Economic and Monetary Union

Edmond Alphandéry

-

Available versions :

EN

Edmond Alphandéry

Introduction:

As a Minister for the Economy in France in the 90's I have been involved in the march towards the euro. When the euro was launched in 1999, I created the Euro50 group because with other European personalities I considered at that time that the creation of the European currency was an unfinished business, and that looking ahead we might hardly avoid travelling on bumpy roads. This is precisely what happened ten years later. I have to add that in my capacity of Chairman of CNP Assurances, the leading French life insurance company, I am now following the current euro crisis from the viewpoint of a private investor.

Looked from abroad, the eurozone is too often described as being on the verge of collapse. This is certainly an outrageous picture. We all know that if there were a breakdown of the euro, then no country in the world would be spared. Consequences would be tragic everywhere. I do not think there is any probability at all of a blow out of the eurozone. There are certainly problems which I will examine with you today. But one has to keep in mind that the European economy remains strong. Its industry, its financial sector and its commercial network remain in good health and competitive. As far as the outlook of the euro crisis is concerned, eurozone gross domestic product contracted -0.3% in the last quarter of 2011. And it is moving closer to a recession (defined as two successive quarters of negative growth). But one can remain confident. There are signs (which I will describe later) that the situation has significantly improved since the beginning of this year. The new stance of ECB monetary policy, the "fiscal compact" in preparation in the Treaty, the building of a significant firewall, the last bail-out agreement on Greece of February 21st, are creating a momentum which may herald a return to a more stable and rosier environment.

Let me today raise for you three fundamental questions which will help me to give you an overall view of the current euro crisis [1]:

1. Why have European sovereign states, each of them with different economies and policies, decided to adopt a common currency?

2. How did the euro perform during its 10 first years, from 1999 to 2009?

3. And about the euro crisis itself: why this crisis? How did it evolve? And how did we face it?

1. Origin of the Euro

On the first question (Why have different European countries embarked into the adoption of the lengthy and complicated process of creating a unique currency?), let me briefly recall some historical facts:

- In 1957, the so-called six founders countries (France, Germany, Italy and the Benelux) decided to put in place a common market among them by the signature of the Treaty of Rome, which expanded in 1967 to form the European Community; then in 1992, the Maastricht treaty gave rise to the European Union. This common market which later was given the qualification of a "single market" boosted commercial and economic activities among its Member States, and as such it played as was intended, the role of a strong catalyst for growth and therefore prosperity for all the members countries.

- In this Union, we definitely made a choice, since its creation, of a regime of fixed exchange rates between the domestic currencies, because we thought that this system would foster exchanges inside this common market. After the demise of the Breton Woods system in 1971 and the generalization of floating exchange rates, we therefore put in place some kind of more or less fixed rates between our currencies: the "European Monetary system" (EMS).

- After a lengthy process and many debates involving political and doctrinal arguments, we ended up in the Maastricht Treaty in 1992 to creating a step by step unique currency which was justified on three main grounds:

• Economically, mainstream thinking was that having a unique currency would enhance trade and foster economic growth. Which it did indeed!

• Technically, the EMS proved to be instable and difficult to handle. It pushed Member countries into frequent painful currency adjustments. After the full liberalisation of capital in the early 90s, the EMS fell under the law of the so-called "Mundell's impossible trinity", i.e. we could not simultaneously have fixed exchange rates, free capital movements and independent monetary policies. In this respect the D-Mark was the anchor of the EMS and it was hazardous for any Central Bank of other Member countries to stray off the monetary policy stance adopted by the Bundesbank.

• Politically, the European Central Bank was designed as a "federal" institution. The European currency was therefore a decisive step towards integration of European states. You have to keep in mind that in the Maastricht Treaty all European countries were supposed to adopt the European currency, two countries (the UK and Denmark) having negotiated an "opting out".

The framework which has been designed in the Maastricht Treaty under the acronym of EMU (Economic and Monetary Union) was founded on two pillars: a monetary pillar which was very strong and solid (and still is), and an economic one which having been ill-conceived has been weak since its inception.

The monetary side of EMU which was emulated on the model of the German Bundesbank rests on three main tenets:

1. The independence of the ECB: in its conduct of monetary policy for the eurozone, the European Central Bank is not allowed to receive any commitment or order from any political body whatsoever. In this respect, the ECB is probably among the most independent Central Banks in the world.

2. The mandate of the ECB is strictly confined to the maintenance of price stability: contrary to the FED for example, the ECB is not committed to support growth or employment.

3. The ECB is prohibited of any monetary financing in favour of Union's institutions, central or local governments. In other words, the ECB is not allowed to buy public bonds issued by Member States on the primary market.

In sharp contrast with this hefty monetary pillar, the economic side of EMU has remained seriously wanting: it did not fully draw the consequences of the economic diversity of the various Member States and also of the decentralized decision-making in the eurozone.

Whereas monetary policy had become a federal competence, economic and fiscal policies were fully remaining in the hands of Member States.

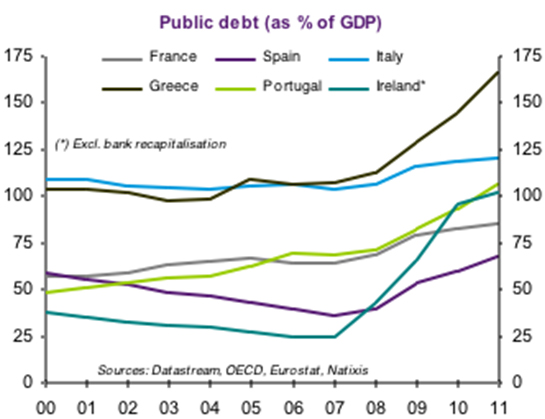

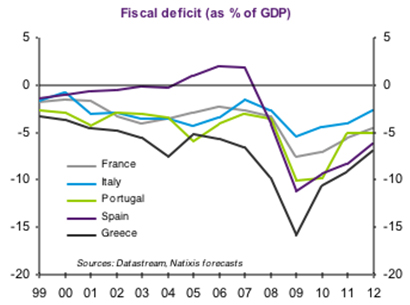

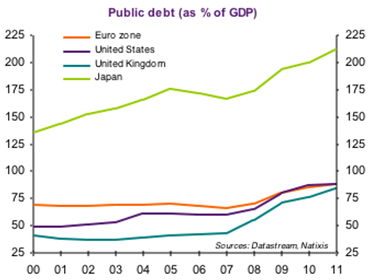

Enshrined in the Maastricht Treaty and later detailed (in 1997) in the so-called "Stability and Growth Pact" were the two ceilings of 3% of fiscal public deficit to GDP and 60% of public debt to GDP ratios, which each Member State was required to abide by. But due to poor enforcement procedures, these rules have been violated, even by Germany and France. Worse, during the world financial crisis in 2007-2009, in order to avoid the world economy to fall into a depression, governments were incited by international bodies (the IMF or the G20), in the pure Keynesian tradition, to expand public expenditures and accept, at least temporarily, higher budget deficits.

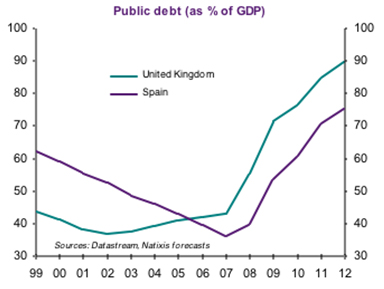

No wonder that in Europe, as you see in the graph, there is an upward move in the rate of public debt increase after 2007. It is telling that this acceleration is more pronounced in the peripheric countries which later on have been hit by the euro crisis.

Let us now have a look at the performance of the euro since its inception in 1999. Two periods need to be considered: from 1999 to 2009, the euro performed remarkably well, whereas since early 2010 the eurozone entered into a crisis which is less about the euro itself than about the public indebtedness of some of its Member States.

2. The successful years: 1999-2009

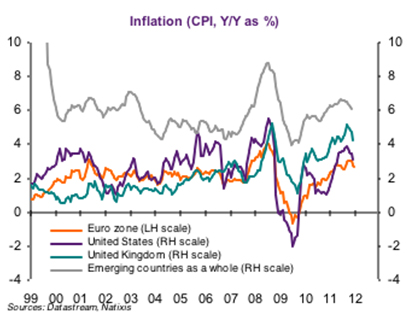

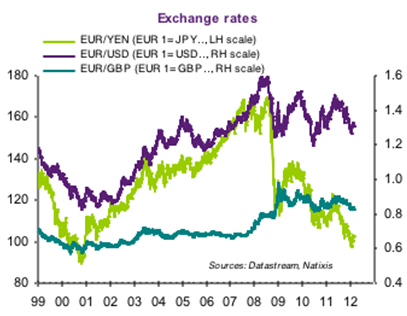

1. During its first decade of existence, the European currency fared remarkably well: its inception which was a perilous exercise took place without any hitch. During all this period, the price level remained stable; the value of the euro on the foreign exchange remained strong. In terms of economic growth, the eurozone economy compared favourably with the other OECD countries.

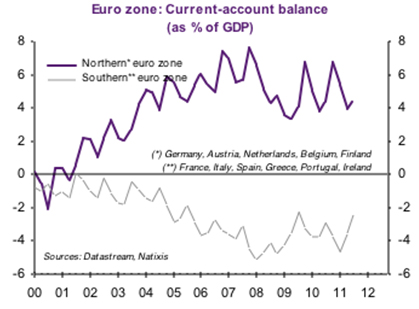

2. Now if you look inside the eurozone, you will observe interesting disparities. First, in terms of balance of payments, there is a clear divide between countries of the north of the euro area (Germany, Austria, The Netherlands, Belgium and Finland) which post a (rising) current account surplus and countries of the "South plus Ireland" (France, Italy, Spain, Greece, Portugal, Ireland) which have a current account deficit.

Clearly, countries in the south have been living beyond their means. By spending more than they produced, they gave birth to a fundamental disequilibrium inside the eurozone which is at the core of the current crisis.

Two explanations to this phenomenon can be drawn from both sides of the macroeconomic equilibrium:

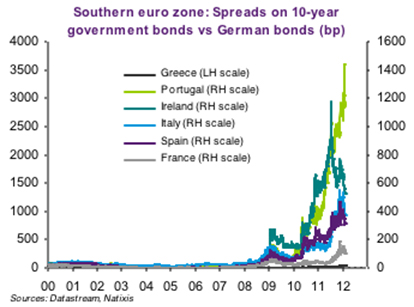

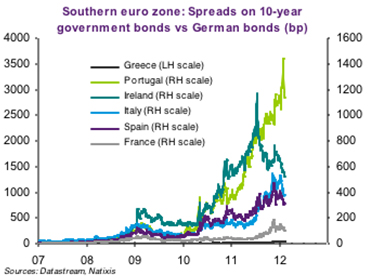

• On the demand side, from the birth of euro up to the financial crisis (2008), investors have been under-pricing the risk: default risk on Government bonds were being considered as practically non existent in all Member States: therefore the spreads vis-à-vis the German bunds remained near zero.

There was therefore a strong incentive to spend (public and private) and invest in housing: hence housing bubbles in Ireland and Spain. Overspending was the consequence of too low interest rates which were a consequence of the mispricing of risk by the markets.

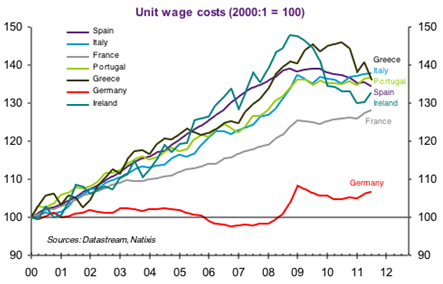

• But there was also another origin which can be found on the supply side: these current account disparities reflect also discrepancies in competitiveness.

You can see on the graph that wages have risen much faster in countries from the "South plus Ireland" than in Germany.

To what extent is the euro to blame for this divide? This question goes to the heart of the debate on the single European currency. For my part, I believe that one of the main innovations the euro has introduced has been the elimination of the external constraint for the Eurozone States. On the face of it, they no longer had to worry about the consequences of a current account deficit. Under the pre-euro European monetary system, the exchange rate acted as a guard rail: whenever a country strayed from the path of discipline needed to keep its currency stable, it experienced a foreign exchange crisis which forced it to restore order to its finances and economy.

By eliminating this external constraint, the introduction of the euro allowed some countries to persistently consume more than they produced. They were able to continue growing their economies for a while by accumulating debt. But when the level of debt – both public and private – got too high, the party was over and the problems began.

So what was the euro's role in all that? It's worth remembering that Germany was one of the countries that joined the euro with a current account deficit and therefore a lack of competitiveness. However, by focusing on improving its competitiveness over the long term, in particular through a policy of wage restraint, and by giving priority to structural reform, Germany ended up reaping the benefits of its supply-driven strategy. Those countries that chose to follow a demand-driven strategy by promoting consumer spending and also home building, continued to flourish for a time due to their membership of the Eurozone. But they were building up serious problems for themselves in the future, as we can see today.

The crisis has taught us that we have under-estimated the effect of the removal of the external constraint. It taught us that the discipline resulting from the external constraint needs to be replaced by discipline imposed within the Eurozone which must go much further than the Stability and Growth Pact. It has to cover each Eurozone State's economic policy and credit terms, in order to ensure that they don't live beyond their means. It taught us that a "one-size fits all" monetary policy must be supplemented by special requirements for each Member State which could take the form of specific required capital ratios or required reserves ratios applied to their domestic banks.

3. The Eurozone crisis: 2010-2012

The crisis started its course in the sovereign debt markets in the peripheric countries. It has reflected on the European financial sector and ended up on the real economy of the eurozone which has been teetering on the verge of a recession since the fall of last year. Let me briefly comment on each of these three aspects of the crisis: the sovereign debt crisis, the financial sector, the real economy.

3.1 The sovereign debt crisis

Eurozone Member States which posted high fiscal deficits and high or increasing levels of public debt started to raise serious concerns about sustainability of their public finance (see graphs). Greece was the first country which during the spring of 2010 forced the European Union to put in place an assistance mechanism. The question that needs to be addressed is to explain why countries of the euro area which figures according to international standards were no worse than in other countries outside the eurozone (the US, the UK) suffered large sales of treasury bonds which enlarged the spreads of their interest rates, and forced the European Union to intervene either in the framework of the European assistance mechanism (EFSF) (Greece, Ireland, Portugal) or through the purchase of sovereign bonds by the ECB on the secondary market (Spain, Italy).

In an insightful paper [2], Paul de Grauwe and Yuemi Ji point out that the countries which suffered a surge of their spreads were precisely those where during the first decade of the euro the sovereign risk had been under-priced. Markets overreacted to this risk, leading to what Paul de Grauwe and Yuemei Ji call a "bad" equilibrium: compared to a "good" equilibrium where an increase in interest rates is a disciplinary incentive for the country to go back to its "fundamentals" (through reduction of its public and private expenditures), in a bad equilibrium, this rise leads a country like Greece in a self fulfilling process away from its "fundamentals", due to an increase in public deficit caused by a built-in surge in interests payments and a fall in taxes induced by the contraction of economic activity.

There are various explanations to this risk overpricing:

• First, it does not seem abnormal that after a long period of risk under-pricing, the market starts to overreact in the opposite direction when figures start to be worrisome.

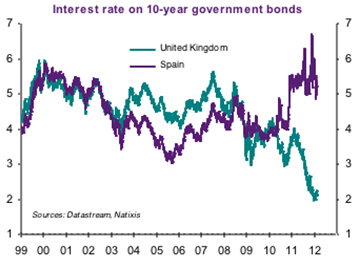

• Second, contrary to stand alone countries (the UK, the USA), the absence of a Central Bank as a potential lender of last resort on sovereign bonds enhances the risk of default. This phenomenon appears clearly when we compare the situation in Spain and in the UK (see graphs) as Paul de Grauwe rightly points out.

Hence the necessity - in order to fight contagion in the eurozone (presently to Italy and Spain)- to build firewalls of a significant size. The European Union is presently trying to be capable to mobilize up to 1 trillion € not only through the current European Financial Stability Facility (EFSF) and the new European Stability mechanism (ESM) but also thanks to international lenders like the IMF. There is a debate between Germany and all other Member States (including other AAA countries) about the size of this firewall. But anyhow, there is a consensus that this is a major tool against the crisis.

Nevertheless the best strategy to fight this surge in the spreads is to incite countries to put their house in order. Significant progress has been made in this respect in the euro area. In all the countries hit by the crisis (Ireland, Greece, Portugal, Spain and Italy), governments committed to fiscal rectitude have recently been put in place. Their endeavour is already bearing fruit: self fulfilling movements play on both sides. When markets think the government to be more solvent, borrowing costs fall (see graph) because it is unlikely to get bankrupt. In Italy the technocratic government led by Mario Monti has been able in a matter of a few weeks to overhaul the pension system, liberalize a raft of monopolistic industries and crack down on tax evasion. As you see, this country ten year bond yield which was above 7% in the end of 2011 has dropped in a matter of weeks to 5.5%. There is also relief in Spain which has seen a sharp drop in its 2-year treasury bond, whereas Portugal is continuing to suffer despite its endeavour to reduce its fiscal deficit, to move decisively on its privatization program and to engage in sweeping social reforms. Ireland is the best pupil in class. Its ability to meet deficit reduction targets and its return to economic growth driven by its exports have impressed the markets. And it is already preparing for an exit from the EU-IMF assistance program at the end of 2013. The yield on 5 year Irish bonds fell from 18% (July 2011) to 8% (February 2012).

Greece which accounts for no more than 3% of the euro area GDP remains the weak spot of this overall comforting picture. In spite of significant improvements which you can see on the 3 graphs which have been given to me by the Greek Prime Minister, Lucas Papademos, whom I visited in Athens on February 2nd, confidence is still lacking.

Despite a new austerity program comprising a cut of 22% in the minimum wage, a reduction of government jobs, a freeze of all salaries, there still remains a doubt on the commitment of the Greek political class to fiscal rectitude and structural reforms.

On the public side, last Tuesday (February 21st), agreement has finally been reached for a second bail out of €130 billion after the first bail out of €110 billion. On the private side, a huge haircut on the Greek public debt (in the order of 75% of its face value, one of the largest debt's restructuring in history) is to be agreed by a majority of private holders. It is expected to reduce the Greek public debt by €140 billion. Will this be enough? Some are asking the Greeks to better deliver on tax evasion or on their privatization program. Others emphasize that more austerity makes return to fiscal equilibrium even more problematic (the "bad equilibrium" issue). Hence a call for more assistance. Both orientations are probably simultaneously needed.

As a passing remark, let me point out that private sector involvement (PSI) may entail drawbacks by fanning the flames of market fear of payment default and haircuts in other countries; this may create distrust among investors and therefore to the unloading of Sovereign bonds. It may therefore be used with caution. Which leads me to the second aspect of the euro area crisis which is about its financial sector.

3.2 The financial sector

There is a clear link of the sovereign debt crisis with the financial sector through its exposure to debt holdings of the ailing countries. This interaction goes in both directions: a deepening debt crisis weakens the financial sector because of its holdings of public bonds which value is negatively impacted by the crisis. But a weaker financial sector has a reduced capacity to grant loans, which may have a negative impact on economic activity, on tax receipts and therefore on public debt. No wonder that much attention is therefore focused on the European financial sector. Let me make two short comments in this respect:

1. First on Ireland. Its public debt to GDP ratio before the crisis (end 2007) compared to nowadays has exploded from 25% to more than 100%. This explosion is due to the fact that the Irish banking sector got bankrupt after the burst of the housing bubble in this country during the world financial crisis. Forced to bail out a banking sector which size was too important according to its funding capacity, the Irish Government was obliged to ask for help from the European Union and to enter into the European assistance mechanism: a banking crisis has been transmuted into a Sovereign debt crisis.

In the euro area which has an integrated monetary policy, the banking systems remain largely national. You can see this feature in the following table taken from a Bruegel policy contribution by Jean Pisani-Ferry [3].

The Irish case shows that despite progress in the pan-European banking supervision architecture (with the creation of the European Banking Authority and the European Systemic Risk Board), there is still a device missing at the European level to take care of the bail out of a national banking sector which bankruptcy may entail a systemic risk for the whole euro area, when the country does not possess the funding capacity to bear the bail out by itself.

2. My second comment is about the recapitalization of European banks.

In order to strengthen the banking sector, policy makers are drafting regulatory rules across the EU known as Basel III. Last summer, fearing an insufficient resilience of the European banking sector to the euro crisis, the European Banking Authority, under the pressure of the IMF, forced the European banks to increase their capital ratio, according to a timing well in advance to the Basel III agenda. This increase in the capital of the banks was already underway in 2011 as shown in the following table.

I do think that this insistence, even through perfectly justified, was ill-scheduled. It has led many banks to start a process of reducing the amount of credit lent to the economy at a time where the eurozone was already slowing down, thereby raising the prospect of a recession, the worst scenario that can be imagined for the euro crisis. Which leads me to the third dimension of the crisis, which is about the real economy.

3.3 The real economy

Late last year Eurozone industrial production contracted sharply, possibly, heralding a eurozone recession. There are at least three reasons for this downturn:

1)

As mentioned earlier, an early tightening of bank required capital ratios which have contributed to put the eurozone economy on the verge of a credit crunch.

2)

The negative impact of economic policies followed in peripheric countries which led some of them in recessionary territories (Greece, Portugal, Italy and Spain).

3)

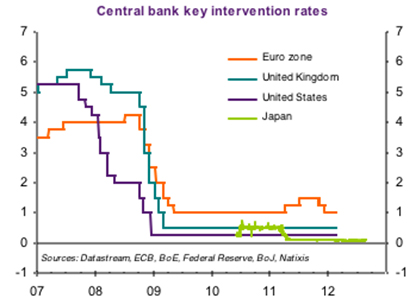

The rather relative strict monetary policy of ECB as compared to other Central Banks (the FED, the Bank of England, the Bank of Japan), which can be observed on the graph which gives the key intervention rate target of the main Central Banks:

The evolution of the crisis and the near breakdown in trust last fall lead the ECB to intervene. After the December 9th European Summit where Member States committed themselves to sign a Treaty to respect fiscal attitude, the ECB took a decisive step: instead of focusing on bond buying program, on December 21, 2011 the new President of the ECB, Mario Draghi, launched a long term refinancing operation (LTRO) to be renewed on February 29, 2012, allowing banks to borrow liquidity at will at a cost of 1% for a three-year time. Its effect was dramatic. Just before Christmas, 523 banks borrowed an amount of € 489 billion. This decision which was permitted by the adoption of the new "fiscal compact" binding eurozone politicians to stronger rules on public finances provided a wall of money which, as Mario Draghi rightly said, "avoided a major, major credit crunch". It also contributed to reducing the pressure on the sovereign debt markets of peripheric countries, many banks using this cheap liquidity to undertake carry trade operations on these treasury bonds.

By reducing in a first move last fall its target rate of 50 basis points, then by launching this LTRO operation, the ECB has embarked into a monetary policy which is in my view more in line with the needs of the eurozone. For the euro area to cope efficiently with the euro crisis, the right policy mix is presently to couple an unavoidable restrictive fiscal stance with a more accommodative monetary policy. I recently spoke in Davos with Nouriel Roubini, (dubbed "Mister Doom"), and we at least agreed on that point that the eurozone cannot afford to pursue a monetary policy which is more restrictive than in the US, in the UK and in Japan. In this respect, it is interesting to notice that the Mexican President, Mr. Calderon, whose country is in charge of the G20, is publicly advocating for a weaker euro.

Conclusion:

Let me conclude this presentation by a comment on the euro itself. The euro crisis led many economists, commentators and even politicians to predict that the eurozone would blow out and that the European currency would eventually disappear.

What we observe today is that if the crisis is certainly not over, the landscape nevertheless has dramatically changed. The mood today is much less pessimistic. New Governments are undertaking courageous and painful policies. Despite all the suffering, none of these Member States ever contemplated the prospect of their country leaving the euro. Look at Greece. When I was in Athens a few days ago, I realized that the great majority of the Greek people did not want to be out of the euro area and were ready to accept the sacrifices which were necessary for them to stay in the euro area.

The current crisis is proving the resilience of the European currency: it remains attractive not only to states inside the euro area, but some in its periphery are still knocking at the door.

In 2000, shortly after the launch of the euro, I wrote a book arguing that countries adopting the common currency should be forced, due to the euro, to undertake the necessary reforms. Ten years later, structural reforms concerning the pensions system, the labour market, competition in many sectors, privatization, reduction of the size of the public sector, are underway or planned in all the euro area countries which are in need for them. If during the first ten years of the European currency the euro alone could not be a sufficient trigger, the crisis of the euro zone, precisely because it was constrained by the discipline imposed by the common currency, is forcing all the Member countries to do their homework. And there is no doubt that at the end of the day all of them will be more competitive, more robust and they will end up with an economic, fiscal and social framework more efficient and better fitted to the harsh rules of globalization.

At the European level, the crisis forced Member States to strengthen their common governance. With the adoption of the Euro Pact, they are enhancing multilateral surveillance among them. They have also designed new tools to fight the crisis and to provide the necessary assistance to countries in need of help. And Article I of the new Treaty under adoption, intends precisely to "strengthen the economic pillar of Economic and Monetary Union by adopting a set of rules intended to foster budgetary discipline through a fiscal compact, to strengthen the coordination of the economic policies and to improve the Governance of the euro area".

Jean Monnet, the founding father of the methodology of the European construction, presciently observed in his "Memoirs" 35 years ago: "the European construction is moving ahead during crises and it will be the sum of the solutions brought about in order to overcome them".

Once again, the magic of the European construction is exercising its effects in front of us. Nothing is definitely settled. But who can deny that albeit painfully we are moving in the right direction?

In order to put a definitive stop to the systemic dynamic which has destabilized the eurozone, is it enough to institute a set of rules that every country should have to adhere to? I am belonging myself to the school of thoughts which thinks that a genuine, quantum leap forward is needed to establish federal structures together with economic power at the eurozone level under the democratic control by parliamentary institutions. We have to think this through with the vision and ambition that the seriousness of the crisis commands. But we must acknowledge that a significant part of the task is already underway.

[1] Speech given at Renmin University of China - Beijing, February 26th 2012

[2] Paul de Grauwe, Yuemei Ji, "Mispricing of Sovereign Risk and Multiple Equilibrium in the Eurozone", unpublished, Leuven, January 2012.

[3] Jean Pisani-Ferry : "The Euro Crisis and the New Impossible Trinity", Bruegel Policy contribution, January 2012.

Publishing Director : Pascale Joannin

On the same theme

To go further

The EU and Globalisation

Olena Oliinyk

—

3 February 2026

Strategy, Security and Defence

Jean Mafart

—

27 January 2026

The EU and Globalisation

Iana Dreyer

—

20 January 2026

Asia and the Indo-Pacific

Earl Wang

—

13 January 2026

The Letter

Schuman

European news of the week

Unique in its genre, with its 200,000 subscribers and its editions in 6 languages (French, English, German, Spanish, Polish and Ukrainian), it has brought to you, for 15 years, a summary of European news, more needed now than ever

Versions :