start of the 20th century than taken up again by development economists in the 1960's

[21] Source: Grasland C. & G. van Hamme (2010), La relocalisation des activités industrielle : une approche centre / périphérie des dynamiques mondiale et européenne, EuroBroadMap project 2009 – 2011 of the DG Regio and DG Research (map adapted by Vandermotten & Marissal, 2004)

[22] Source: PIPAME (2011), Industrie automobile : facteurs structurels d'évolution de la demande, DGCIS prospective.

[23] Source: European Commission

[24] Around 382 000 gross jobs in the German renewable energy sector in 2011 according to the most recent study ordered by the German Ministry for the Environment.

[25] Source: Mark Huberty and Georg Zachmann (mai 2011), Green exports and the global product space : prospects for EU industrial policy, Bruegel Working Paper

[26] See Robert Mundell (2003), Une théorie des zones monétaires optimales, in Revue française d'économie, Volume 18 N°2, pp. 3-18 : "In the real world of course, currencies are mainly the expression of national sovereignty. Monetary re-organisation will only be possible if it goes together with in depth policy changes"

[27] This plan should be based on the SET plan (plan for strategic energy technologies). A similar approach exists in the transport sector. Apart from future sectors with high potential sectors like energy, transport, IT, communications and biotechnologies have to be covered as well as the traditional sectors like metallurgy, textiles etc ....

[28] These roadmaps could use the experience acquired in " European industrial initiatives " created by industrial players in various areas (wind, solar, bio-energy, nuclear, capture and storage of carbon, networks) as part of the SET plan.

[29] See Philippe Aghion, Julian Boulanger, Elie Cohen (June 2011), Rethinking Industrial Policy, Bruegel Policy Brief

[30] See Lirzin Franck (2012), For European Centres of Innovation and Industry, European Issue n°230, Robert Schuman Foundation, 27th February 2012.

[31] See Riccardo Crescenzi, Andrés Rodríguez-Pose, Michael Storper (2008), The Territorial Dynamics of Innovation: A Europe-United States Comparative Analysis : "Despite coordination glitches – such as the recent wiring problem in the new Airbus 380 – Airbus has shown that complex collaborative innovation arrangements can work and compete with more geographically integrated systems. And recent advances in telecommunications and transportations may help increase the viability of the more diffuse European systems of innovation. The question is whether, at some point, these represent viable functional alternatives to the American process geography, i.e. capable of helping Europe overcome the innovation gap."

Publishing Director : Pascale Joannin

On the same theme

To go further

Businesses in Europe

Olivier Perquel

—

16 December 2025

Digital and technologies

Josef Aschbacher

—

9 December 2025

Democracy and citizenship

Florent Menegaux

—

2 December 2025

Democracy and citizenship

Jean-Dominique Giuliani

—

25 November 2025

The Letter

Schuman

European news of the week

Unique in its genre, with its 200,000 subscribers and its editions in 6 languages (French, English, German, Spanish, Polish and Ukrainian), it has brought to you, for 15 years, a summary of European news, more needed now than ever

Versions :