Industry

Franck Lirzin

-

Available versions :

EN

Franck Lirzin

It is custom to speak of de-industrialisation and how not to do it, whilst in 20 years the share of industry in the European GDP has decreased by 28.2%, and now represents less than one quarter of the EU's GDP. Service outsourcing, globalisation and technological developments have entirely changed the face of industry, but our view has not changed.

In reality and unlike the USA, which is often quoted as a comparison, the EU is managing to maintain its position in the world goods trade. In 1958 its exports represented 23.9% of the world total, against a present 16% [1], whilst the USA has declined from 27.8% to 11.2%. Its trade deficit with the rest of world remains relatively limited, around 0.5% in 2011; the euro zone even experienced a surplus of 1.1 billion euros in October 2011. And this deficit is mainly due to energy imports, whilst Europe remains mainly in surplus in terms of chemical products, industrial machines and cars.

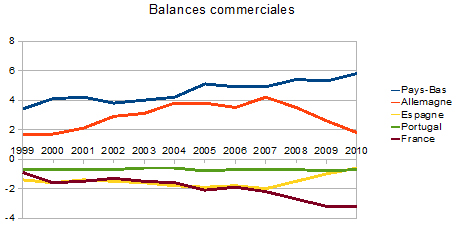

Whilst some countries like Germany and the Netherlands enjoy significant trade surpluses, others like France and Spain suffer chronic deficits. The Economic and Monetary Union opened the way to the unprecedented integration of national markets, thereby leading to an overall improvement of living standards. But this growth has gone hand in hand with major imbalances within the European Union between exporting, industrialised countries and others which import and foster domestic sectors or which find it necessary to rely on credit (construction industry). Warning mechanism, such as exchange rates and interest rates, have no longer played their role in preventing imbalances. The "euro zone" crisis has primarily been one of the EMU's economic model: the EU has take stock of the problem and re-introduce elements of industrial policy into its economic policy tools – and not focus so much on the quality of the economic environment (labour market, infrastructures, respect of competition) but rather on each territory's ability to produce exportable goods. If it does not want to limit itself to financial transfers between countries ad vitam aeternam, the EU is going to have to draw up a European industrial policy.

This policy would aim to restore investor confidence and return to a growth path. Far from wanting to reproduce major French-style programmes, this means being flexible and drawing up an industrial policy that can be used like a tool box and which has to adapt to each sector, each situation and each country. Hence when it comes to developing a chemical industry in Greece, this would mean subsidising R&D, helping to build the necessary human and industrial capital, to build adequate infrastructures, creating strategic trade partnerships to develop local markets and even to introduce regulation. Public authorities, as well as investors and industrialists will have to work together from a resolutely European standpoint.

The creation of European Centres of Innovation and Industry (ECII), that are spread across Europe and specialised in certain technological areas and linked together by a network, would be a major step forwards in fostering an improved integration of European industry – not only would this lead to the circulation of capital, but also of men and ideas.

1. European industry, decline or revival?

The 2008-2009 crisis, the death blow for industry?

The figures seem to speak for themselves: in 20 years the share of European industry in the GDP has fallen from 33.3% to 23.9% [2]. Naturally this is reflected in the net destruction of jobs: the share of industry in total employment dropped from 21.9% in 1995 to 16.9% in 2010, i.e. 6.5 million jobs less, with a sharp drop between 2008 and 2009.

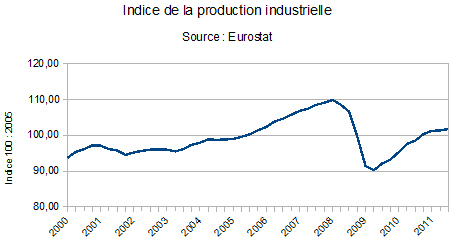

The 2008-2009 economic crisis made a major impact on industry, whose output plummeted by 17% in one year and it has now only reached its 2005 level. The crisis accelerated the destruction of jobs in industry and nothing has changed this trend since, whilst industrial output seems to have stabilised again since 2011.

But industry still provides work to 36.3 million Europeans. In a communication released on 17th October 2010 the Commission said that "one job in four lies in the manufacturing industry and at least one other job in four lies in associated services that are dependent on industry, both suppliers and clients", "80% of work in private sector R&D is attributable to industry". Another positive point is that "its average margin is high and it comprises a dynamic network of small companies," recalls Jean-François Jamet [3].

Moving towards a "hyper-industrial" society

A careful assessment of recent developments encourages us to be more measured. Over the years international competition has led industries to focus on their core business. They have outsourced all of their support functions such as communication, accounting and legal affairs, which have boosted the business service sector. Overall industry and its associated services have created 6.2 million jobs since 1995 and represented 71.6 million jobs in 2010.

Globalisation has also increased the risks, whether these are technological, financial or industrial and companies have increasingly had to use financial and insurance services to protect themselves. Businesss is the main consumer of complex financial products: hence they focus on production, and give the responsibility of managing the various accounting risks to the financial and insurance institutions.

Finally the growing complexity of the technologies used, calling on extremely diverse competences, has placed technological innovation at the heart of industrial dynamism. Universities and businesses have had to learn to work more closely together than they have done in the past, notably within clusters.

Although industry occupies a stable or reduced position in terms of production in the economy, this is not necessarily so much a sign of decline but of transformation in industrial activity: it is because industry is everywhere that we can no longer see it.

Far from being post-industrial, with a predominance of service or intellectual activities, our society is rather more "hyper-industrial". To be convinced of this we just have to look at all of the services and goods that are required for the simple production of an iPhone.

The European Union, a major, international industrial player.

The European Union continues to be a major industrial player, representing 16% of world exports and 17.3% of imports, which, excluding intra-community trade, make the EU the world's leading market.

It is remarkable that, unlike the USA or Japan, its trade relations are balanced overall: its trade deficit lay at 159.9 billion € in 2010 [4], i.e. -0.65% of its GDP, in comparison with the French deficit, which represented nearly 2% of the GDP in 2010.

Although its relations are balanced overall, this is only the case on an individual basis: the European Union has a trade deficit of 169 billion € with China and a surplus of 73 billion € with the USA. Likewise it imports its energy and raw materials from Russia and the OPEC countries.

There is nothing surprising in this, it is just an international division of labour, in which Europe imports what it does not have or in which it is not the most competitive, so that it can focus on its strong points. Hence it maintains leadership in a great number of industrial sectors in which its trade balance is in surplus: in chemical products, cosmetics, transformed raw materials (plastic, paper, steel), machines (industrial, energy production), cars and transport equipment in the main.

The only area of high technology where it struggles to remain in the race is in microelectronics. Although European industry has lost its leadership in terms of the most visible products, as far as consumers are concerned, such as computers and clothing, it does maintain it over a number of goods that are not as present in daily life, but which model rather more the world economy. The EU's fundamental role in the definition of international industrial standards, for example communication standards, is a reflection of industrial soft power [5] : the Global System for Mobile Communications (GSM), for mobile phones was established in 1982 by the European Conference of Postal and Telecommunications Administrations (CEPT) and is the main standard for mobile, digital communications.

European Industry, a strategy to move upmarket, but which does not suit everyone

To adapt, and to be relatively successful with regard to new globalised conditions the European Union has chosen to specialise in high tech as part of the Lisbon Strategy and to relinquish its labour intensive activities, such as textiles, to countries with low wages like China for example. This choice has speeded up the change or the decline of certain traditional sectors such as the textile or steel industries, but it has enabled the emergence of new technological sectors such as micro-electronics and biotechnologies, in which European businesses hold international leadership.

In the longer term, this strategy, which is based on the idea of an international division of labour, in which Europe retains its "noble" functions, in R&D and technology, whilst the emerging countries take care of the "meanest production tasks" will come to an end when the emerging countries reach an equivalent or higher technological level than Europe, and when nothing will prevent these "noble" functions from migrating to areas outside of Europe. The USA is already concerned about the relocation of certain R&D work to China. The European strategy over the period 2014-2020 may then be moving in the wrong direction and it should already acknowledge that tomorrow China, India or Brazil will be able to compete with Europe in a greater number of technological areas.

Not all countries have been able to implement this strategy. We just have to look at the R&D work accomplished by each of the European countries: only Finland, Sweden and Denmark have succeeded in rising above the Lisbon goals (3% of the GDP devoted to R&D). France has achieved nearly 2%, Italy struggles to maintain 1.5% and on average the EU achieves 2% whilst the USA rises to 2.7% and Japan 3.4% [6].

Although the European Union from the outside is a major industrial power, the situation of the countries that make it up is much more contrasted. Some have undeniable assets to move towards a knowledge economy and the existence of an integrated European market has undoubtedly presented them with a major opportunity; but many others did not enjoy the same initial advantages and have had to undertake different economic, more opportunist policies, in which the euro zone crisis partly finds its origin.

2. The Economic and Monetary Union, an asset or handicap for the peripheral countries?

The opening up of international trade has fostered productive specialisation in individual countries, according to the Ricardo's theory of comparative advantage. The 1986 Single Act, then the creation of the Economic and Monetary Union as of 1990, enabling the free circulation of goods and capital, led to the creation of a vast, borderless economic area. Whilst the integration of economies was to enable a convergence of living standards and society styles towards a knowledge economy, it has, on the contrary led to major divergence in economic policy. Several factors have played a major role in this.

A geographical centralisation of industrial activities

By removing borders and foreign exchange risks, industrialists have been able to choose where they establish themselves and to concentrate simply on industrial factors and the comparative advantages of individual countries and not on financial or legislative risks. Naturally industries tend to concentrate in order to achieve economies of scale [7]. They focus their production centres but above all they will associate with other industries, laboratories and training centres in a given place [8]. The integration of the markets has fostered the productive specialisation of territories.

But the geographical factor is also just as decisive: industries place their production centres near their clients and in places where they can be delivered easily. The easier it is to export products, the closer they will be produced to the client base and to major communication axes such as ports, rivers, railways and motorways: "in a Monetary Union, industry tends to be establish at the centre and services on the periphery, simply because of transport costs," analyses Patrick Artus and Marie-Paule Virard [9].

But this factor does not explain everything since, for example, Finland and Sweden are extremely distant countries whose industry is flourishing, but it explains in part the concentration of foreign direct investments in Benelux (171 billion € in 2005 [10]) and in Germany (44 billion € in 2005), i.e. half of the investments made in the EU. Between 2001 and 2005, these four countries represented 40% of foreign investments, followed by the UK (17%), with France only representing 9% [11].

Geography is important in the Union: being at the centre of Europe is an advantage in itself.

The Rose effect and the domination of the markets by established companies

Those who created the euro hoped that by doing away with foreign exchange risk, the single currency would enable countries to trade more amongst themselves. They notably hoped that the smallest companies, which when national currencies still existed, tended to trade more on their domestic market, would develop internationally and take advantage of a European sized market.

But if we assess the impact of the introduction of the euro on a country's trade, called the Rose effect, another story emerges. The creation of the EMU, then of the euro fostered businesses that already had a high profile on the markets such as those in Benelux and Germany, and not so much the companies established in peripheral countries like Greece. Only Spain is an exception amongst the "peripheral" countries, with an increase in its trade in the wake of the introduction of the euro. [12]

This development might be explained by the dominant position that French, German and Italian or Dutch companies had managed to achieve on the domestic or adjacent markets and which when the euro zone was created, enabled them to conquer new markets more easily. These businesses that had the advantage of size did not find it difficult to benefit from the opening of the markets, whilst those in the smallest or most distant countries, which were less experienced or weaker, did not succeed in conquering any new markets [13].

In a bigger, more open territory the price to pay by a new comer in the industrial sector has increased: can we believe it possible for Greece to develop a chemical industry when we know the capital required to do that and above all, the competition a young company would immediately be up against?

Warning mechanism that usually play a role, for example rising interest rates in the event of rising debt or exchange rates that worsen when there is a trade imbalance, have no longer done so in a single currency zone in which interest rates converge. There has been nothing to prevent the excesses of economic models.

Opportunist or strategic economic policies?

When the common market, then the euro was created, countries had to adopt economic strategies or make initial allocations that met their specific needs and they had to adopt new rules. Hence the Netherlands were able to strengthen their role as a trade flow entry point towards the rest of the continent; the UK took advantage of a consolidated financial market, German industries were able to develop in Central and Eastern Europe and to sell on much vaster markets. Initial allocations should be interpreted as being assets that the countries were able to use in the new integrated market of Europe: geographical positioning, cheap labour, a business-friendly economic environment, an innovation-friendly eco-system.

Some of these factors can be improved by appropriate, voluntary based economic policies that play on taxation, labour law or on the improvement of higher education, to lead to a harmonised European economic model. Via the Structural Funds the European Commission plays a major role in the convergence of economic models, but some geographical or historical linked factors cannot move along at the same pace, nor are they inter-changeable. The European economy will never be uniform simply because of the multiplicity of types of capitalism, which are quite often firmly established both culturally and politically and because of European geography.

Countries' economic strategies have been based on various factors but they have not been coordinated on a European level. Whilst Spain has encouraged a domestic market that was supported by a real estate bubble, thanks to relatively low interest rates and high private debt, Germany, via structural reforms e.g. Hartz between 2003 and 2005 [14], relaxed its labour market to make industry more competitive. Both countries have followed individually rational strategies but which have led to major trade imbalances in the euro zone.

The creation of the EMU tended to erase the warning mechanism that might have pulled the alarm earlier; it tended to lead to the idea that sooner or later everything in Europe would look the same and that differences would dissipate. In this sense States' strategies have been opportunist, since they have not had to face reality: had Portugal and Greece not been in the euro zone their public finance and competitiveness problems would have come to the surface earlier and their effects would have been less disastrous.

Countries have not been encouraged to improve the factors that could have been improved: the major differences in results between the World Bank ranking in terms of how easy it is to do business (Denmark comes 5th, Greece 100th out of 184 countries) and the summary innovation indicator of the European Innovation Scoreboard (Slovakia scores 269, and Sweden 750 out of 1000), prove this. On the contrary convergence in interest rates and the illusion of a shared, homogeneous euro zone has encouraged countries to develop sectors that are relatively protected from both European and world competition, such as the building and services sector, by using a leverage and debt effect instead of improving their international competitiveness.

Hence, individual States have adopted rational strategies but without really facing reality or coordinating between themselves. There has been opportunism, which was undoubtedly unplanned, but we should wonder whether, given their geographical handicap or their lack of initial capital, countries like Portugal and Greece could have have developed their industrial base by making vast reforms to their economy.

From de-industrialisation to the euro zone crisis: the challenge of intra-EU imbalances

By choosing to support domestic growth and sectors that are protected from international competition, to the detriment of sectors that favour exports, such as industry, countries have been exposed to the risk of a downturn in their trade balance. According to Patrick Artus and Marie-Paule Virard "since de-industrialisation has led to the emergence of a chronic external deficit, it means that the economic agents of a said country fall permanently into debt so that they can fund the current deficit. Until the crisis, it was of concern for the private sector. Since 2008, it has been the public sector's turn". [15]

The worsening of public finance in Europe is linked to de-industrialisation and imbalances in the trade balance: the settlement to the euro zone crisis implies a return to balance in trade between European countries.

At present this return to balance implies internal devaluation – ie a reduction in labour costs to reduce imports (buying power is weaker) and an increase in exports (production costs are weaker). This policy is extremely painful from a social point of view and is uncertain in terms of its results: Spain seems to be on the right path, but this is not the case either with Portugal or Greece.

Another solution would have been to create transfer mechanisms between territories in the shape of budgetary federalism [16]. But it is just as difficult to move along the path towards greater political and social integration as it is to re-industrialise a country.

3. Towards a European territorial, differentiated industrial policy

Within this economic and monetary context the idea of an "industrial policy" takes centre stage but it would be wrong to believe that it had totally disappeared from people's minds until now. The European Commission attaches great importance to innovation and supports major community R&D programmes, such as the Galileo satellite programme.

Within the EU, the idea that the States have of what "industrial policy" is varies greatly: for some it should be limited to creating a healthy, stable, economic environment, by guaranteeing free, undistorted competition, for others it might take the shape of State supported R&D programmes and the constitution of "European champions". The European consensus found to date is mainly based on a horizontal approach to industrial policy: this aims to harmonise national economic systems from a tax, regulatory and environmental point of view to guarantee free, undistorted competition, to promote higher education, research and innovation and to develop infrastructures for the transport of goods and information necessary for the integration of the European area. The tools available are numerous, from the structural fund, to negotiations on industrial regulations, but they are still based on the idea that the community level must only enter play when the market can no longer do so and in the respect of every country's sovereignty, according to the subsidiarity principle.

Although this laissez-faire enables businesses to define their strategy more freely and intelligently, it sometimes this leads to situations that are contrary to general interest: the car industries for example have no interest in producing clean vehicles and regulation is necessary to force them to do this. Likewise a rise to power of internet businesses based on personalised advertising raises issues in terms of protecting private lives, that can only be settled via regulation The geographical concentration of productive activity answers the same logic: industries tend naturally to focus on their core business but this weakens territorial unity. In this case political action is legitimate to guide industrial strategy and to bring them to focus on public interest.

Harmonising the economic environment or promoting difference?

The concentration of innovative activities at the heart of Europe and the influence of cultural and geographical factors should lead to the relativization of this horizontal approach. Since there is a lack of economic policy coordination and in fine of national industrial policy the difference between the territories cannot really be taken into account. Without citizen mobility and transfer mechanisms that guarantee a counterbalance, Europe has to learn to coordinate its action from a territorial point of view to achieve its goal of harmonising living standards and limiting geographical inequalities as much as possible.

However harmonisation does not mean convergence towards a single European model: given the geographical, cultural differences and the variety of capitalist models, this would be aberrant. On the contrary, the specialisation of regions that falls in line with that of other regions would improve the well-being of all. This specialisation might be technological, such as the aviation industry in Toulouse or telecommunications in Finland; but it might also be based on tourism or traditional activity, such as the perfume industry in Grasse. This is all the more important since as one study reminds us, [17] "competitiveness in innovative sectors is not enough to improve employment and growth across the entire economy". In other words it is not in the interest of all regions to move towards a knowledge economy.

The European Commission has started to adopt a more vertical approach in terms of industrial action via stronger sectoral policies, for example in telecommunications or aviation, and "smart specialisation" or intelligent specialisation, whereby each region commits as a priority to supporting a limited number of sectors. [18] Empirical studies have shown that if regions focused their public action on a limited, but appropriate number of competitive sectors, their economic growth was greater. [19] This action is all the more effective if it includes the entire sector and not a limited number of companies.

The specialisation of territories will only be intelligent if it is coordinated on a community level. Each region is launching itself into race for eco-technological industry: few will prove to be winners and a better coordination would help prevent the formation and bursting of a green bubble. Specialisation can entail following a certain fashion trends and a European vision would help prevent sterile competition.

The European Union, and particularly the European Commission already has most of the necessary tools for a more geographical, sectoral approach but it lacks two things: a more flexible mode of governance and more funding. Europe has to make some strategic choices between the territories and have governance that enjoys the necessary political legitimacy. Not only is legitimacy acquired democratically but also via close work with civil society, industrial representatives and workers. However, too often unions that are established far from Brussels find it difficult to take part in European negotiations [20]; likewise regional public authorities on the periphery of Europe have less information than those in Belgium or the Netherlands. European governance must reflect European geography in order to implement industrial policies in terms of development planning.

Industrial policy as public action's "Swiss army knife"

Contrary to industry in the 60's when major state programmes led to new sectors, modern European industry is typified by its complexity and the increasing integration of all sectors. Europe now lies on the technological border and since it has no model to follow it has to invent its future and the sectors that will lead to its future growth. It is a difficult exercise which cannot be dictated top down, but which must come from local, individual initiatives communicated on a collective level.

However the major differences between the existing and emerging sectors make it impossible to come up with a miracle recipe: helping a chemical industry that requires heavy capital investment would not be done in the same way as the support given to internet start-ups. Only a subtle understanding of the issues at stake in each sector will enable the definition of public policy tools that are best adapted to each individual situation. The relationship between the local level- working with industries to detect and support their first steps - and the national and community levels that make it possible to support the extension of their sectors and their territorial coordination is a vital aspect of community industrial policy.

Some sectors like new energies, the dismantling of ships or the processing of waste are governed by strict regulations. The State then plays a fundamental role in defining the market. Left to their own devices companies do not always take the right innovation path and State intervention is important in defining the regulatory framework which will encourage businesses to develop green non-pollutant technologies [21]. This is true of sectors such as the car industry in which demand is greatly determined by the regulations in force. At this point public authorities can legitimately intervene in terms of regulations and they can then foster the gradual improvement in industrialists' competences, as was the case with the REACH regulation with regard to chemical products.

In other sectors that are open to international competition, technological innovation is a factor of success: pharmaceuticals, aviation, micro-electronics or chemicals. But R&D, notably when it lies upstream, cannot be funded by the market and requires major support on the part of the State. However we have to be aware that this support might be for non-viable projects short term and lead to leapfrogging between governments who reduce companies' margins and impede their own investment capacities forever, as was the case in the micro-electronics industry for example.

In the chemical or pharmaceutical industries significant investment is required initially and state support can be justified if the financial market is unable to support projects like this. Public authorities then play a long term role as investors: in an economy in which business is guided by short term shareholder interests, state players play a vital role in long term risk taking and the sustainability of the sector. States are gradually acquiring sovereign funds, like Norway or France (FSI) but in a community context, it would be necessary to have a tool like this Europe wide: the European Investment Fund (EIF) might be able to make direct investments in businesses, not only in SMEs but also in major groups.

Industrial policy tools are as varied as technologies or sectors. European industrial policy must not just be limited to improving business environments, it also has to take on board the specific features of each sector so that the right levers are activated. The Silicon Valley innovation model is not the only one and is not appropriate for some technologies. In the energy sectors for example end investments are always significant and can only be made by large companies or public authorities: SMEs therefore need leaders of size in order to develop.

We should also wonder whether these support policies in terms of supply and demand are enough to develop an industrial sector, notably in countries where deindustrialisation is widespread. Historically the countries that were late in developing an industrial sector such as Germany and China, have undertaken a policy whereby they have developed their domestic market first by protecting imports before opening up to the outside. Should re-industrialisation take the same path as late industrialisation? State subsidies that distort competition to a certain extent, but which enable the weakest areas to build infrastructures, to improve technologies and to foster local demand, might lead to re-industrialisation.

Creating European Centres of Innovation and Industry (CECII)

Innovation in modern industry increasingly depends on the ability to link technologies that a priori are very different. The ability to connect resources that are a priori different into a network will be the key to tomorrow's growth. Above all a car manufacturer will be someone who puts together technologies that are as leading edge as they are different, ranging from nano-materials to leading edge digital technologies and he will have to learn how to employ the right technological or human resources at the right time in the right place. Geographic and cultural proximity is therefore a significant advantage but the heterogeneous nature of thinking and working methods is also a major stake in drawing up innovative solutions in a complex universe. From this point of view Europe, more than the USA and China, is one step ahead thanks to its long tradition of debate and its heterogeneity.

This mix of technologies is only possible if industries have reciprocal knowledge of one another, either by being on the same site or by sharing joint networks. The responsiveness required to follow market developments and notably to enable production and R&D to work together, will gradually force some industries to relocate their activities.

The EU has a major card to play in developing this new industry by creating meeting points between applied research, varieties of technologies and productive industries. There are examples of this, such as the CEA in Grenoble, which has succeeded in integrating an entire, innovative eco-system around nano-technologies. Hence we might create European Centres of Innovation and Industry (ECII) in Europe. To avoid a geographical concentration within the euro zone, these centres would be geographically spread, across all of Europe and more precisely on border areas or on confluences: Spain/Portugal, France/Spain, along the Danube, etc. [22] These centres would host researchers from all European countries, as is the case for example with the CERN. They would attract businesses and foreign direct investments: there would be an attractive fiscal policy in the ECII zone, reduced red-tape to encourage establishment, plenty of land and long term prospects provided by a European strategy – these are all advantages that will lead to new sectors on the basis of a core of fundamental research. These centres would also enable the circulation, not only of goods and capital, but also and above all of men and ideas – and this is the most important resource in an open, innovative economy.

These Centres might also function according to a cluster approach and contrary to what is happening at present, they might become part of a European strategy. Like Euromediag, there might be a cluster of European alliances focusing on medical diagnosis, the European territorial organisation of these Centres, in which each would be specialised in a specific technology but which would be positioned on a value chain that is complementary with the other Centres.

***

The re-balancing of trade areas will be the major industrial challenge of the next few years. The euro zone crisis may lead to weak growth in some and possibly in all, European territories. And so it is necessary to deploy a growth policy that is modest – since budgetary conditions are not ideal – territorial and differentiated.

Via this growth policy public authorities will be able to foster export sectors, notably industry. De-industrialisation is not a fatality but to re-industrialise it is vital to change our approach and remember that struggling countries are not in this situation only because of poor economic policy, but also because they do not enjoy the same geographic, historic or trading advantages as other, more prosperous States. Although the consolidation of public finance and the reform of the economy are still vital, we must also create more territorial tools that make it possible to compensate for these inequalities: differentiated taxation, the coordination of budgetary policies, the relaxation of monetary policy, the building of Europe-wide infrastructures or European Centres of Innovation and Industry.

The establishment of European Centres of Innovation and Industry would lead to the conditions necessary for pan-European cooperation around major, federating programmes and for the development of industry in peripheral areas. The development of infrastructures and the strengthening of trade relations with the rest of the world would lead to a better use of the linguistic and historical assets of some countries, such as Portugal and Greece.

Most importantly we have to draw up an industrial policy – not as a ready-made set of formula, but as a tool box that we can adapt to every situation, to each sector, to each country in a cooperative framework that is both decentralised and coordinated on a European level.

[1] Source : Eurostat, External and Intra-EU trade, A statistical yearbook, data 1958-2010

[2] Source : Eurostat

[3] Jamet J.-F. (2007), Où va l'industrie européenne ?, Question d'Europe n°82, Robert Schuman Foundation 3rd December 2007.

[4] Eurostat (2011), External and intra-EU trade, A statistical yearbook, 2011 Edition.

[5] Laiki Z. (2008), La norme sans la force : l'énigme de la puissance européenne, Les Presses de Sciences Po

[6] Source : Eurostat, 2009

[7] Krugman P. (1996), La mondialisation n'est pas coupable, MIT, Editions La Découverte.

[8] Porter M. and R.E. Wayland (1995), Global Competition and the Localization of Competitive Advantage, Advances in Strategic Management, Vol. 11, part A, Greenwich, CT: JAI Press, c1995

[9] Artus P. et M.-P. Virard (2011), La France sans ses usines, Editions Fayard.

[10] Source : Eurostat, data not available for the Netherlands after 2005

[11] Eurostat (2007), European Union foreign direct investment yearbook 2007, Data 2001-2005, Eurostat Pocketbooks

[12] Baldwin (2006), The euro's trade effects, Working paper series ECB, n°594, March 2006.

[13] Aglietta M. (2012), Zone euro, éclatement ou fédération, Michalon.

[14] Giraud O. et Lechevalier A. (2008), Les réformes Hartz des politiques de l'emploi, instrument ou reflet de la normalisation du marché du travail ?, Note du CERFA n°54, IFRI, Avril 2008.

[15] Artus P. et M.-P. Virard (2011), Ibid.

[16] Lirzin F. (2010), Pour un fédéralisme budgétaire dans la zone euro, Policy paper, Question d'Europe n°178, 19th July 2010, Robert Schuman Foundation.

[17] McKinzey&Compagny (2010), How to compete and grow, a sector guide to policy, McKinzey Global Institute, March 2010. The author's translation.

[18] European Commission (2011), Industrial policy: Reinforcing competitiveness, Communication from the Commission to the European Parliament, the Council, the European economic and social committee and the Commitee of the Regions, COM(2011) 642 final.

[19] Aghion P., M. Dewatripont, L.Du Ann Harrizon & P.Legros (2011), Industrial policy and competition, GRASP Working paper 17, June 2011.

[20] Wagner A.-M. (2005), Vers une Europe syndicale : une enquête sur la Confédération européenne des syndicats, Editions du Croquant.

[21] Aghion P., Boulanger J. and Cohen E. (2011), Rethinking industrial policy, Bruegel Policy Brief, Issue 2011/04, June 2011.

[22] Jamet J.-F., Klossa G. (2011), Europe, la dernière chance ?, Armand Colin.

Publishing Director : Pascale Joannin

On the same theme

To go further

Businesses in Europe

Olivier Perquel

—

16 December 2025

Digital and technologies

Josef Aschbacher

—

9 December 2025

Democracy and citizenship

Florent Menegaux

—

2 December 2025

Democracy and citizenship

Jean-Dominique Giuliani

—

25 November 2025

The Letter

Schuman

European news of the week

Unique in its genre, with its 200,000 subscribers and its editions in 6 languages (French, English, German, Spanish, Polish and Ukrainian), it has brought to you, for 15 years, a summary of European news, more needed now than ever

Versions :