Budget and Taxation

Anne Vitrey,

Sébastien Lumet

-

Available versions :

EN

Anne Vitrey

Sébastien Lumet

When the Treaty of Luxembourg in 1970 and the Treaty of Brussels in 1975 established the European Economic Community's financial autonomy, they also set out the nature and limits of the European budget. In 2011, the Treaty of Lisbon formalised the existence of the Multiannual Financial Framework (MFF) which establishes the expenditure of the European Union for a period of seven years. The coronavirus pandemic that hit Europe in the spring of 2020, triggering a crisis of unprecedented proportions, has put the EU budget to the test and propelled negotiations on the MFF, supported by the recovery plan, in the spotlight.

A budget that is low in volume, highly constrained and rigorously balanced

Here we shall retain three specific aspects of the European budget: the low overall volume, the constraint of different ceiling levels, and the principle of equilibrium. One of the main features of the Union's budget is its modesty. Its volume is of the order of 1% of the wealth produced by 27 Member States, i.e. less than 2.5% of public spending in Europe, even though the public sector is particularly well developed[1].

Subject to further developments following the last phase of negotiations between the European Parliament, the Council and the Commission (trilogue), the European Union's budget for the period 2021-2027[2] will total €1,074.3 billion in commitment appropriations and €1,061 billion in payment appropriations (in 2018 prices). As an example, the US federal budget represents about 21% of US GDP.

The structure of the European budget is based on a rationale of ceilings: according to the terms of the agreement of 21 July 2020 reached at the European Council, the resources ceiling is limited to 1.46% of the European Union's gross national income (GNI) for commitment appropriations and 1.4% of GNI for payment appropriations[3].

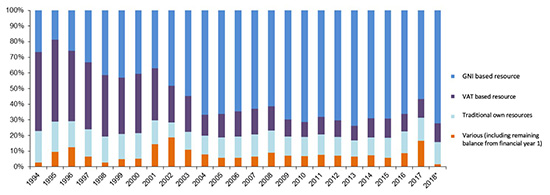

The decision of 21 April 1970[4], arising from the Treaty of Luxembourg, replaces national contributions with "own resources", which means that the Community has tax revenue at its disposal. While the system was supposed to be based on genuine own resources, it is evident that these have been drastically reduced in the context of international free trade agreements. Direct and indirect national contributions now account for 80% of the European budget, 70% of which comes from the GNI levy. As soon as a balancing revenue based on the GNI of the Member States was created, it became necessary to control the pace of expenditure. This was the purpose of the 1988 reform, which established a binding link between the MFF expenditure ceilings and the own resources ceiling. The annual budget respects the multiannual financial framework (TFEU, Article 312.3).

Composition of EU budget revenue between 1994 and 2018 (in %)

Source : draft finance bill 2018 (Financial Relations with the European Union)

Among cardinal budgetary principles, inspired by traditional budgetary law and laid down by the Treaty on the Functioning of the European Union (TFEU) and the financial regulation, the principle of equilibrium is a unique feature of the European budget. "The budget must be balanced in terms of revenue and expenditure" (Article 310 TFEU). Clearly, the European Union cannot resort to borrowing to cover its own expenditure.

In May 2018, after two years of consultations, the European Commission presented its proposals for the financial framework 2021-2027 whose priorities are based on the State of the Union Address (4 September 2016), the Bratislava Agenda (16 September 2016), the Rome Declaration (25 March 2017) and the European Parliament reports of March 2018 Olbrycht-Thomas (MFF chapter) and Deprez-Lewandowski (own resources chapter). Since Brexit was being negotiated, it was necessary to adjust the new framework, both in terms of revenue and expenditure, and to review a number of mechanisms rooted in the rationale of financing the Union's activities.

Maintaining an ambitious medium-term budget was then a challenge to which the outgoing Commission, supported by the European Parliament, has tried to respond, notably in the wake of its reflection paper on the future of EU finances published in 2017. While this document made some ambitious proposals that highlighted many of the contradictions inherent to the current structure and configuration of the European budget, there was every reason to believe that negotiations on the new multi-annual budget would largely be conducted within conventional dynamics. A relatively balanced but incisive proposal from the Commission, an ambitious position adopted by the European Parliament at an early stage, an internally divided and very conservative Council.

___________________________________________________________________________________

Procedure for the adoption of the MFF Regulation (Article 312 TFEU)

The MFF is adopted in the form of a regulation through a special legislative procedure, in which the Council acts unanimously after having received the approval of the Parliament, expressed by an absolute majority. Failing this, the European Council may unanimously authorise the Council to act by qualified majority when adopting the MFF regulation. In addition, Article 312(5) TFEU requires the European Parliament, the Council and the Commission to take all necessary measures to facilitate the adoption of the MFF.

Procedure for adopting the Own Resources Decision (Article 311 TFEU)

Decisions on own resources are adopted unanimously by the Council after consulting the European Parliament. Moreover, Council decisions on own resources only enter into force once they have been approved by the Member States "in accordance with their respective constitutional requirements", which generally implies the approval of national parliaments.

However, Council decisions on own resources go hand in hand with implementing acts in the form of Council regulations, to which the European Parliament must give its approval, as in the case of the MFF regulation.

Legislative part (programmes)

Legislative work includes the processing of 48 legislative proposals on new and ongoing spending programmes and funds under the next MFF. Most of them will be adopted under the ordinary legislative procedure, in which Parliament and Council act on an equal footing.

___________________________________________________________________________________

Discussions regarding the MFF 2021-2027 started very late in the Council, since the political agenda of successive presidencies (Romania, Finland, Croatia) was embroiled in Brexit related difficulties. To this must be added the renewal of institutions: European elections in May 2019 and the new Commission, confirmed in December 2019. The Finnish Presidency first proposed a 'negotiation box' at the end of December 2019. Brexit offered a rare political window of opportunity to discuss a profound overhaul of the European budget, but this first negotiation box did not seem to go in the direction of challenging the rationale of 'juste retour', nor of a significant reorientation of the budget towards new priorities.

After intense consultations, the President of the Council convened an extraordinary summit (20-21 February 2020), which was inconclusive. This European Council meeting revealed deep divergences between Member States. Alliances were formed mainly between the "Frugal Four (or Five)" and the "friends of cohesion", mainly countries of the Višegrad Group. In the spring of 2020, given the 'business as usual' attitude adopted by Council negotiators and despite the Commission's urgent calls for a successful conclusion to the negotiation, an agreement was not possible at this stage and the political will was clearly lacking to agree on an ambitious medium-term financial framework for the European Union.

From the MFF to the Recovery Plan

The unprecedented and violent health crisis that hit Europe in the spring of 2020 gave rise to novel initiatives and created a new dynamic in budget negotiations. According to the International Monetary Fund (IMF), the world economy is expected to contract by 4.9% in 2020; the outlook for the eurozone is gloomier, with its GDP likely to shrink by 10.2% in 2020[5].

In the face of an unparalleled shock that has affected Member States to varying degrees, new initiatives were taken, according to an accelerated timetable. On 25 March, nine Member States sent a letter to the President of the Council indicating their support for the deployment of a common debt instrument. On 9 April, the Eurogroup conclusions discussed the possibility of setting up a recovery fund. Two weeks later, Ursula von der Leyen, President of the Commission, raised the possibility of creating an Instrument that would allow the European Commission not only to make loans to Member States but also to distribute grants. On 18 May, France and Germany launched a joint initiative proposing a €500 billion recovery fund, exclusively in the form of grants. On 27 May, the Commission took up the spirit of this initiative in a two-part proposal. A reinforced MFF: €1100 billion over the period 2021-2027 and a European recovery instrument of €750 billion over the period 2021-2024. On 19 June, then on 17 and 18 July, the Council presented several "budget negotiation boxes" based on the Commission's draft. On 21 July, after four days of tough negotiations, the 27 Heads of State and Government reached an agreement to link the next multiannual budget of the European Union to a €750 billion recovery plan.

These decisions, unprecedented in scope, their impact and pace of adoption (four months compared to the usual two years it takes for an agreement at Council level on a MFF) are historic. The breakthrough achieved by this agreement paves the way for unprecedented pooling at European level, allowing the Commission to borrow massively in its own name to make transfers among Member States.

Negotiations with the European Parliament - which must give its approval to the final agreement of the MFF regulation - are still ongoing. In its resolution of 23 July, the Parliament set out three key conditions:

• The establishment of new own resources by 2024, based on a roadmap that the European Parliament wants to be binding. These should cover the repayment of the debt contracted by the 27 Member States in order to finance the "Next Generation EU" Recovery Plan. It is worth recalling that in 2014, at the request of the European Parliament, a High-Level Group on Own Resources, chaired by Mario Monti, was set up to rethink the existing own resources system. In its resolution of March 2018, the European Parliament established a strong link between revenue and expenditure: "No agreement can be reached on the MFF without a significant step forward on own resources[6]". With the adoption of its consultative opinion on 16 September 2020, Parliament paved the way for the ratification of the own resources decision which will make it possible for the European Union to borrow on the financial markets. Following this vote, the Council can now approve this decision and begin the ratification procedure in the Member States;

• The establishment of a mechanism linking funding from the European budget to the respect of the Rule of Law is one of the major points of tension in the agreement between the Heads of State and Government of 21 July. The ambiguous wording concerning the mechanism that must guarantee this link led to fierce controversy as to its effective capacity to condition the provision of European funds. Recently, the interinstitutional power struggle in this respect intensified in the final phase of the negotiations, particularly when the German Presidency of the Council presented a very diluted version of the conditioning mechanism, initially proposed by the European Commission, and whose scope had already been reduced at the European Council in July. The European Parliament will probably have to make important concessions on this point, the resolution of which promises to be extremely complex within the Council itself. The mechanism, which the German Presidency has now explicitly stated that it will not be a financial sanction mechanism for Member States that do not respect the rule of law, seems to be moving towards a narrower definition around the deployment of measures when violations of the principles of the rule of law affect in a sufficiently direct manner the sound financial management of the Union's budget. Meanwhile, the European Parliament has commissioned and released a timely public opinion survey which suggests that "nearly eight out of ten participants (77%) across the EU support the concept that the EU should only provide funds to Member States if the national government implements the rule of law and democratic principles"[7].

• Increased funding for forward-looking 'flagship' EU programmes, the list of which has been reduced from forty to fifteen (Erasmus +, Horizon, EU4Health, in particular). Initial amounts planned for these programmes were substantially reduced by the Council in comparison with the Commission's proposal and the European Parliament is looking for an increase to reach an equilibrium. This objective seems attainable in the last weeks of negotiations and remains the point on which the Parliament is in the strongest position to negotiate.

In terms of procedure, it should be noted that the European Parliament has managed to draw a little closer to the negotiating table to which it is not formally invited, by making use of the possibilities offered by Article 312(5) TFEU, by insisting on the need to reform the financing of the Union's budget and to create new own resources. Indeed, although several texts under different legal procedures are under negotiation, from a formal point of view the Parliament only has a veto right on the MFF. However, as the MFF and the Recovery Fund are intrinsically linked, it is difficult to separately apprehend, at least politically, the adoption of these texts. The numerous regulations governing the details of the MFF and the Recovery Fund also imply that all elements must ultimately be supported by the Council and Parliament in a spirit of conciliation.

While this observation is essential to the understanding of a particularly complex interinstitutional negotiation, it is nevertheless important to note that the traditional dynamics of negotiation have not been fundamentally altered and that the final compromise will most probably reflect the realities of the European budgetary balance of power. Adjustments will be made on the margins of the main agreement reached by the Council, but on key points where the Parliament must use its limited room for manoeuvre without giving in to the pressure of time. During negotiations over the 2014-2020 MFF, Parliament accused the European Council of having imposed a ready-to-go budgetary and legislative package, acting as a de facto legislator (contrary to the provisions of Article 15 TEU), thereby flouting the co-decision prerogatives attributed to Parliament by the Treaty of Lisbon. This "non-negotiation" left a bitter taste, and it is essential for the Parliament's institutional legitimacy in budgetary matters to work towards a better balance.

Derogations and taboos in the face of the health crisis

In the current situation of emergency, the European budget, which is too small in volume and constrained by numerous rigidities, has not played a leading role. On the other hand, it appears, in addition to national recovery plans, as the indispensable transmission belt for the Union's economic recovery, via the MFF on which the Recovery Plan is based.

Since spring 2020, in response to the Covid-19 pandemic, Member States and European institutions have deployed a range of instruments to mitigate the economic and social consequences of this unprecedented crisis. While divergences and disagreements between States and criticism on the slowness of response on the part of European institutions are frequently spotlighted, the rapid decisions and massive efforts to support the European economy and the single currency are worth highlighting. Most particularly, these actions are based on numerous departures from existing rules and break certain taboos.

First of all, the recourse to borrowing in order to finance the recovery plan is exceptional because of its legal and budgetary structure, its volume and its purpose. Admittedly, the Commission has already had recourse to borrowing on the basis of Article 122 TFEU (possibility of granting financial assistance to a Member State when it is in serious difficulties); Article 143 TFEU (possibility of providing "mutual assistance" to Member States outside the euro zone); Article 212 TFEU (macro-financial assistance to third countries), but the principle of budgetary equilibrium does not permit borrowing within the framework of the Union's budget.

750 billion euros is approximately equivalent to the sum of five additional annual budgets, of which €390 billion is in the form of grants. The Council decision on the own resources system is the linchpin of this construction. It requires legal certainty: unanimous adoption by the Member States and ratification by all national parliaments. It will be assigned revenue, i.e. it will be treated outside the budget balance so as to comply with the principle of budgetary equilibrium laid down in the Treaty. Finally, financial security will be achieved through a temporary increase in the (hitherto unattained) ceiling of own resources to 2% of the European Union's GNI, so as to offer a guarantee to the markets regarding repayment capacity. This is why this decision is of paramount importance.

Among other measures, the European Commission has proposed to trigger the general escape clause. The Council supported this proposal on 23 March to allow for a coordinated budgetary response to the pandemic. This clause from the Stability and Growth Pact has never been triggered before. The Commission also offered maximum flexibility within the existing framework, allowing for large-scale support for business liquidity and compensation for direct losses suffered by companies and sectors most affected by the crisis. It then adopted a temporary framework relaxing State aid rules, derogating from the usual provisions, in order to further support businesses.

The intervention of the European Central Bank (ECB) has ensured financial stability. On 18 March 2020, the Governing Council of the ECB announced a new Pandemic emergency purchase programme successively raised up to €1350 billion until the end of June 2021.

A system of voluntary guarantees provided by Member States based on their share of the European Union's GNI now allows the European Commission to borrow on the markets so as to lend to countries on favourable terms to help them "address sudden increases in public expenditure to preserve employment[8]." This facility, a new European instrument for temporary Support to mitigate Unemployment Risks in an Emergency (SURE), can reach up to €100 billion. The first issuance of €17 billion was very well received by investors with requests for bonds exceeding capacity by 13 times according to the Commission.

Optimising the resources available under the cohesion policy is part of a €37 billion investment initiative in response to the coronavirus. In practice, the Cohesion Policy Regulation has been amended to allow the European Commission to waive its obligation this year of requesting reimbursement from Member States of unused pre-financing under the European Structural and Investment Funds to the value of €8 billion. By freeing Member States from this constraint, the sum should serve as national compensation for a European co-financing envelope of around €29 billion.

Problems of democratic control, implementation of the Recovery Plan and risk factors

The MFF is part of a framework of implementation and discharge obligations strictly defined by the Treaties (Articles 317, 318 and 319 TFEU) and which gives an important role on democratic oversight to the European Parliament. By contrast, it appears that certain elements of governance set out in the recovery fund, which is de facto part of the public finances of the European Union, raise a number of questions.

This is particularly the case for the Recovery and Resilience Facility (RRF), the main tool of the Recovery Fund which will be endowed with €672.5 billion, of which €312.5 billion will be direct expenditure and €360 billion in loans. As a necessary precondition for accessing the RRF funds, Member States have agreed on a complex and in some respects problematic governance and approval process.

As defined in the July agreement, the governance of the RRF is based on a technical assessment (carried out by the Commission in the framework of the European Semester) validated according to a "peer review" mechanism within the Council. First of all, it is important to underline the paradigm shift generated by this new mechanism with regard to the coordination of Member States' economic policies. The "European Semester", within the framework of the European Stability and Growth Pact, is a technical coordination exercise based on a mechanism of recommendations that is not linked to the distribution of European budgetary resources[9]. Under the RRF, "Member States develop National Recovery and Resilience Plans setting out their reform and investment programmes for the years 2021-2023[10]". These national plans are then submitted to the European Commission for assessment against general criteria laid down in the relevant regulation. The approval of this evaluation is carried out by the Council voting by qualified majority, subject to compliance with predetermined intermediate and final objectives. In addition, an "emergency brake" mechanism is designed to enable one or more Member States to refer the matter to the next European Council meeting in the event of a major concern with regards to "serious deviations from the satisfactory fulfilment of the relevant milestones and targets". This is a very political exercise, as these national plans and their approval have a massive distributive impact within Member States.

It seems that this governance mechanism introduces at least two significant deficits. Firstly, democratic oversight does not seem to correspond to the ambition and scope of this instrument. Indeed, the European Parliament plays no role in the governance of the RRF, neither in the procedure for assessing recovery and resilience plans nor with the emergency brake. This situation is due to the absence of a technical link between external assigned revenue (Article 21 of the Financial Regulation) and the expenditure of the European budget. However, this marginalisation seems questionable[11], especially considering the political inseparability of the Recovery Fund and the European budget, the volume of expenditure to be committed and the importance of national recovery plans for future economic policy coordination at European level.

Secondly, the structure of this governance is articulated around two main dynamics, a technical component which falls under the responsibility of the Commission, and a political-decisional component which falls under the responsibility of the Council. The closed circuit created by a governance model based on a "peer review" mechanism ultimately leaves little room for real oversight, insofar as no Member State has an interest in blocking another Member State's plan if it does not want to take the risk of having its own plan called into question. The emergency brake procedure poses the same problem of mutual approval dependency. It was also decided that the Commission would base its assessment of the intermediate and final targets on the advice of the Economic and Financial Committee, itself composed of senior national officials[12]. In order to compensate for the lack of ex ante control, and because it is absolutely essential for this new instrument to guarantee quality expenditure, it seems that the European Parliament should be given a 'right of scrutiny' through the delegated acts provided for in Article 290 TFEU.

In its Opinion n°6/2020, the European Court of Auditors makes a number of observations designed to improve the proposal for a Regulation of the European Parliament and of the Council establishing a Recovery and Resilience Facility. The Court calls for appropriate mechanisms to be established in order to ensure coordination with other sources of Union funding and to guarantee the correct application of the principle of additionality, in particular by:

- linking the recovery and resilience objectives of the facility more closely to allocation keys;

- simplifying procedures for recovery and resilience programmes and payment claims as much as possible, so as to reduce red tape and facilitate absorption;

- establishing indicators appropriate to the overall outcome of the Facility;

- defining the role of the European Parliament in the budgetary process, and clearly indicating the audit rights of the European Court of Auditors.

Finally, the massive amounts that are expected to be injected into the Recovery Plan carry a real risk of under-execution or even poor execution, including fraud and corruption. The complexity of the financial package inside and outside the European budget, the plurality of funding sources, the difficult complementarity of allocation criteria are complex elements which could hinder the effective implementation of this budgetary package. Finally, the urgency of making funds available to meet urgent needs could lead to absorption difficulties in a period of very low economic activity, and reduce the expected impact of measures, which should rather be considered in the medium term. It is therefore all the more important to take the time to design a sound governance framework for the Recovery Fund in order to ensure proper absorption and implementation of the Recovery Plan rather than insisting on its rapid deployment.

***

European budget negotiations for the year 2020 are both historic and ambivalent. Historic because Heads of State or Government have agreed on a massive recovery fund which paves the way for unprecedented borrowing at European level. Ambivalent, because initial shortcomings of the MFF are compounded by new concerns about the governance of the Recovery and Resilience Facility, the ability to ensure that spending will be in line with policy objectives of the Union as a whole and will bring significant European added value, the resolution of long-standing budgetary debates such as those regarding own resources or the respect of the rule of law to access EU funding.

The stakes are high, because if Next Generation EU fails to guide European recovery towards a new path of economic development, the historic breakthrough of 2020 will have raised as much hope as frustration. However, if Europeans manage to organise an unprecedented collective capacity by defining together the terms of a sustainable and balanced recovery, the European Union will not only have proved its resilience and the relevance of coordinated public action, but will also have paved the way for far-reaching institutional and political changes.

[1] Public spending represented 46.7 % of the GDP in 2018

[2] Conclusions of the European Conseil 10/20, p.67

[3] idem, p.8

[4] JO L94 of 28 October 1970, p.19

[5] IMF World Economic Outlook updated June 2020

[6] Olbrycht Thomas Report, op. cit.

[7] https://www.europarl.europa.eu/news/en/press-room/20201016IPR89545/el-77-de-los-europeos-insiste-en-vincular-fondos-de-la-ue-y-estado-de-derecho

[8] https://ec.europa.eu/commission/presscorner/detail/en/QANDA_20_572

[9] This procedure, moreover, gives Parliament only a consultative role, in particular through the organisation of public debates at the end of which it adopts a resolution.

[10] Conclusions of the European Council 10/20, p.5

[11] Lucas Guttenberg & Thu Nguyen, How to spend it right - A more democratic governance for the EU Recovery and Resilience Facility, Policy Brief, Hertie School Jacques Delors Europe, 11 June 2020

[12] Guntram Wolf, Without good governance, the EU borrowing mechanism to boost the recovery could fail, Bruegel, 15 September 2020

Publishing Director : Pascale Joannin

On the same theme

To go further

Freedom, security and justice

Jean Mafart

—

15 April 2025

Asia and the Indo-Pacific

Pierrick Bouffaron

—

8 April 2025

Democracy and citizenship

Radovan Gura

—

25 March 2025

Strategy, Security and Defence

Stéphane Beemelmans

—

18 March 2025

The Letter

Schuman

European news of the week

Unique in its genre, with its 200,000 subscribers and its editions in 6 languages (French, English, German, Spanish, Polish and Ukrainian), it has brought to you, for 15 years, a summary of European news, more needed now than ever

Versions :